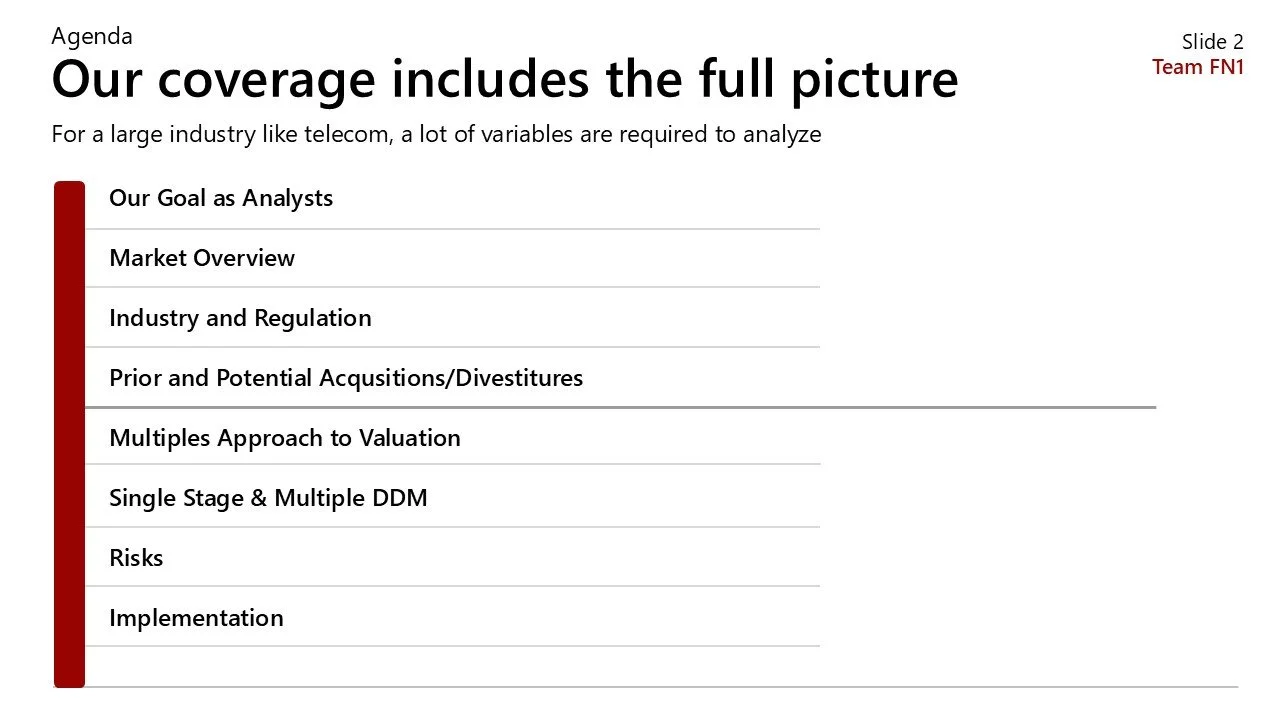

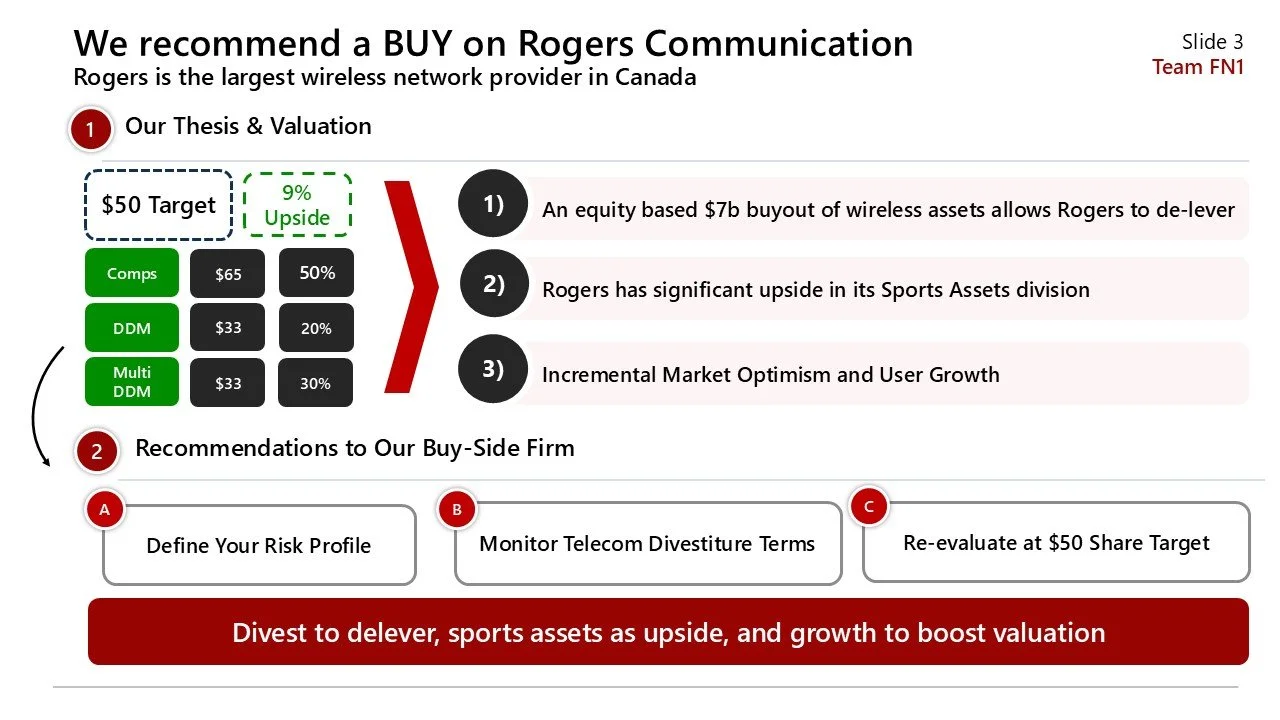

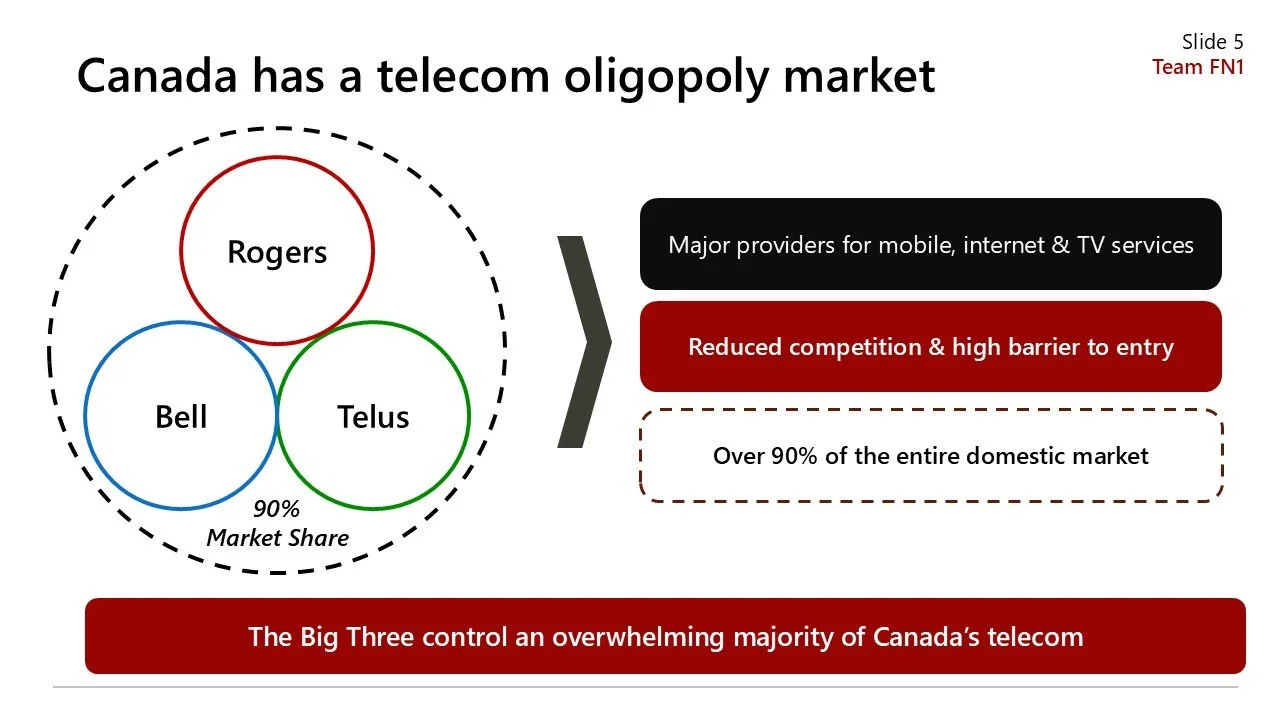

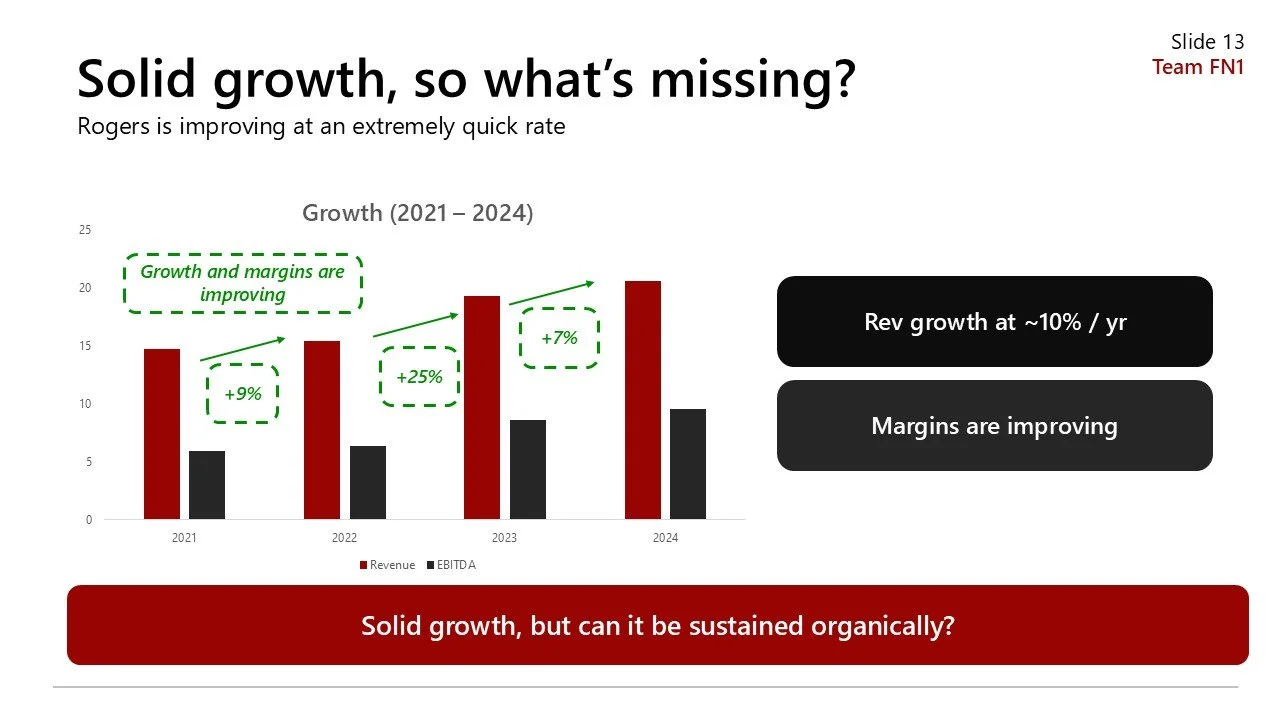

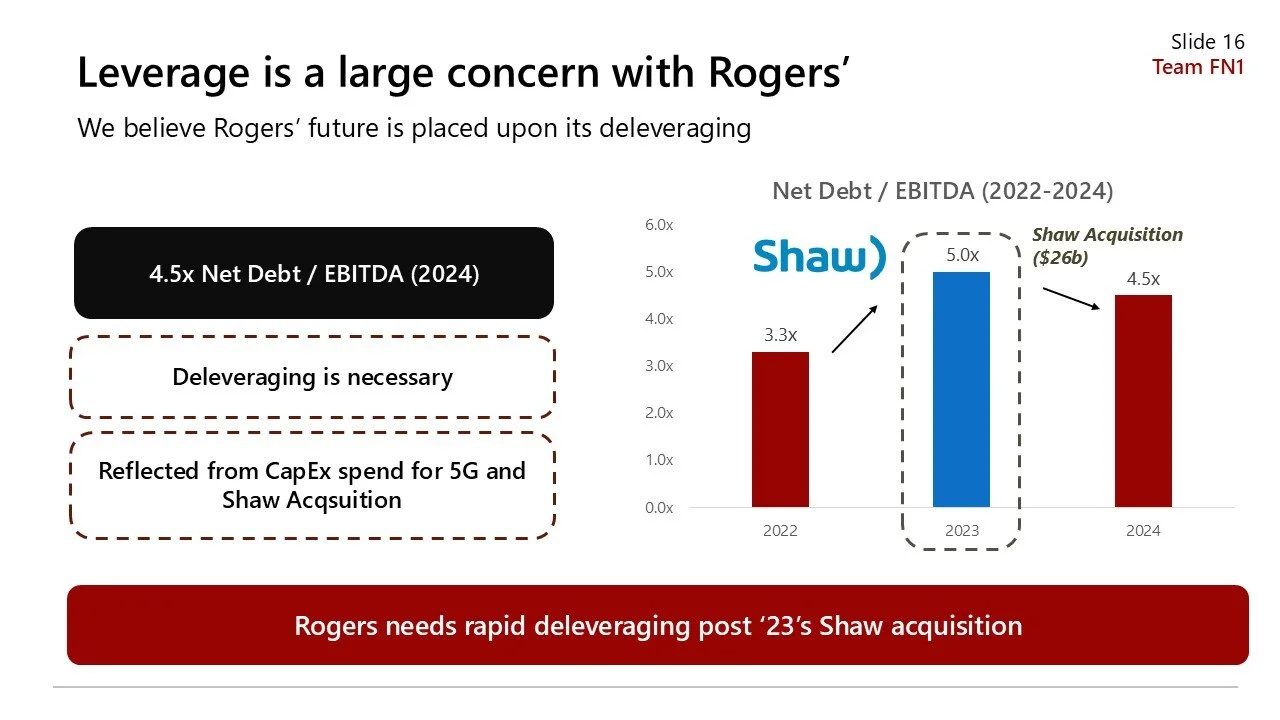

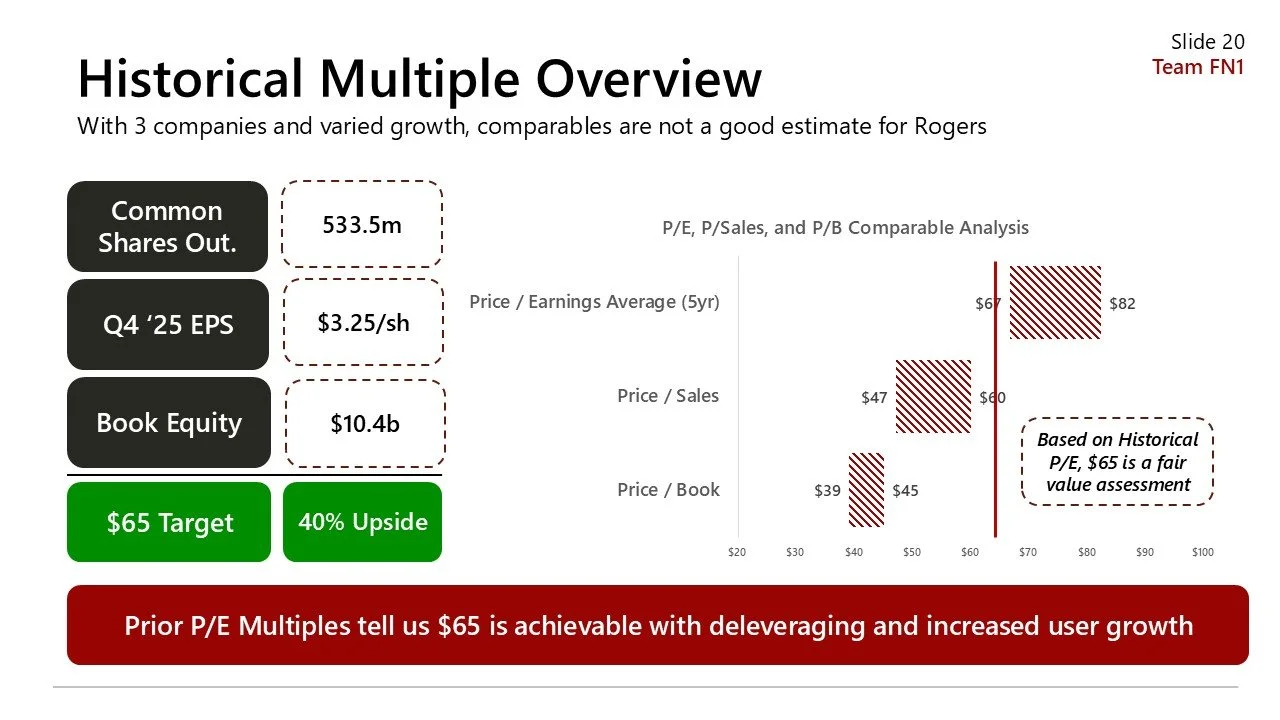

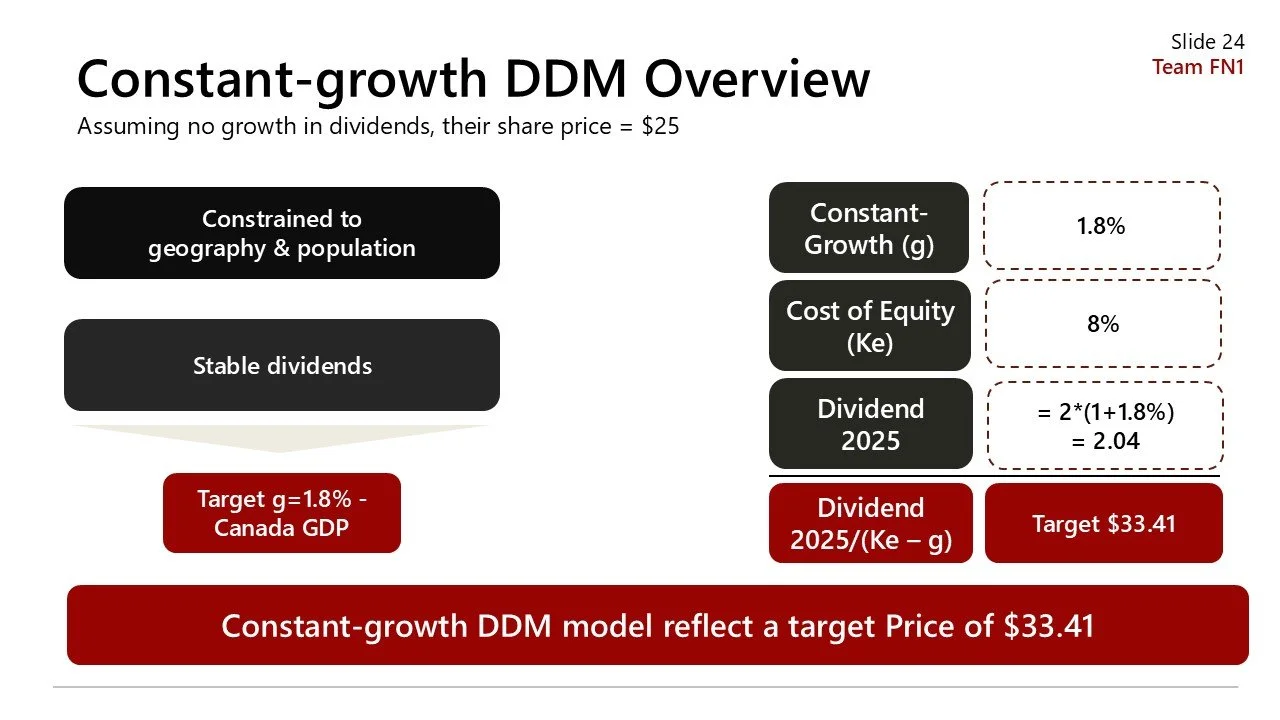

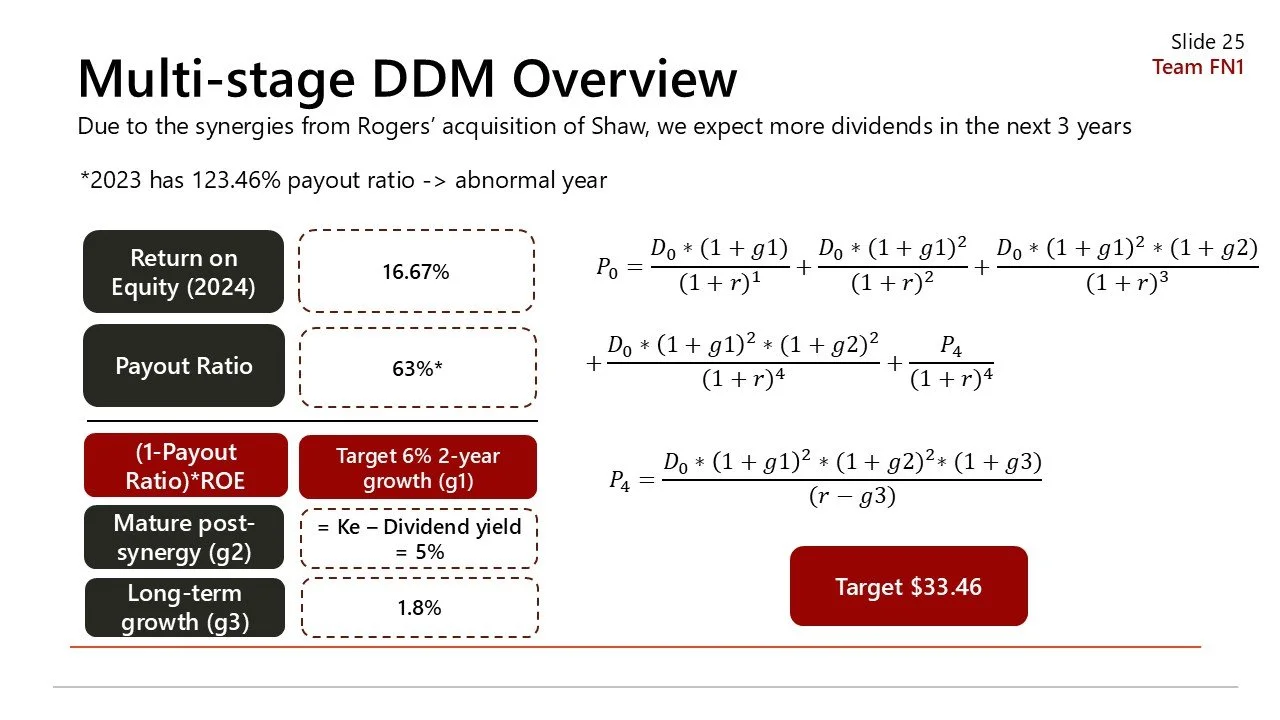

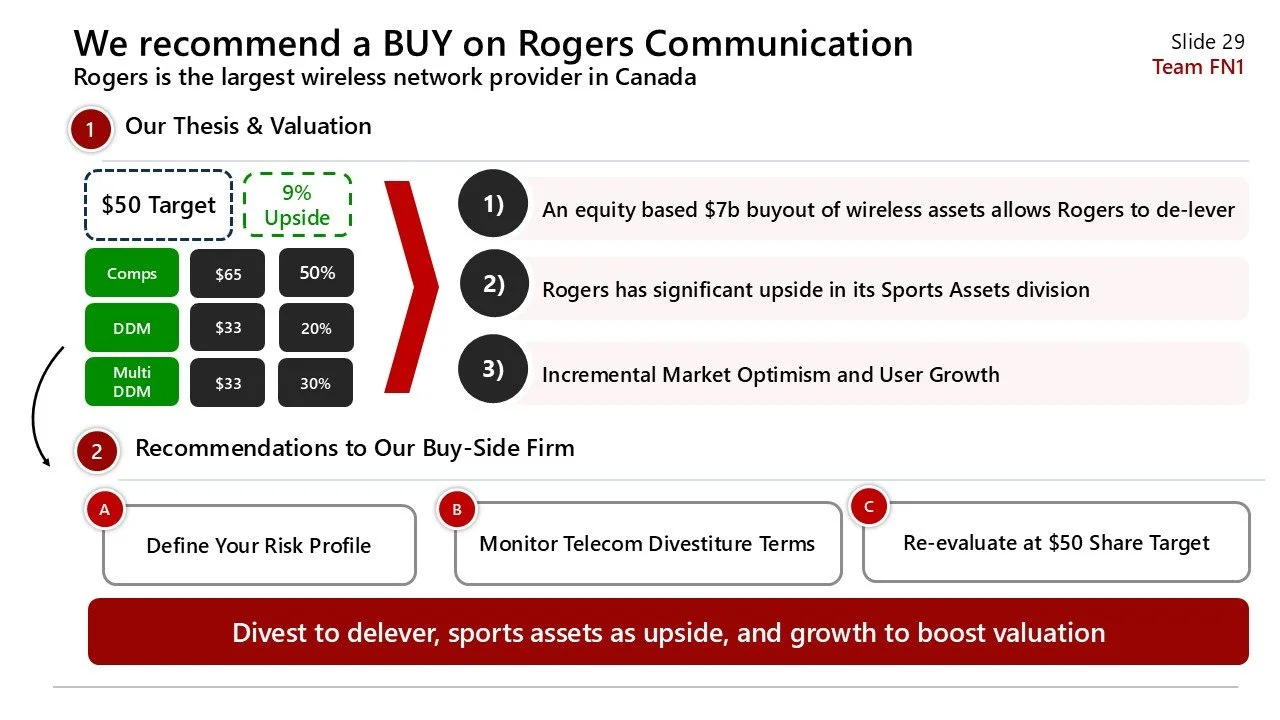

Advancing to the final round at Queen’s University in Kingston, Edina and I were asked to value Rogers Communication under very tight constraints. We were limited to dividend discount models only, both single stage and multi stage, with trading multiples given to us upfront. There was no freedom to forecast cash flows creatively, so all of the conviction had to come from understanding capital structure, dividend sustainability, regulation, and the industry itself.

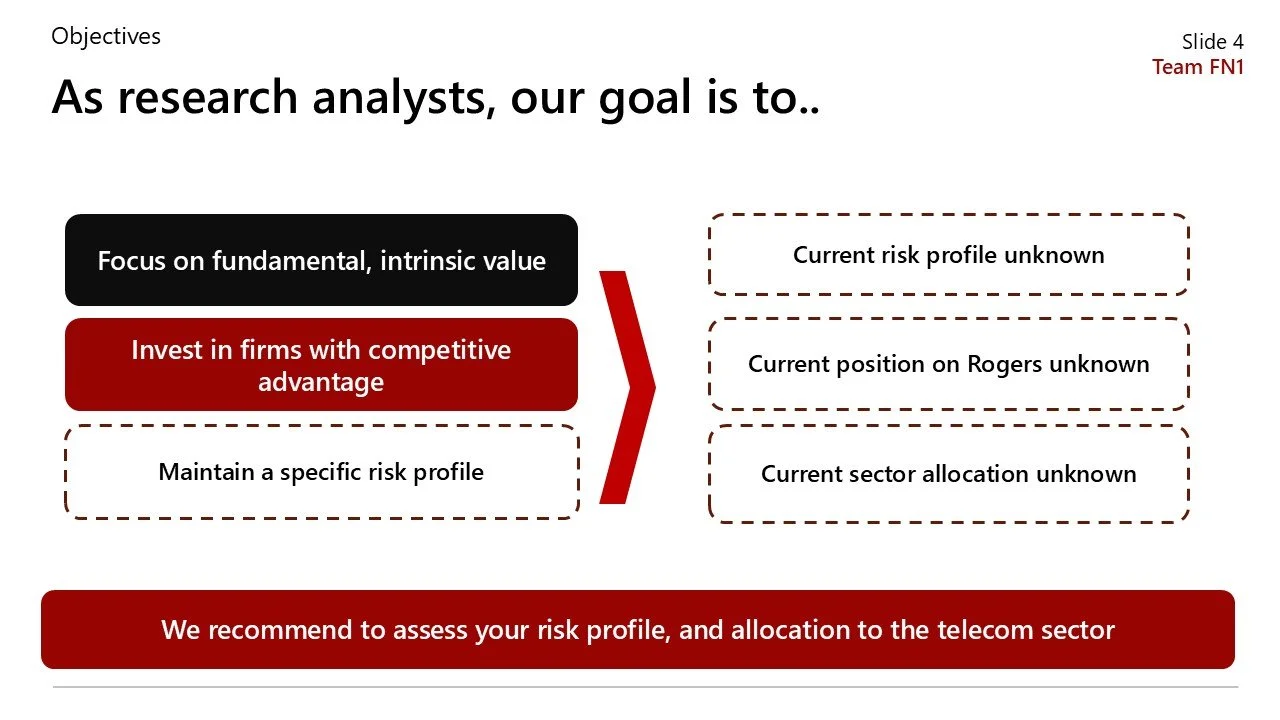

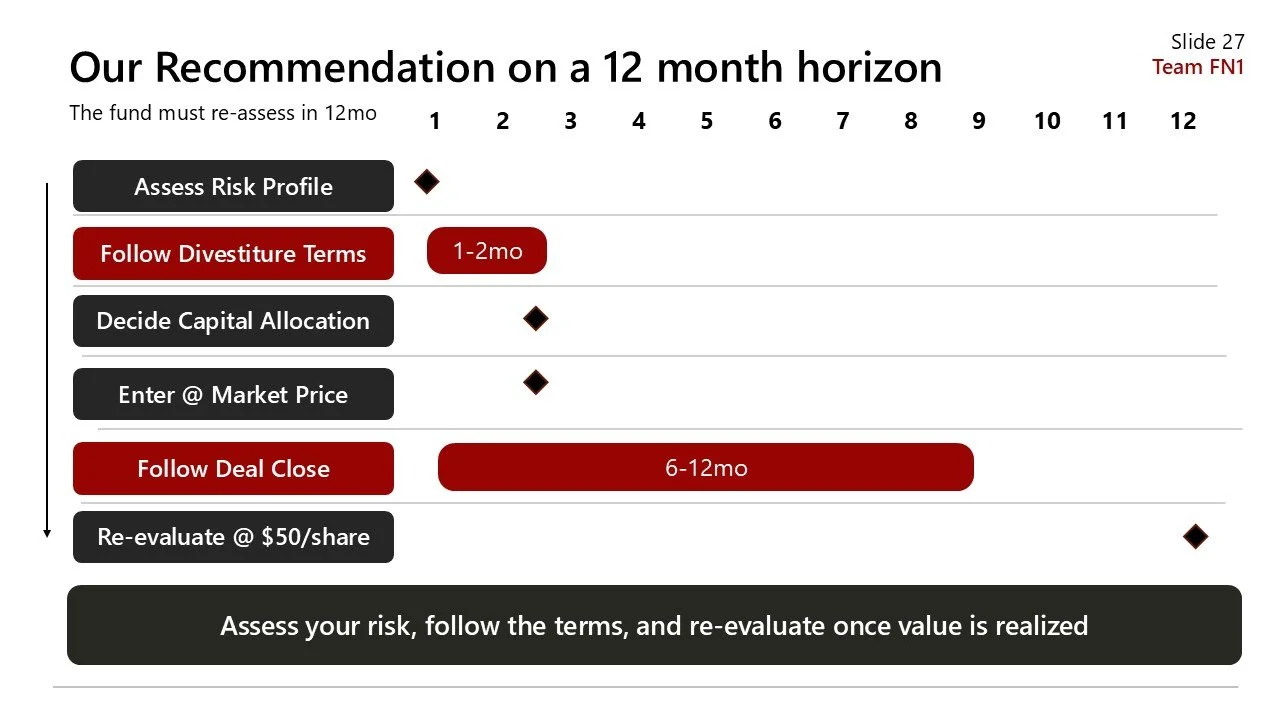

I strongly believe that how you position an idea matters just as much as the math. We were effectively pitching to an institutional fund, but we were given no context on their sector allocation, mandate, or risk tolerance. Based on how Dr. Bob always taught us, we approached the case by first thinking about who we were presenting to.

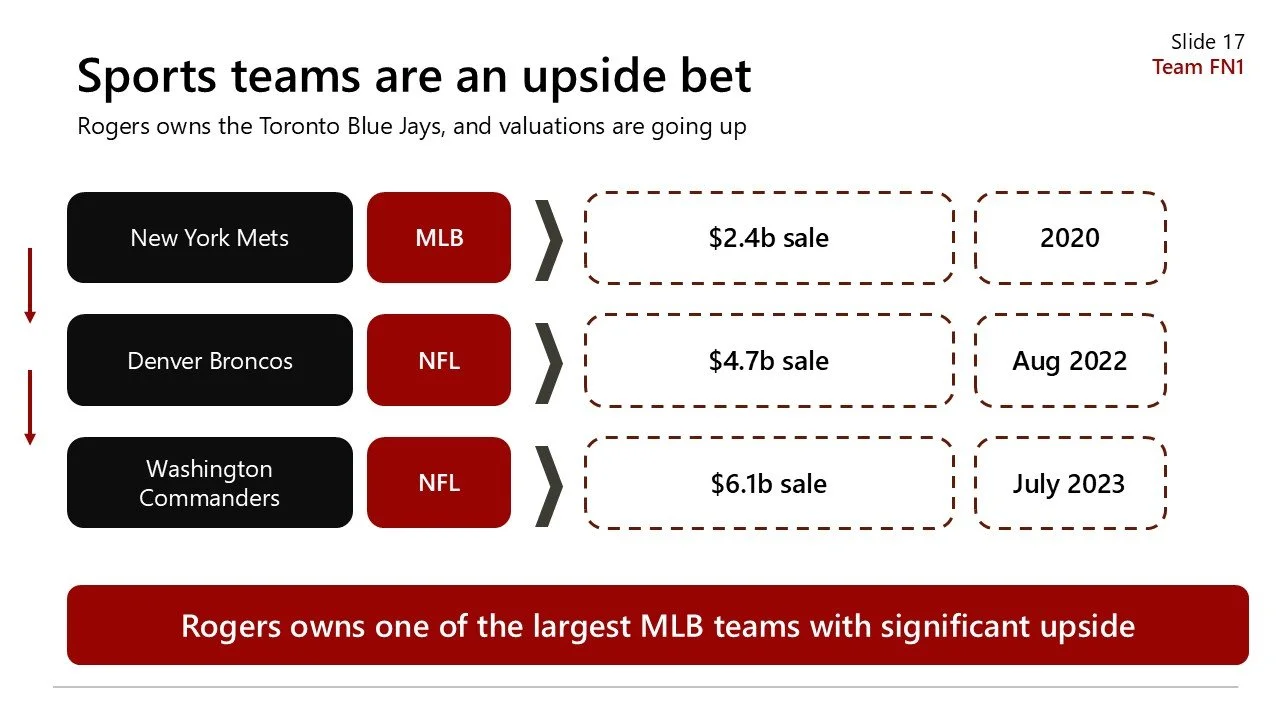

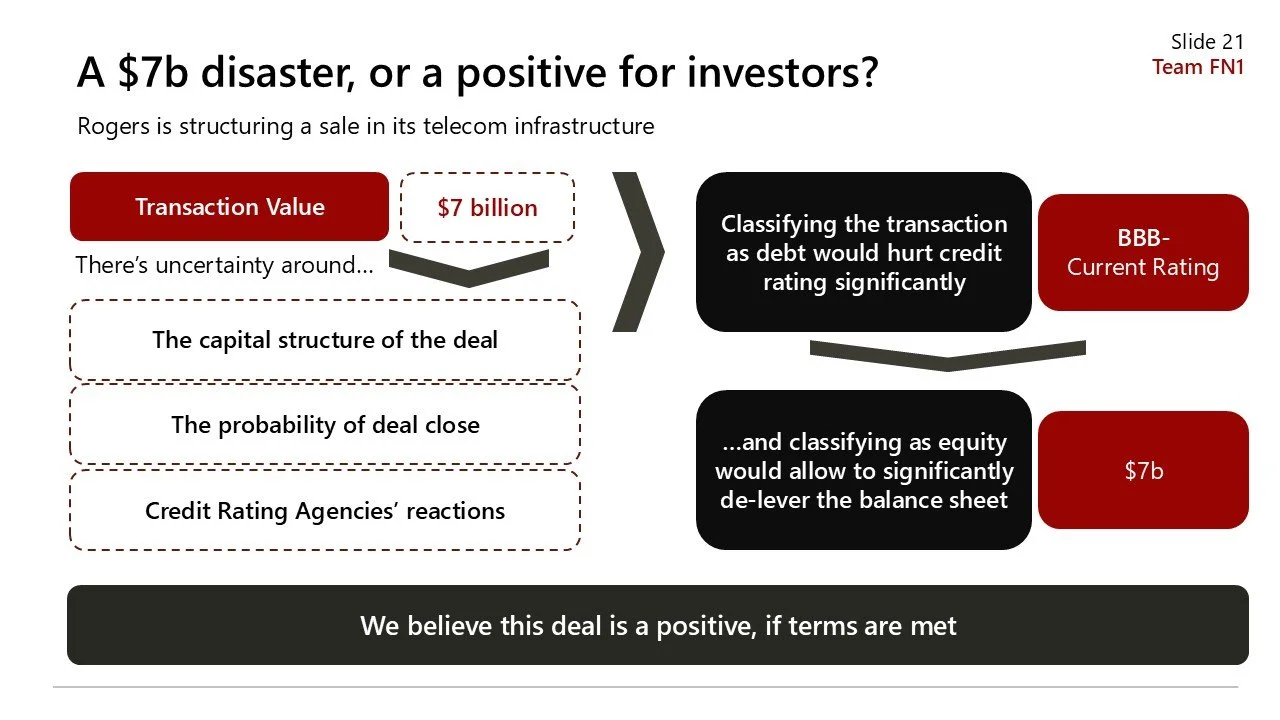

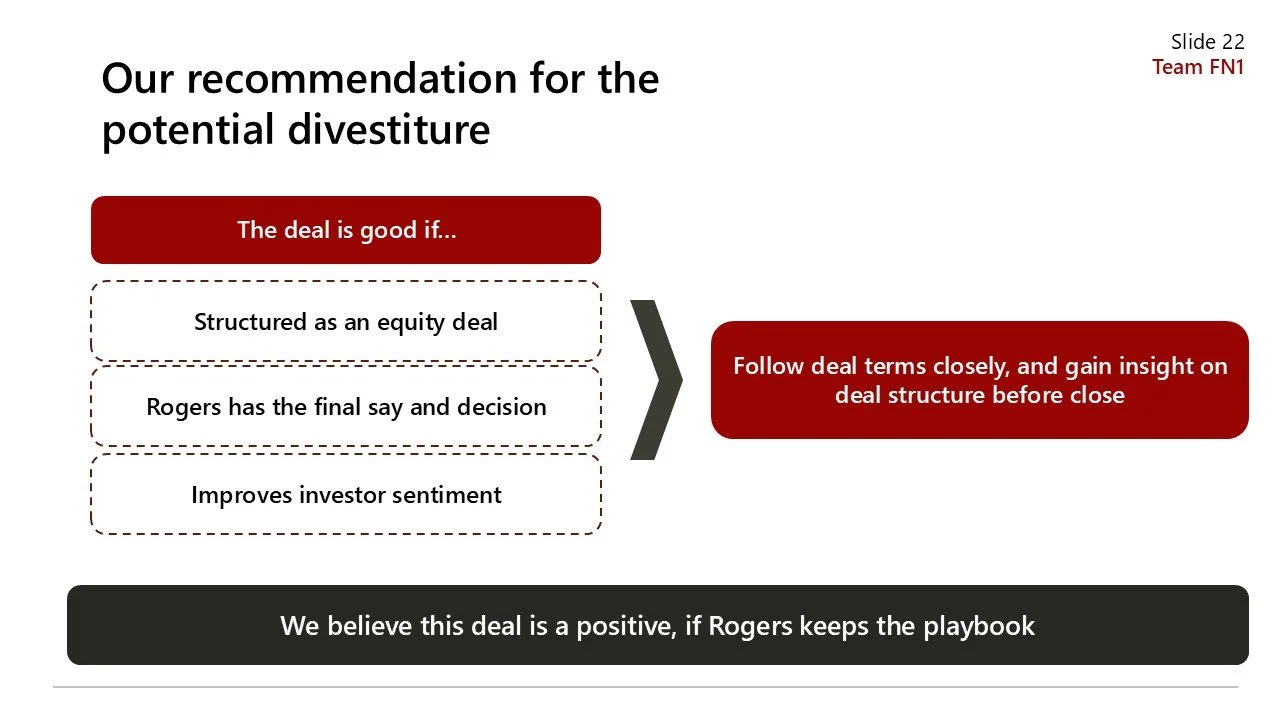

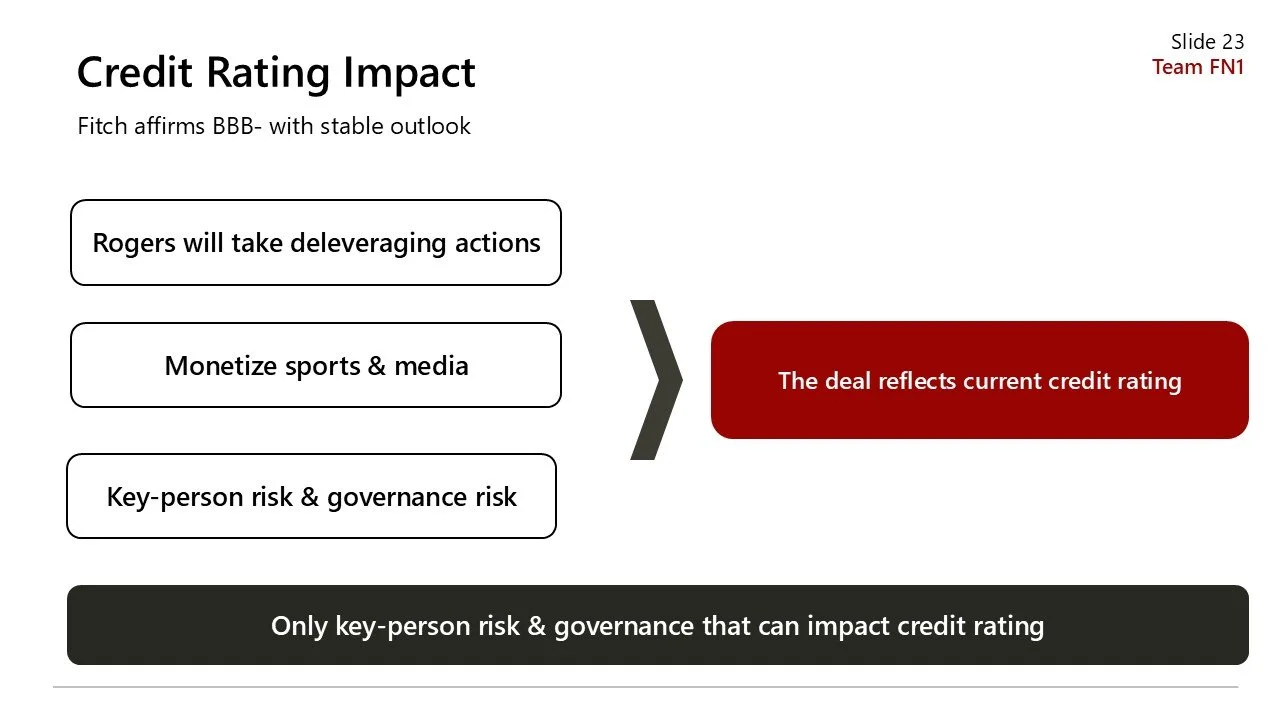

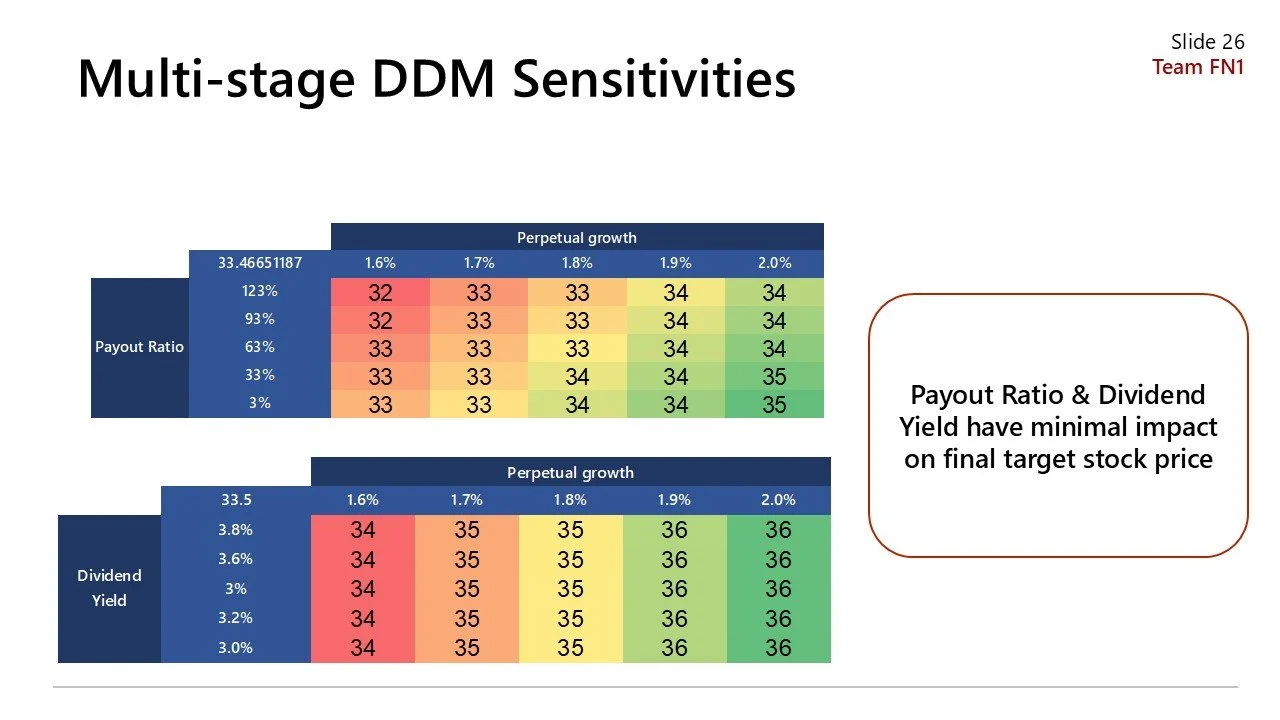

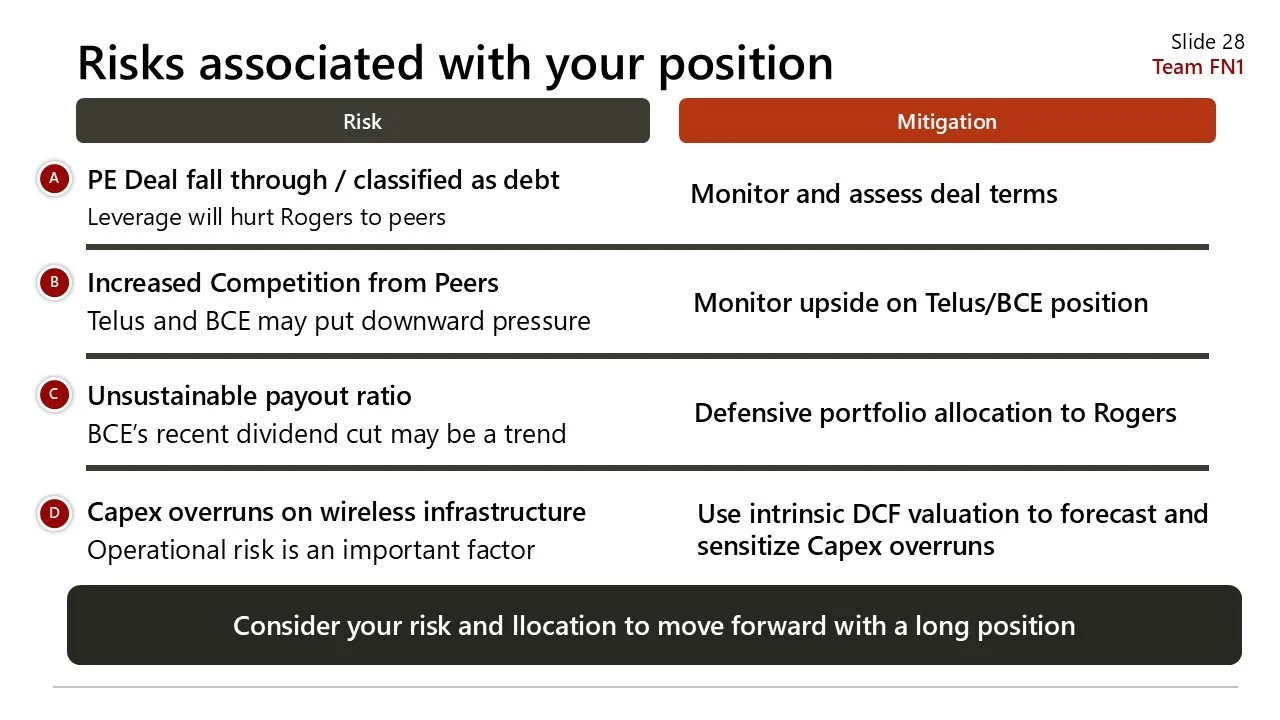

Instead of forcing a blanket buy or sell, we framed the pitch around portfolio fit and decision usefulness. We built a multi stage DDM anchored in post capex normalization and deleveraging, stress tested our assumptions under regulatory and competitive pressure, and then translated that work into a clear, risk aware investment recommendation. The goal was to be expressive, disciplined, and realistic about how capital is actually deployed in an institutional setting.