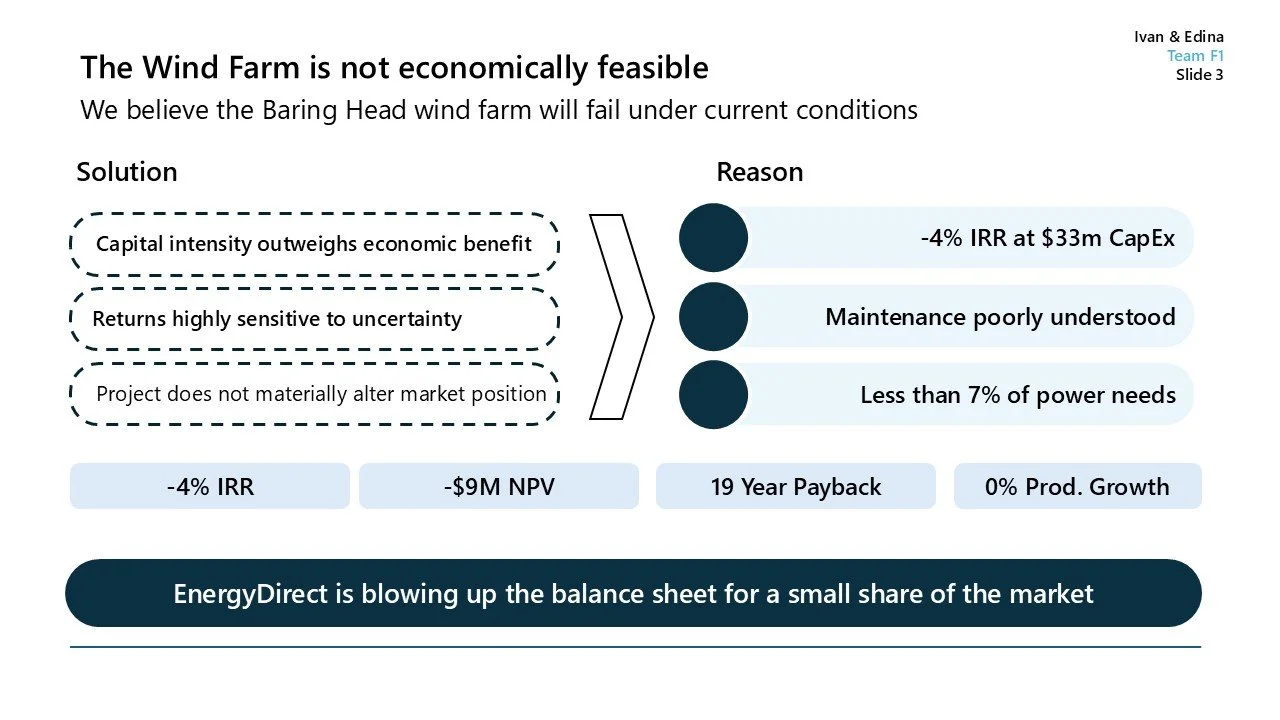

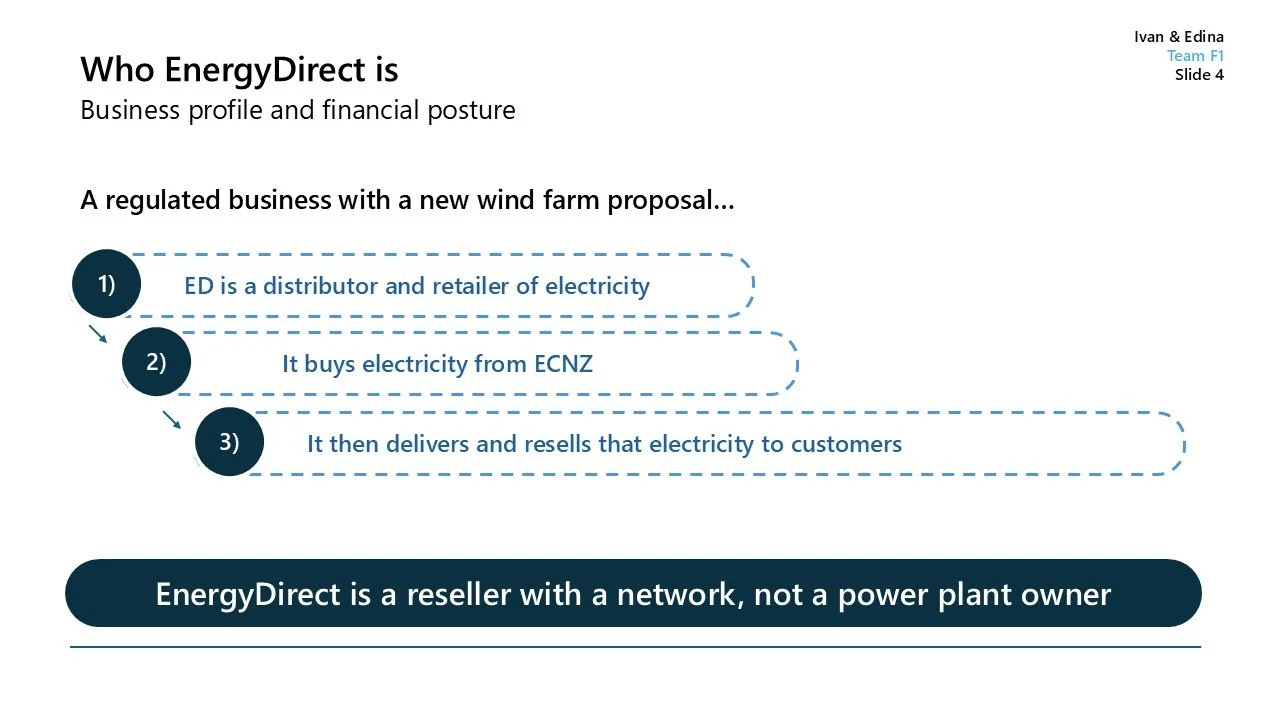

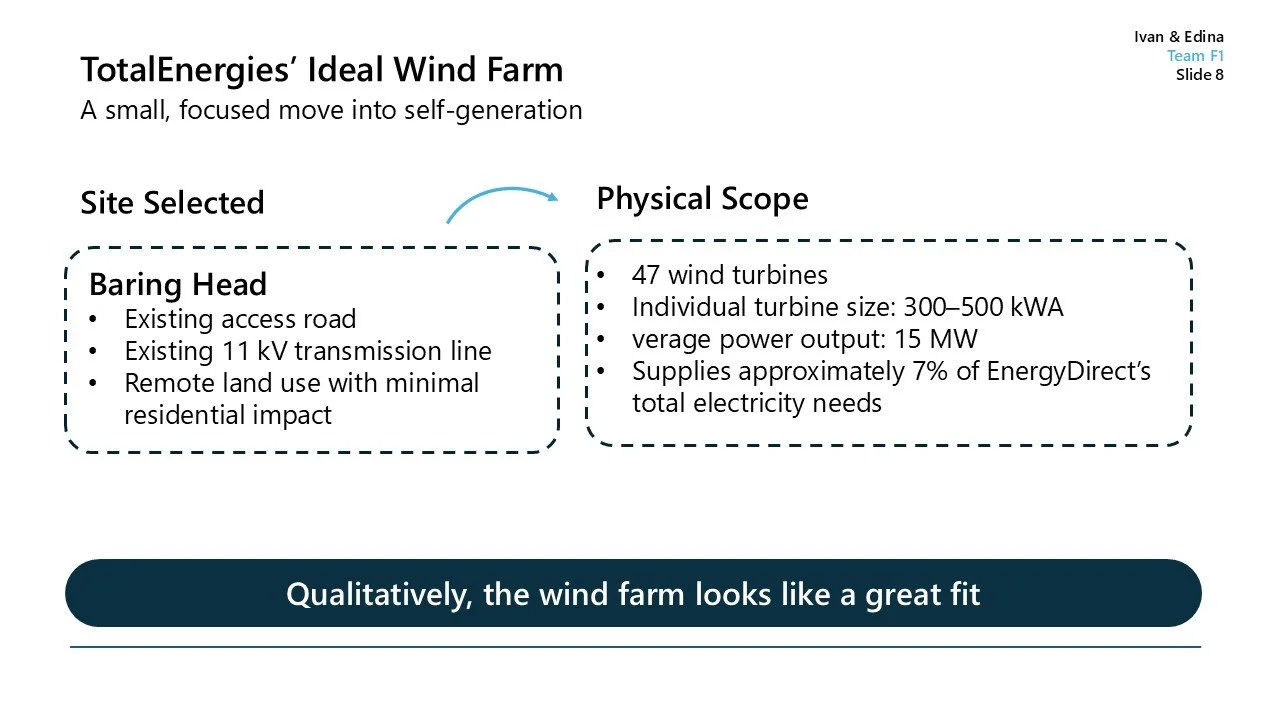

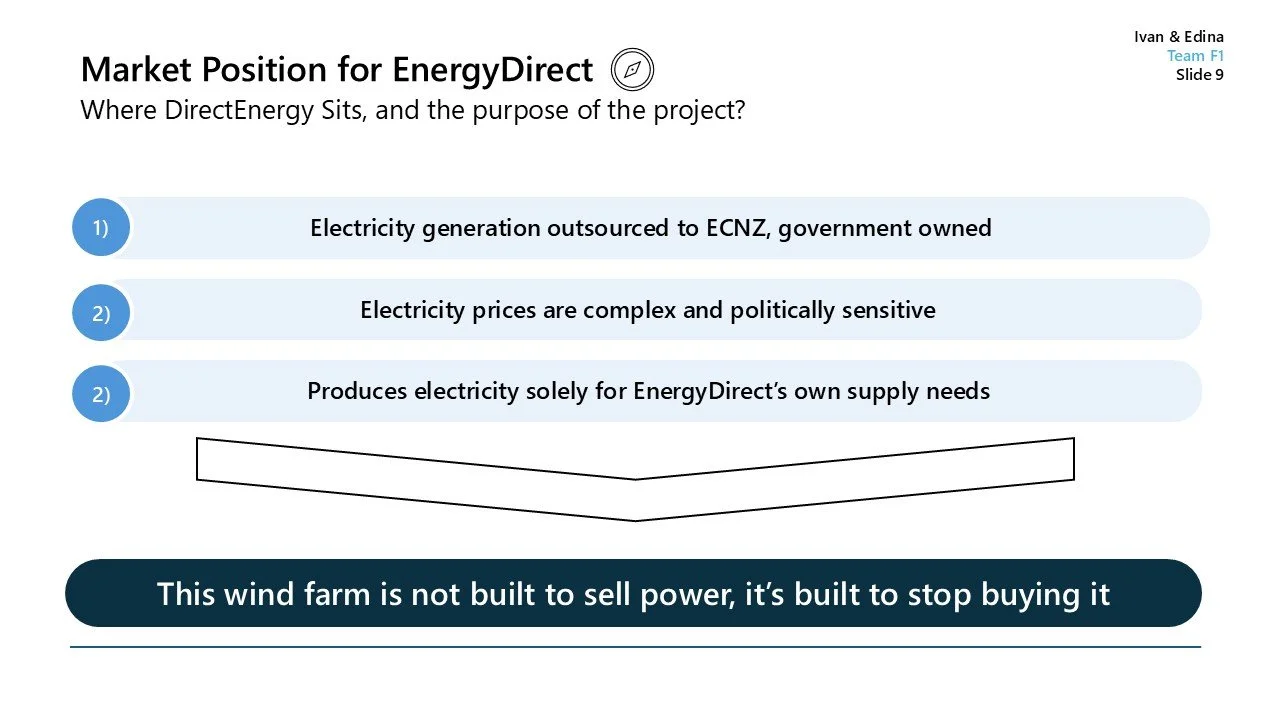

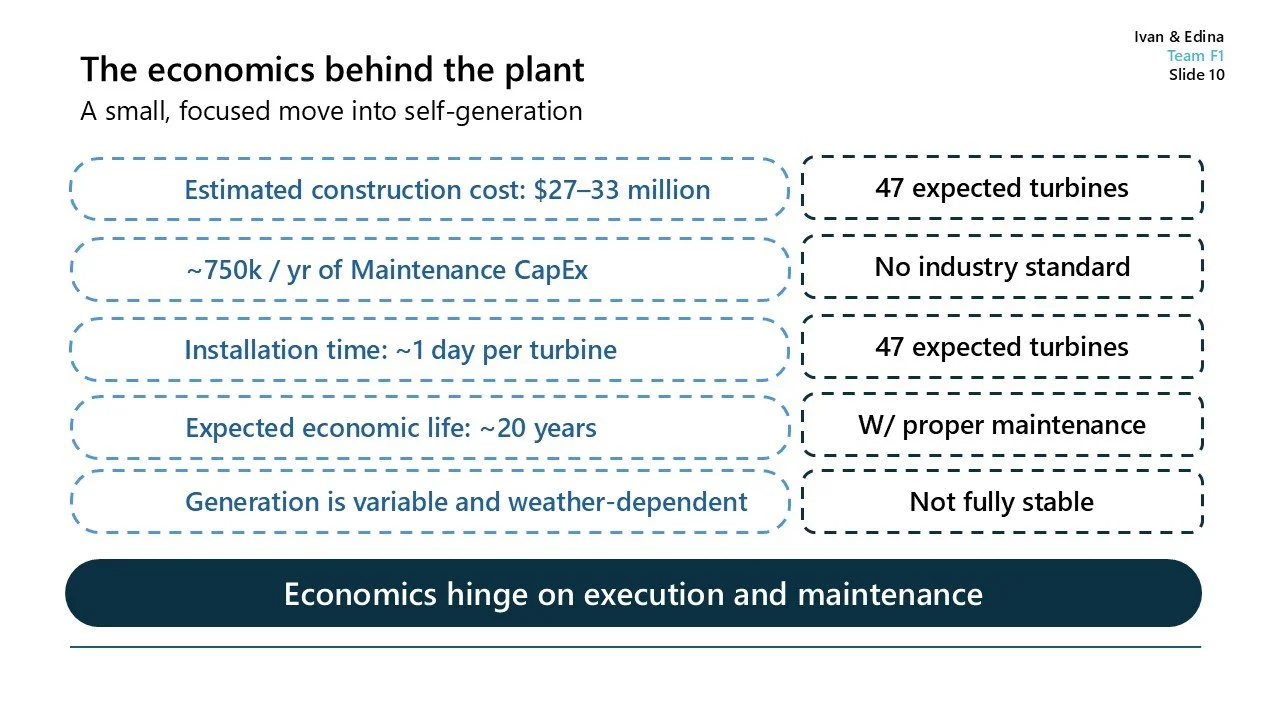

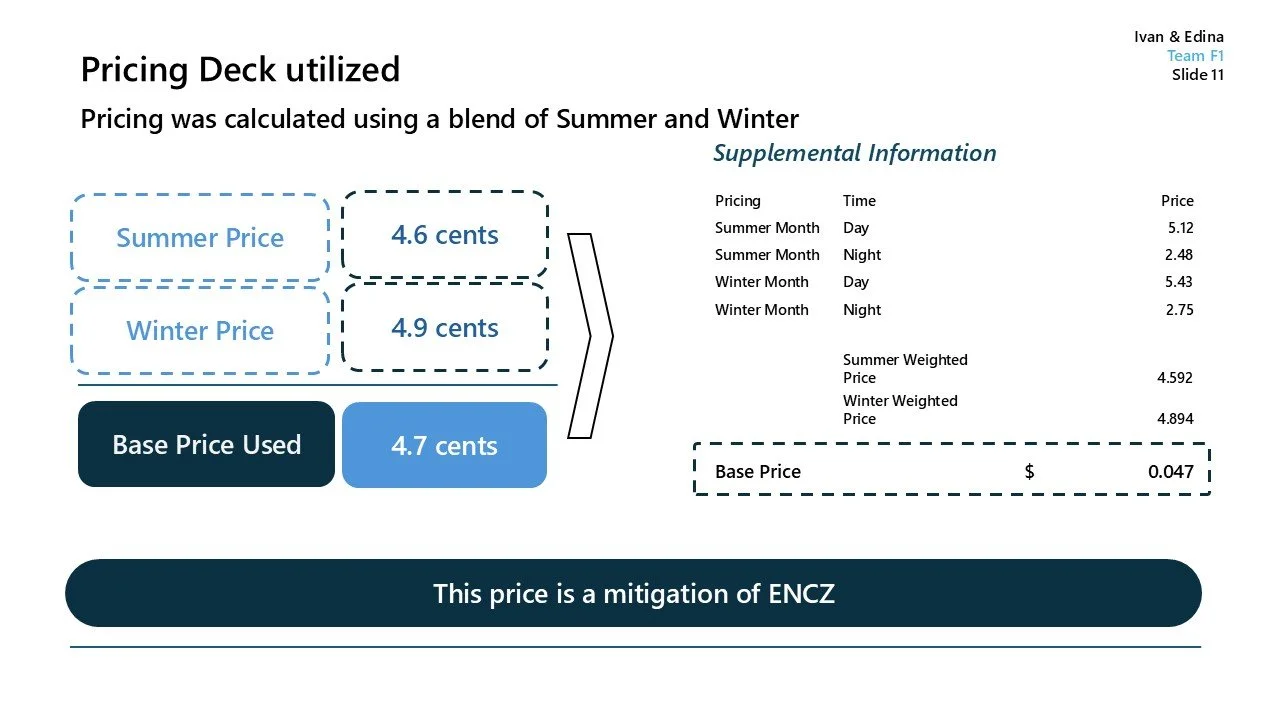

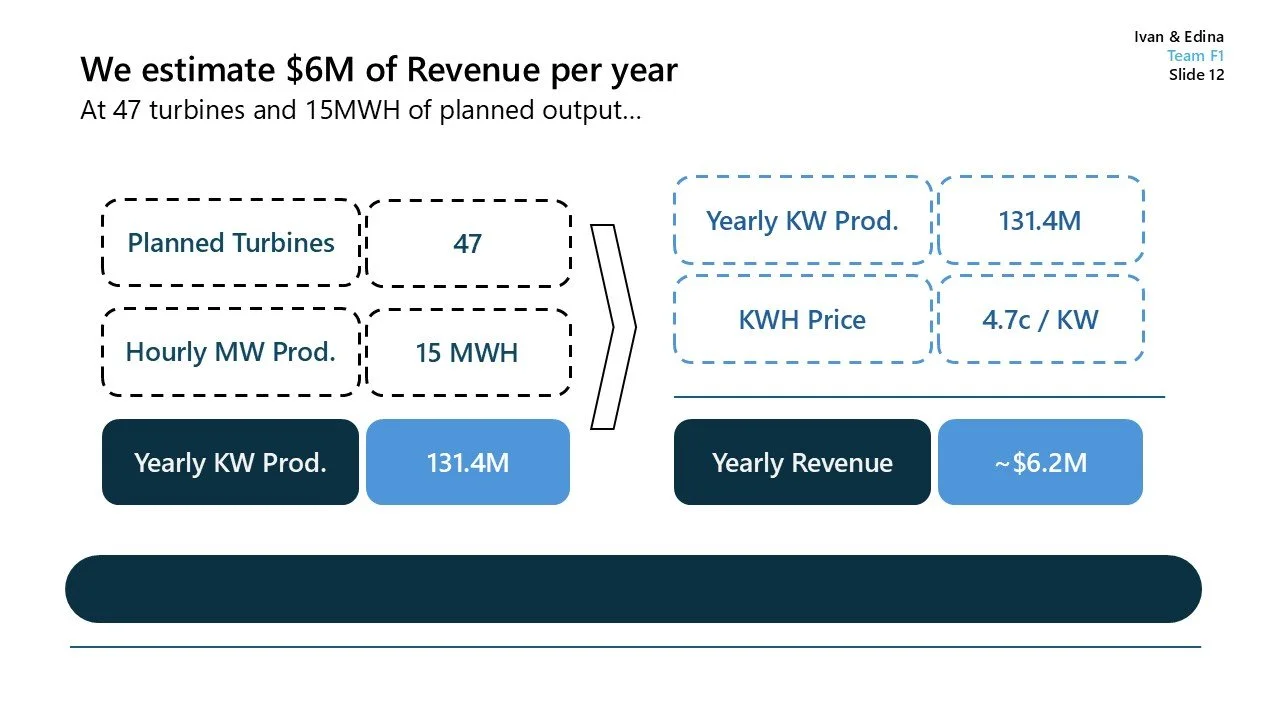

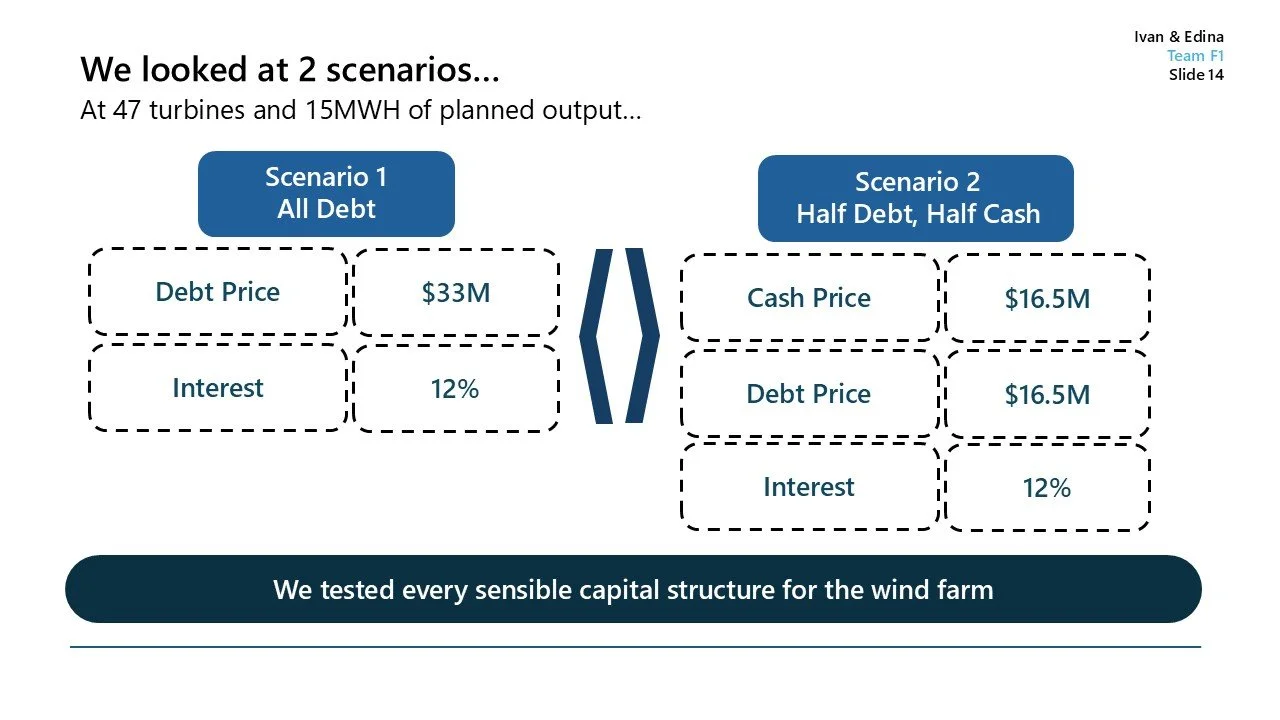

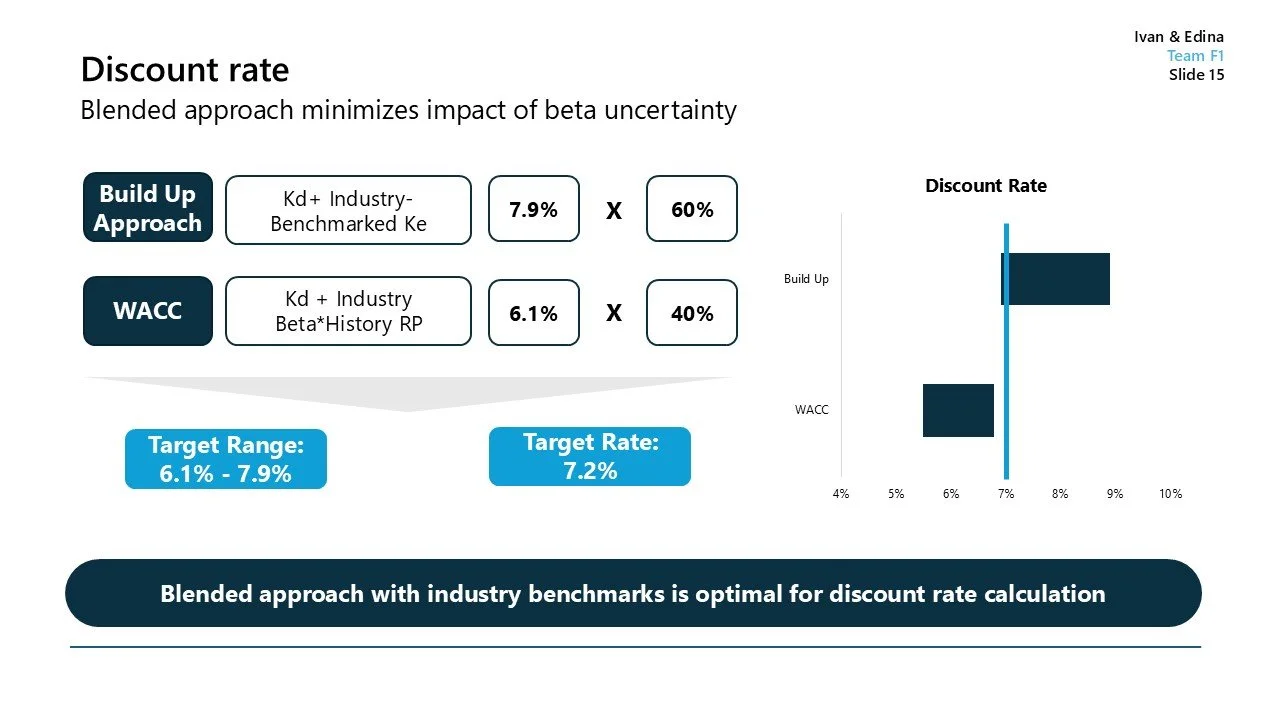

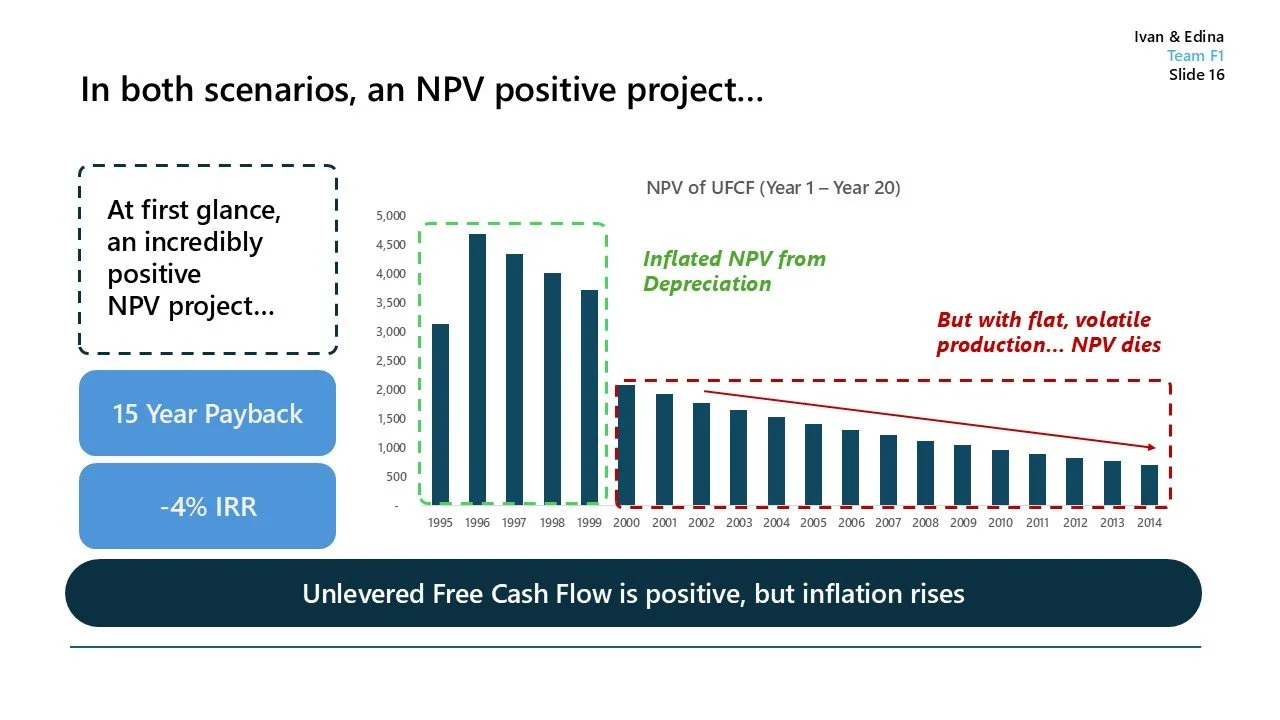

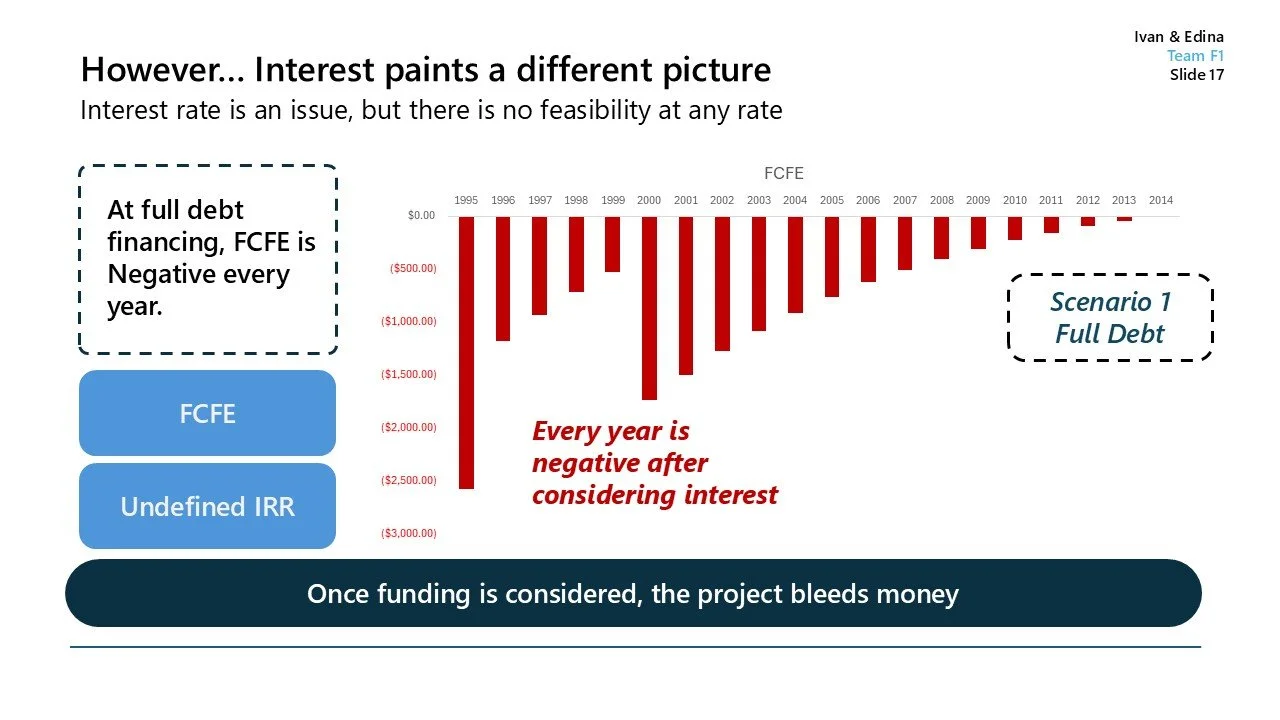

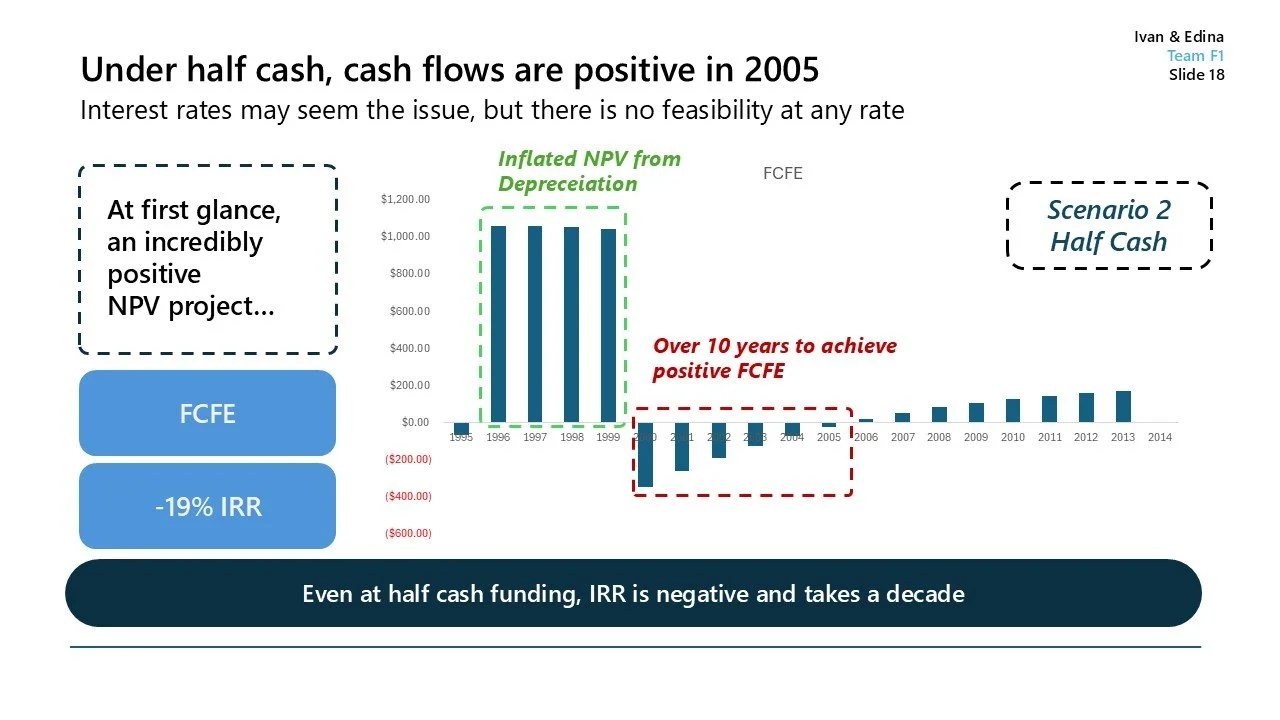

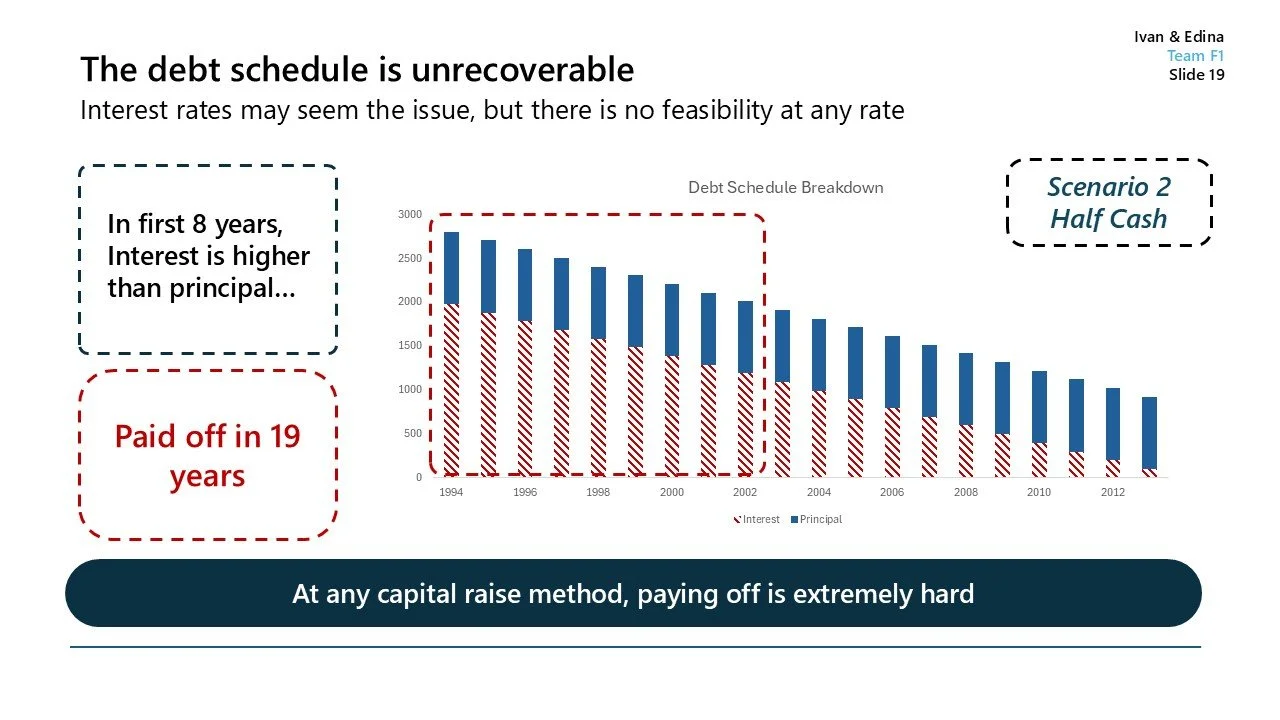

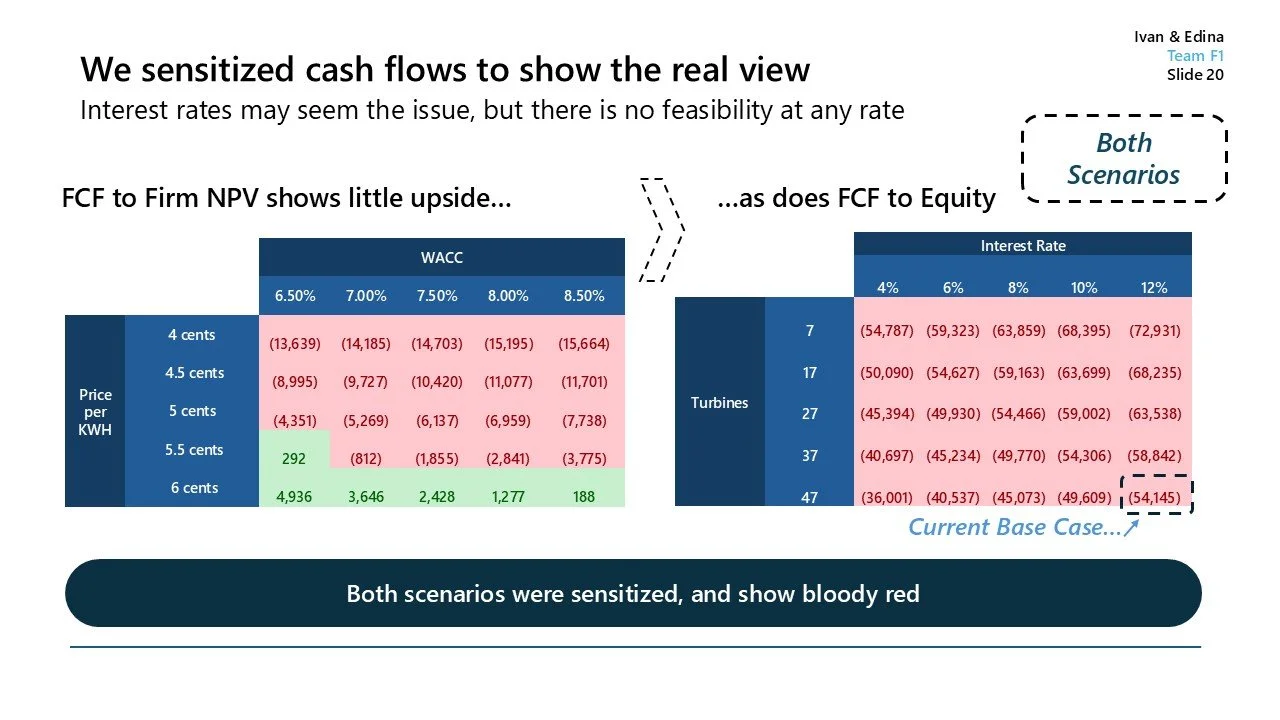

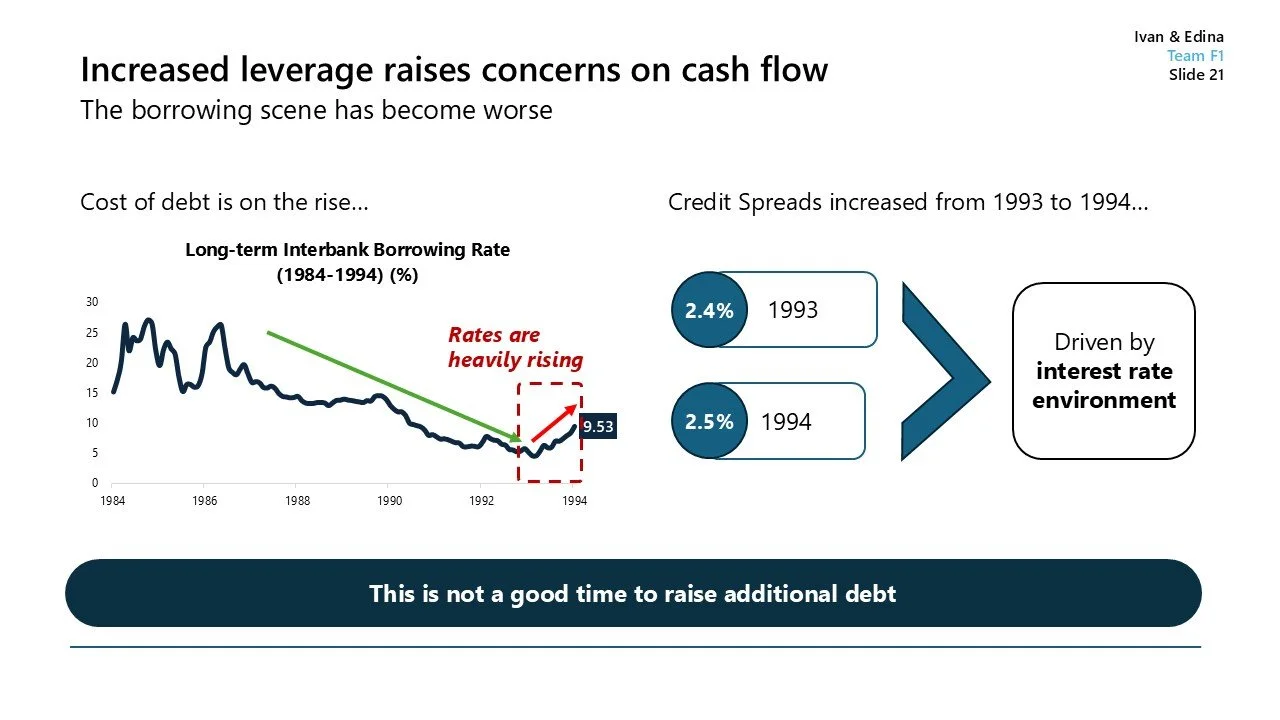

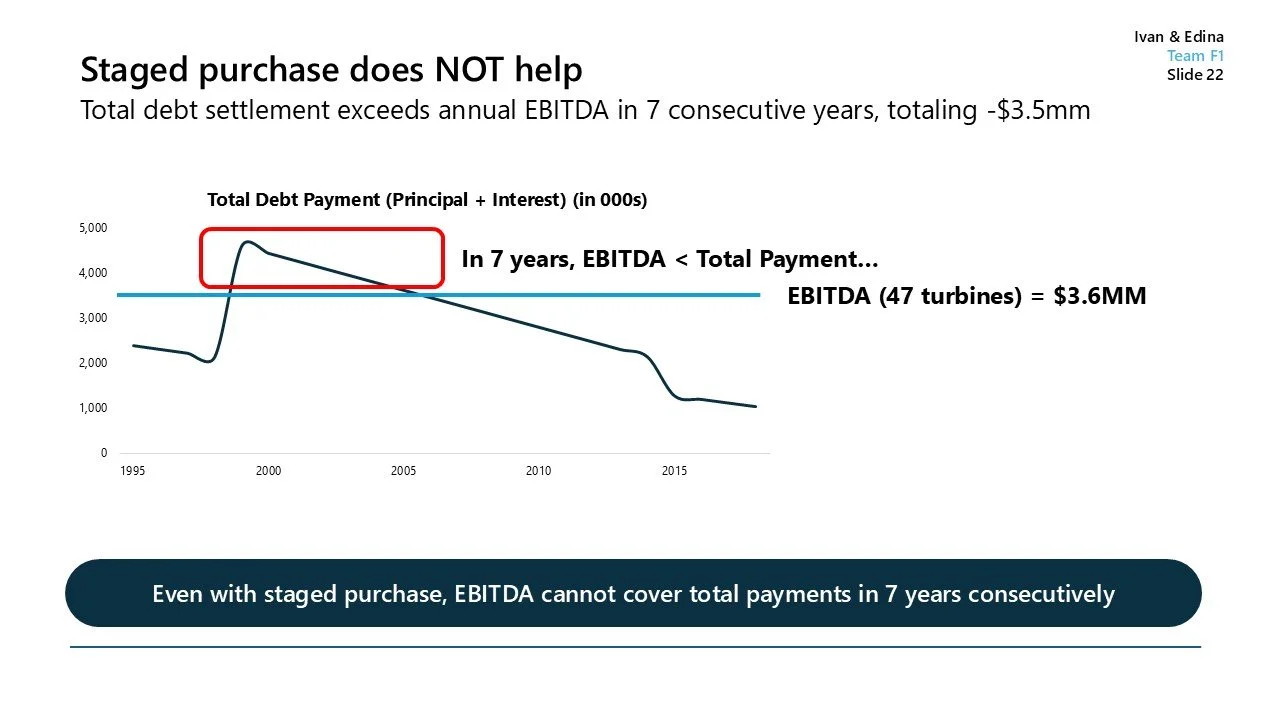

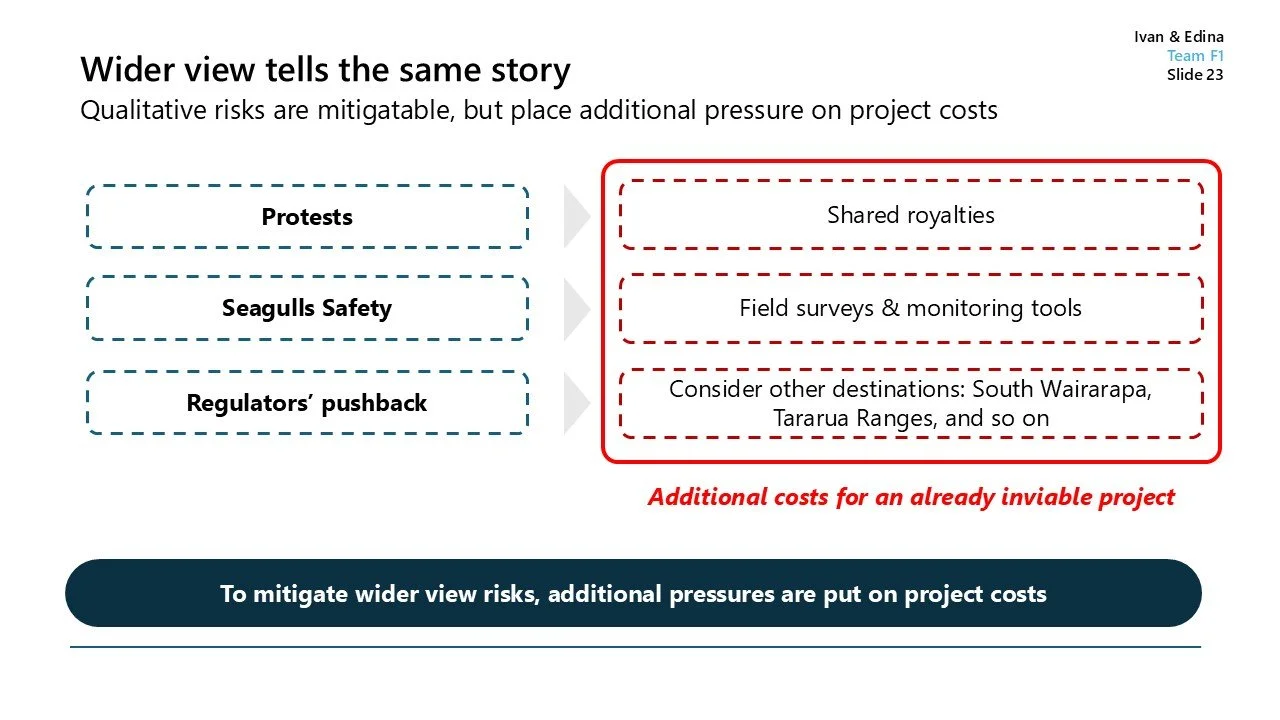

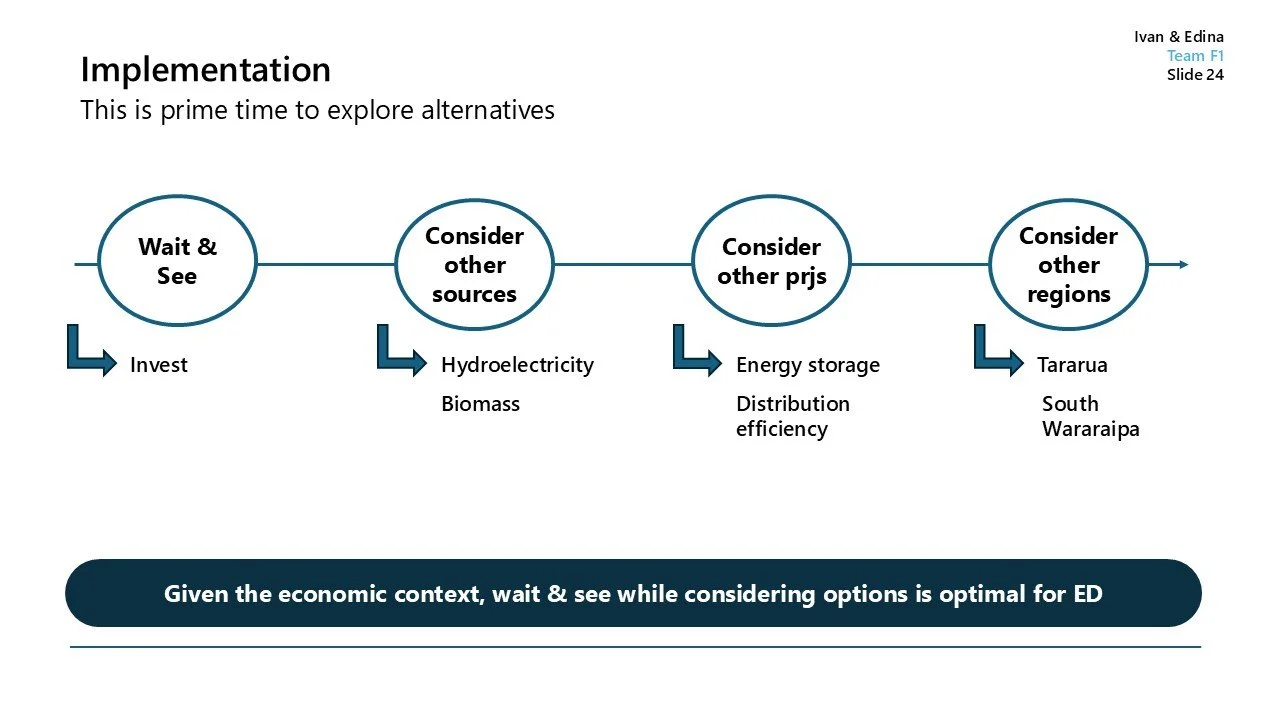

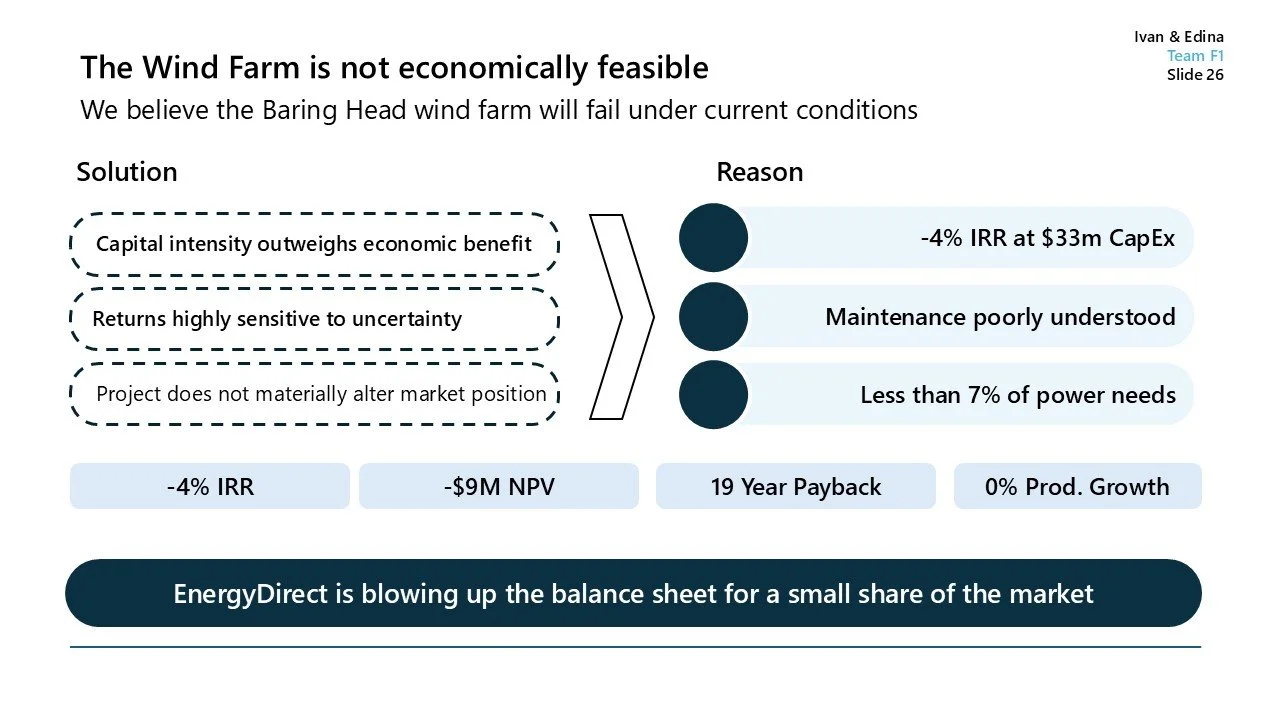

This case assessed the economic and strategic feasibility of EnergyDirect’s proposed Baring Head wind farm in New Zealand. The analysis combined discounted cash flow modeling with regulatory, political, and market considerations, focusing on whether the project created value once financing and interest rate risk were incorporated. While the site quality and strategic rationale were strong, the financial analysis showed persistently negative equity returns under realistic capital structures. The recommendation concluded that the project was not economically viable without structural support such as subsidies or alternative financing, emphasizing that qualitative appeal cannot override fundamentally negative cash flow economics.