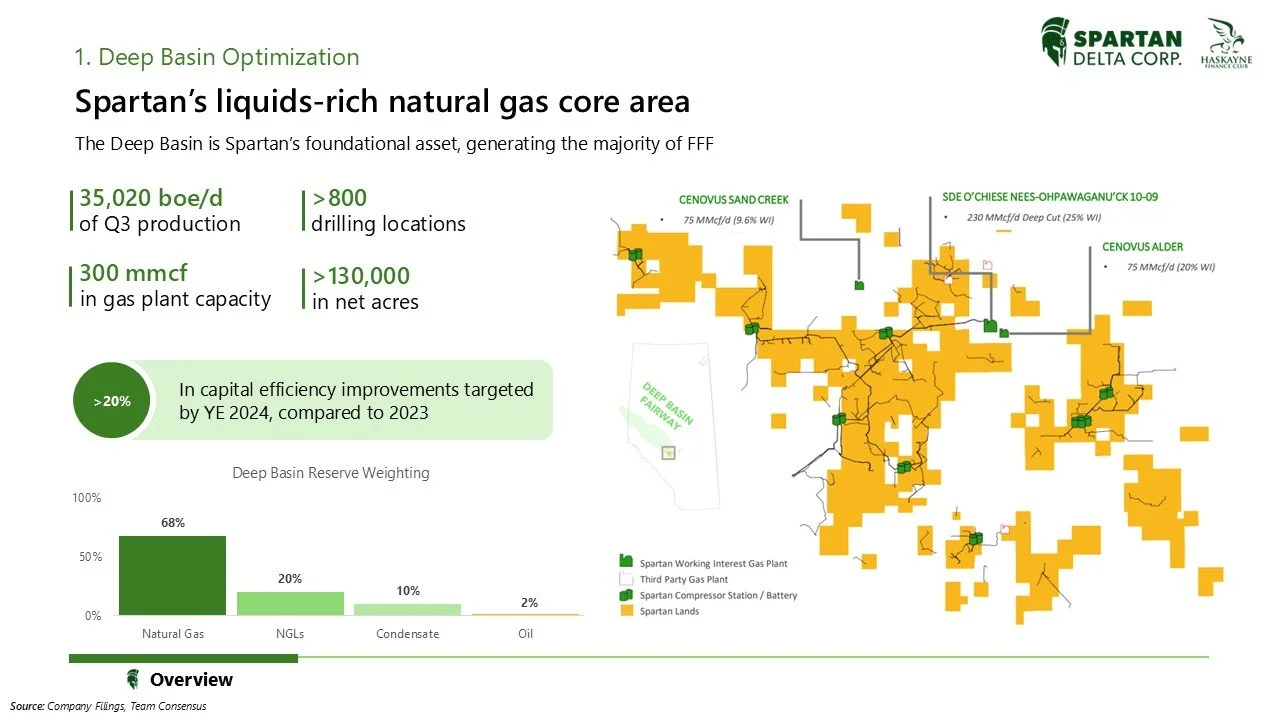

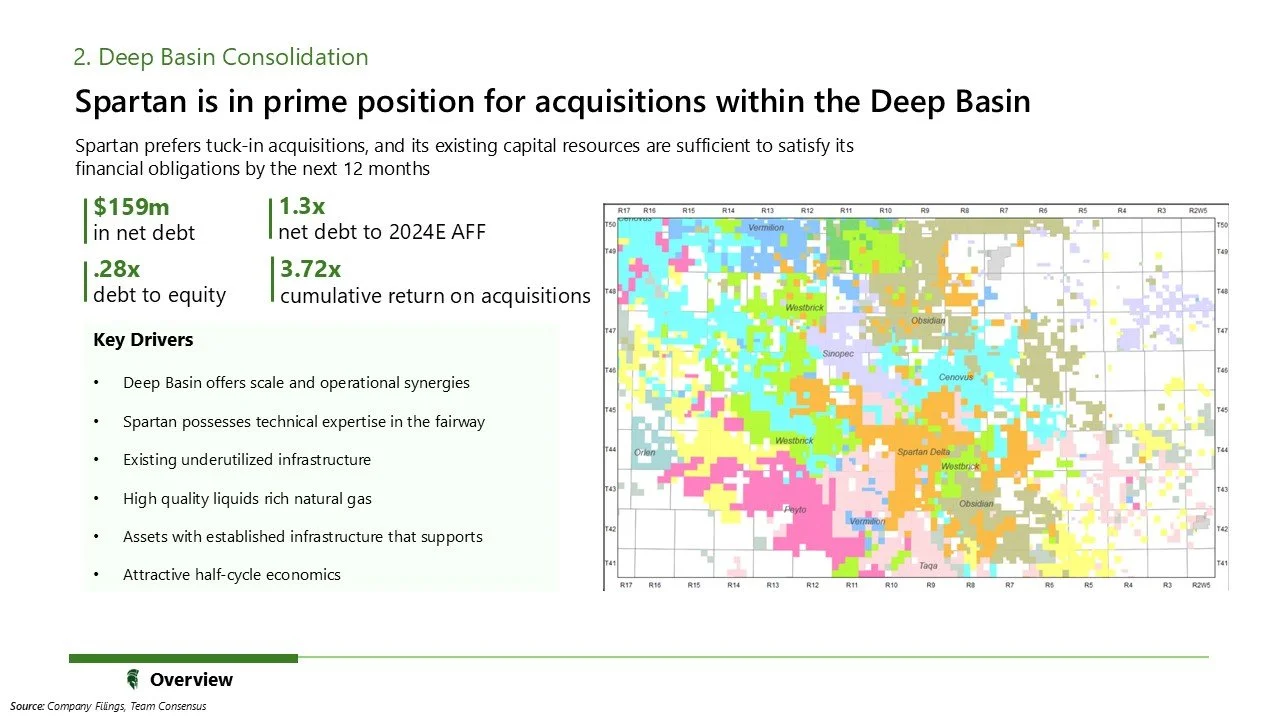

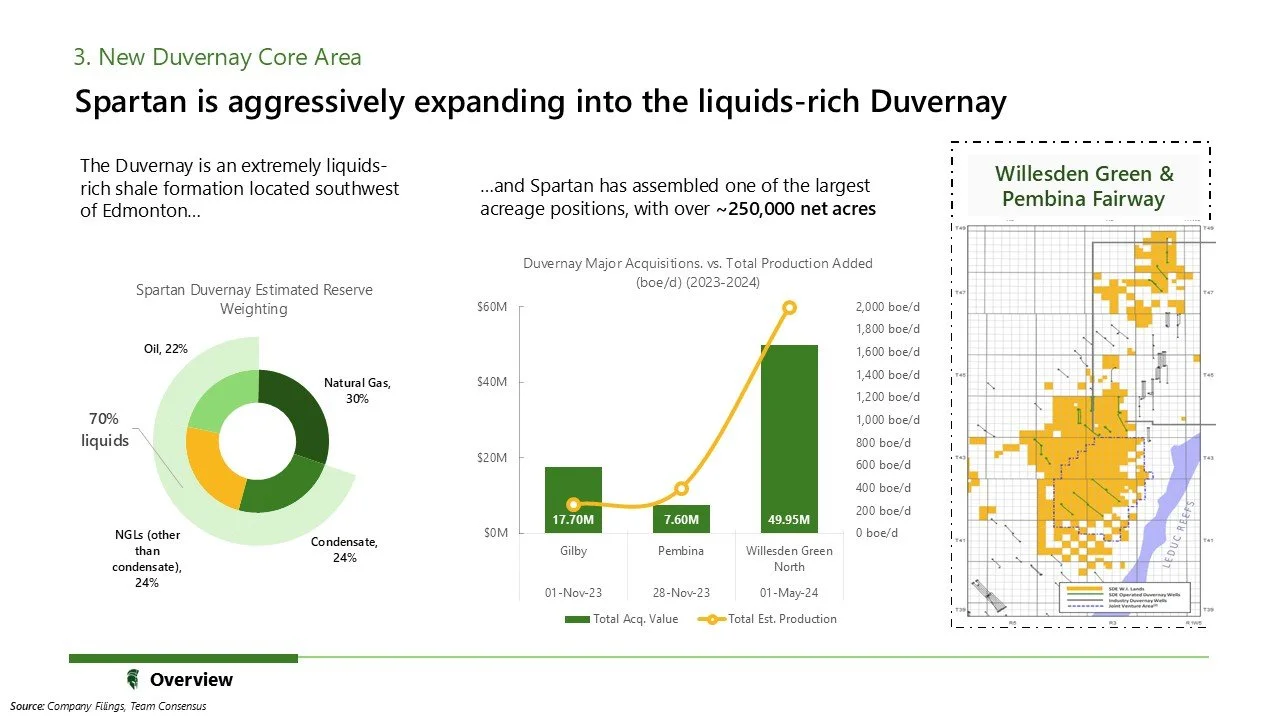

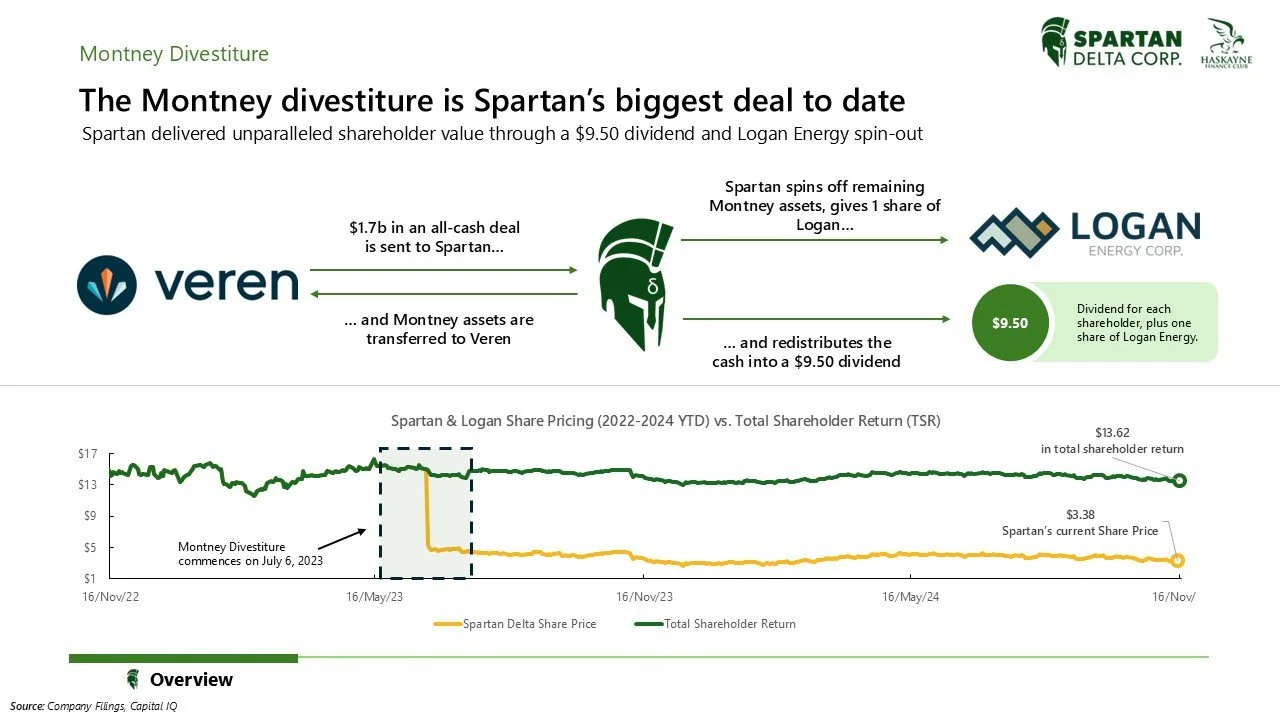

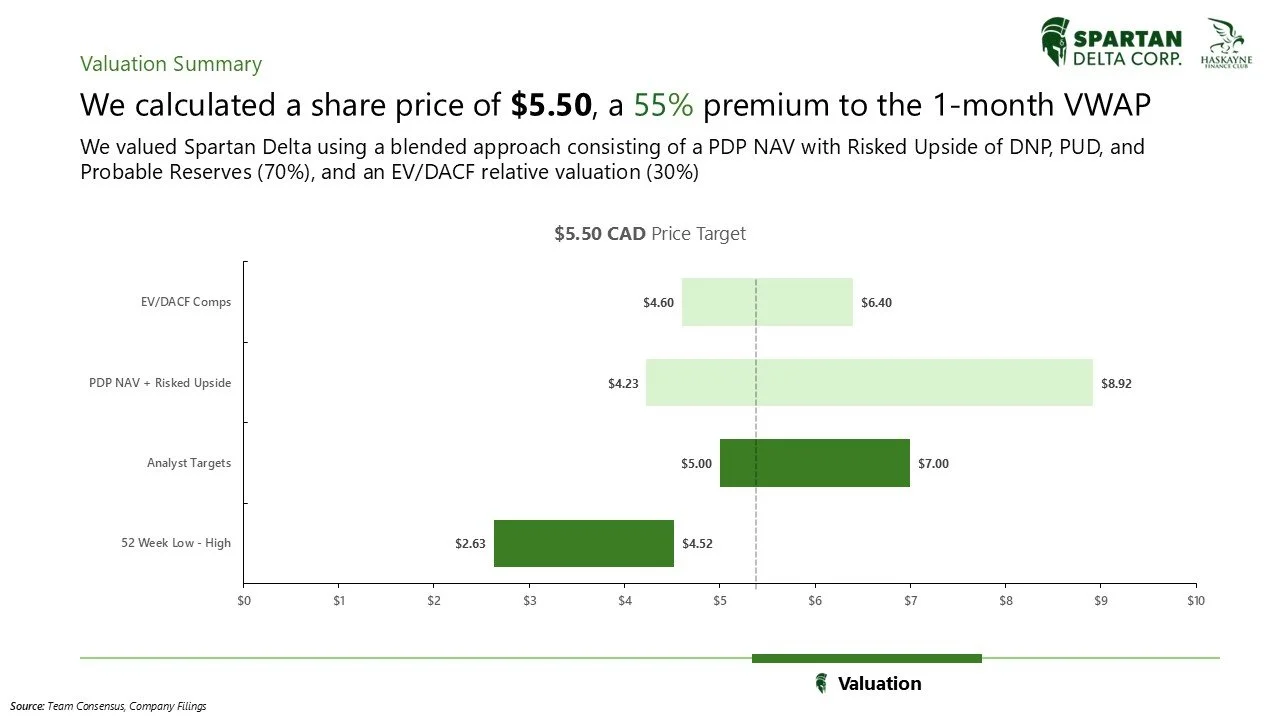

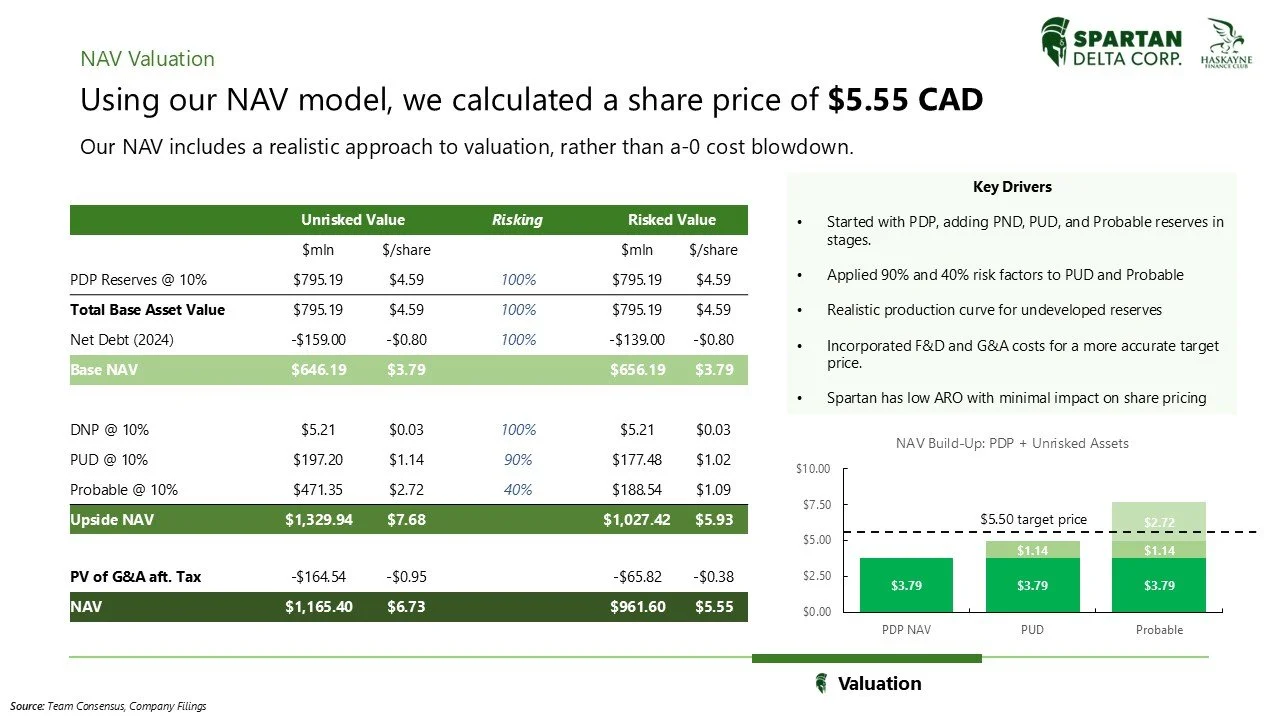

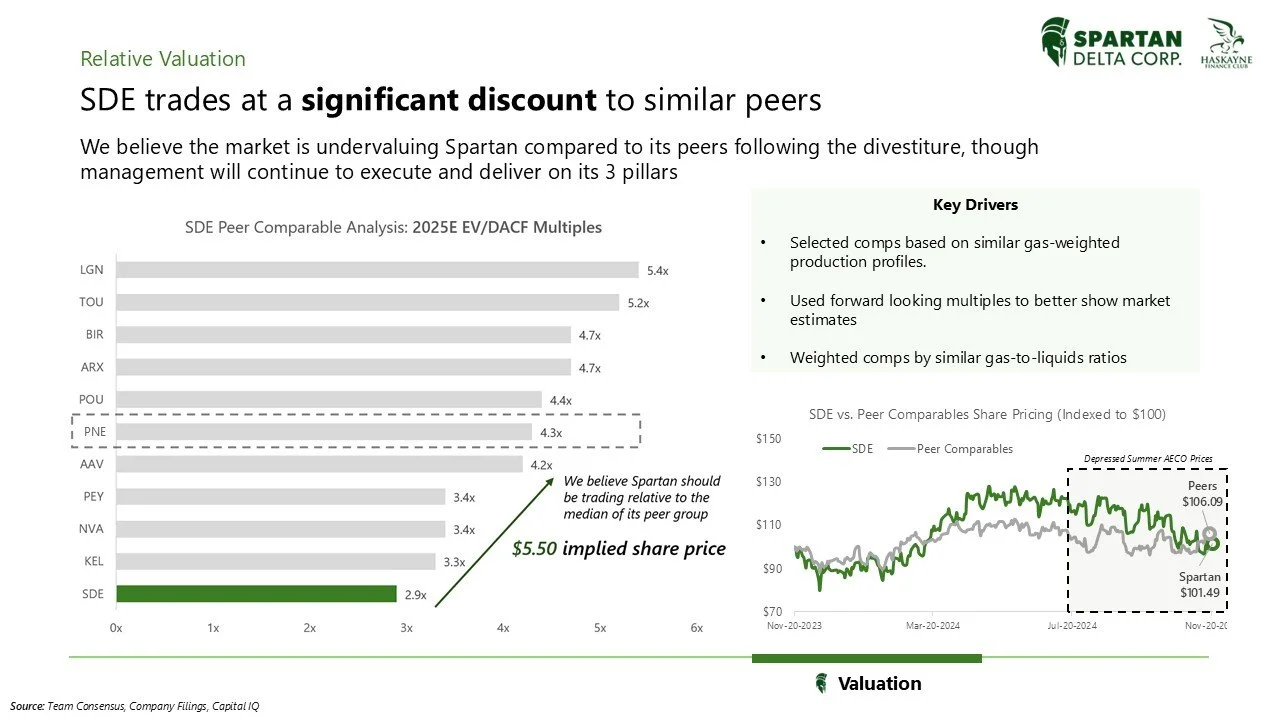

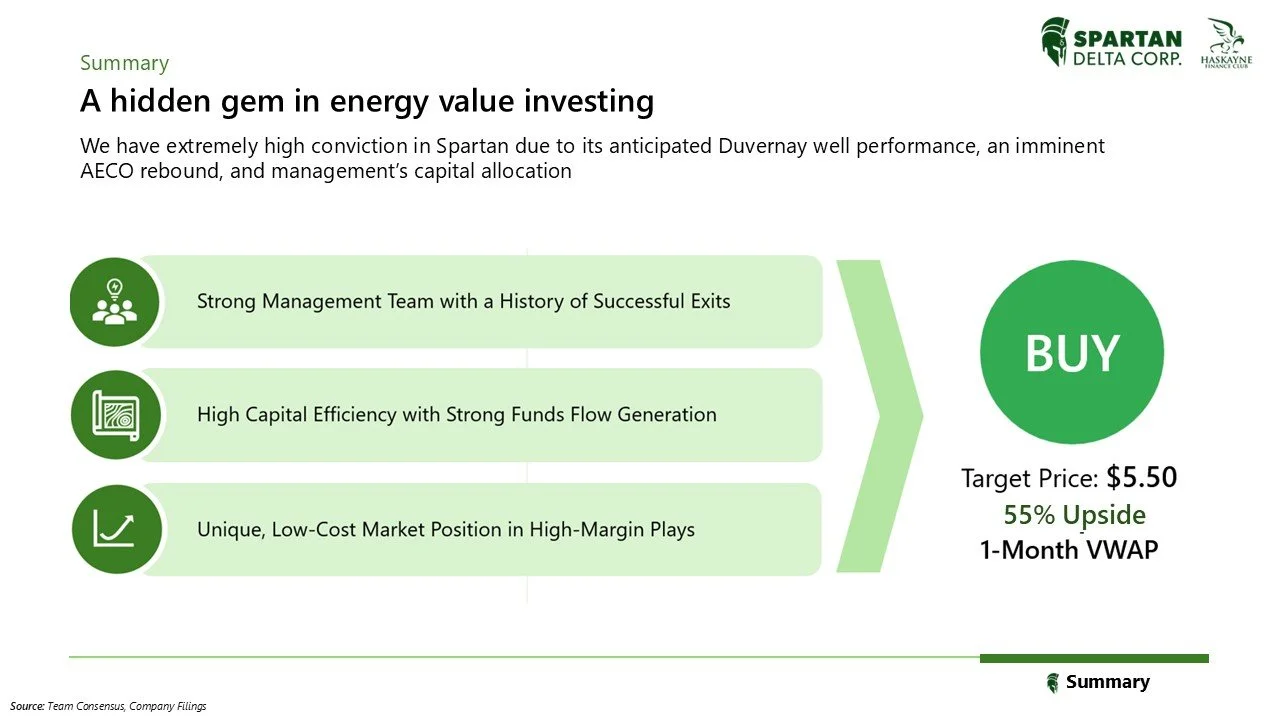

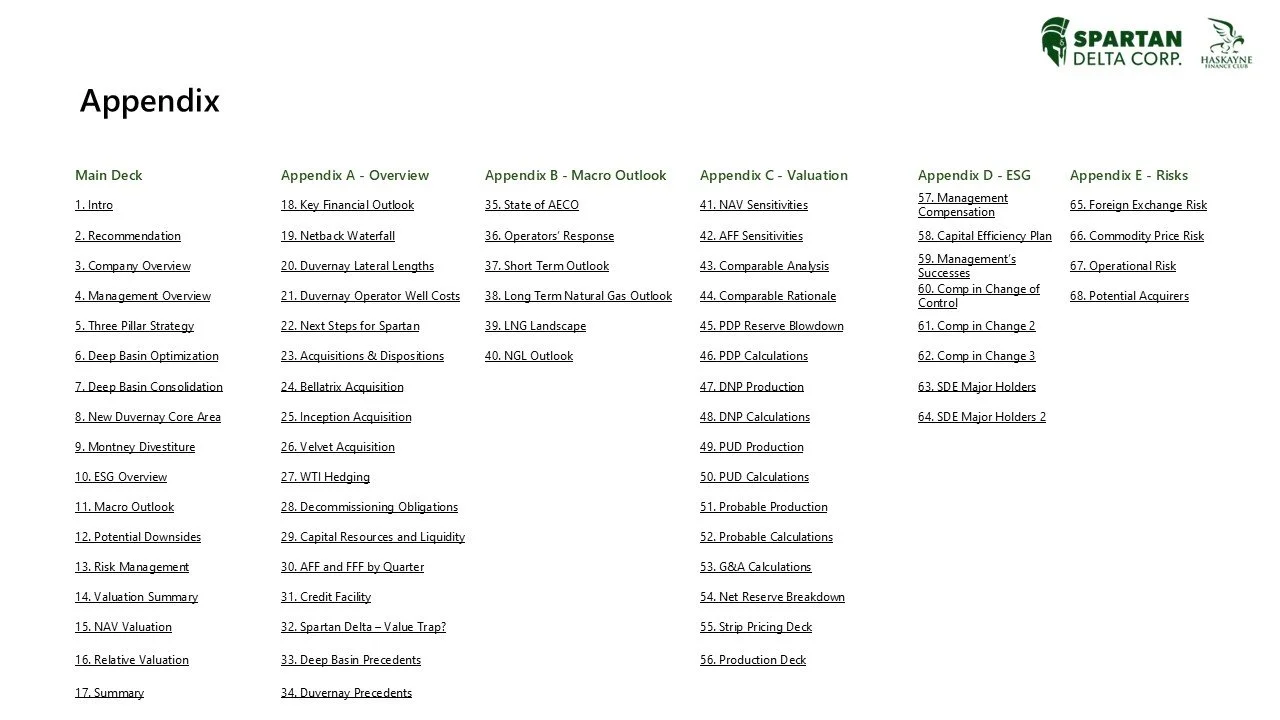

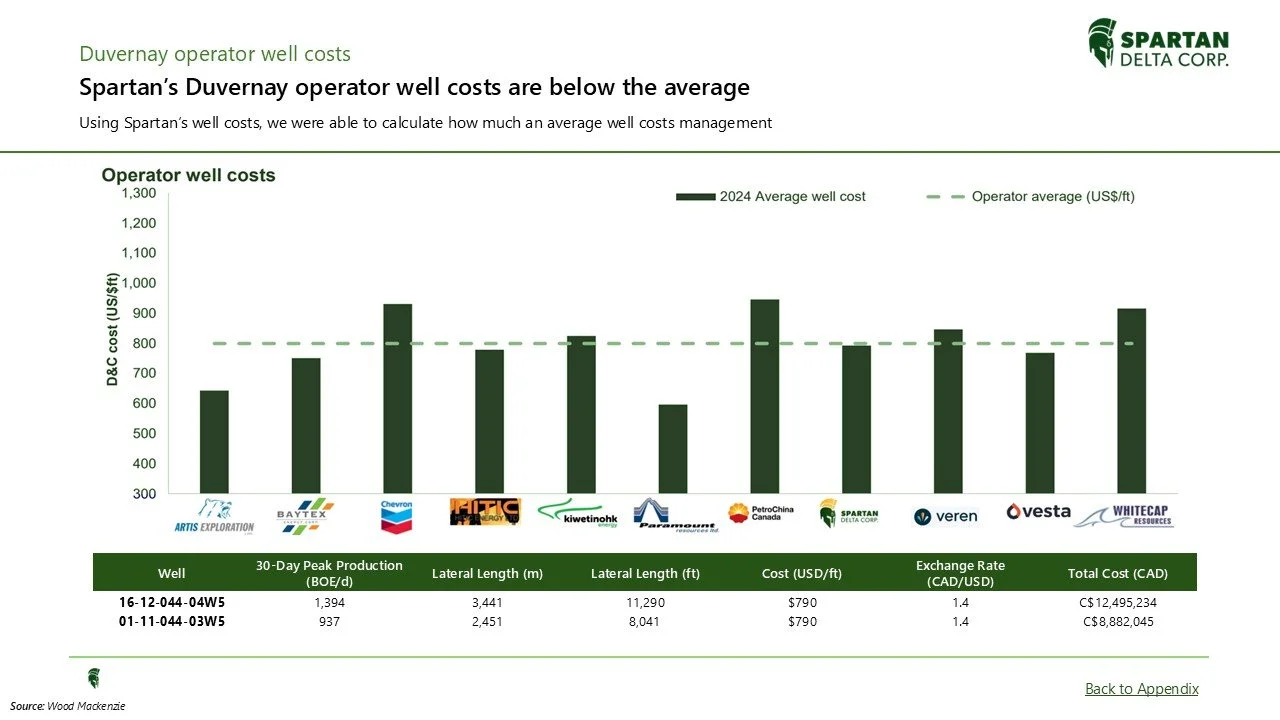

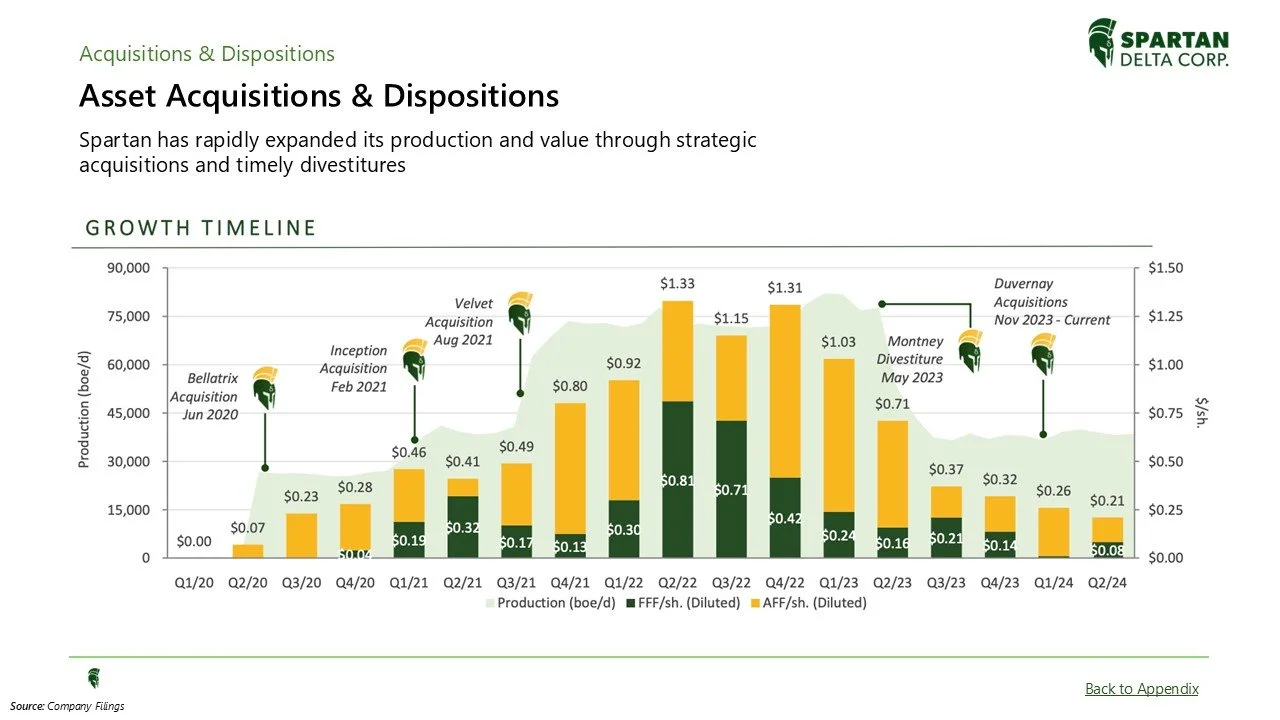

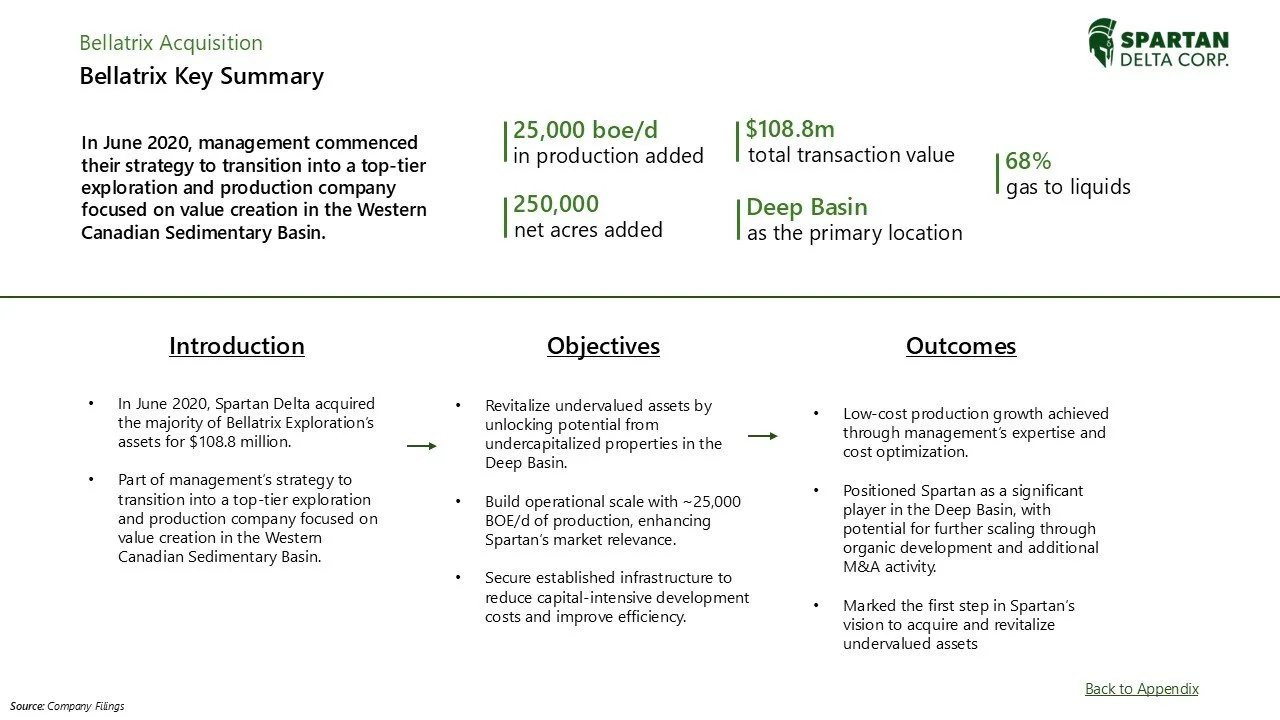

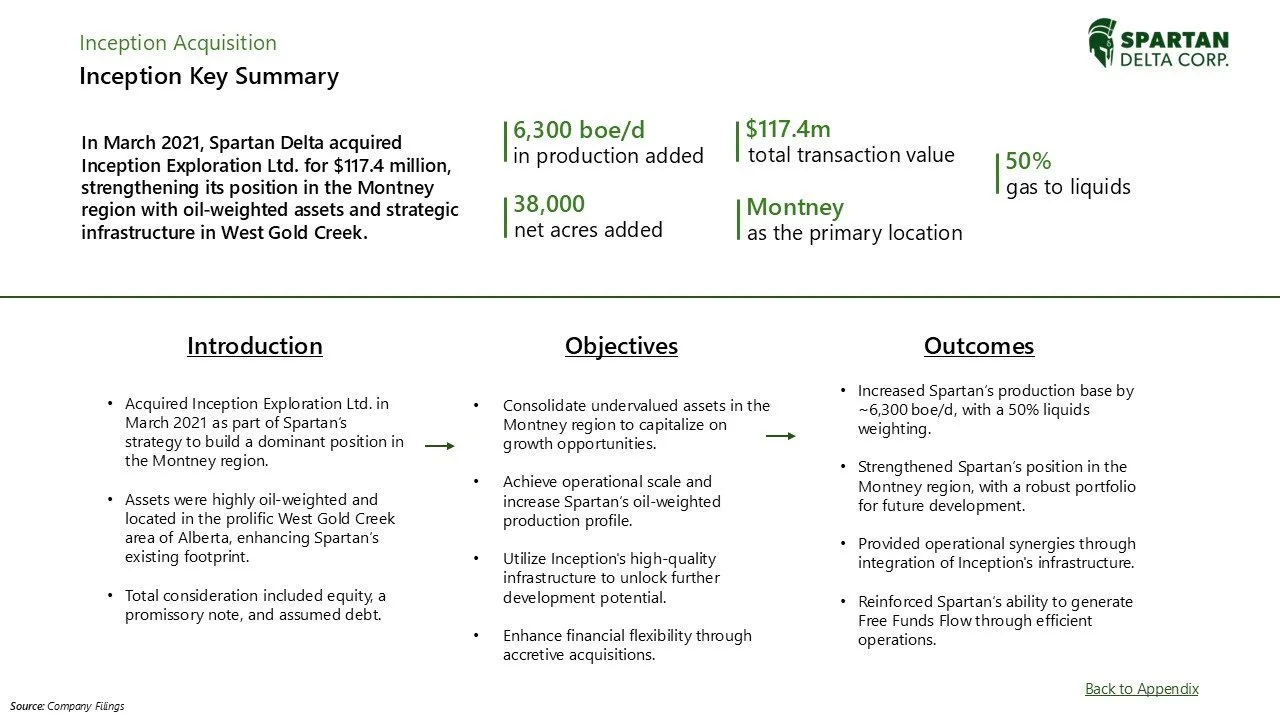

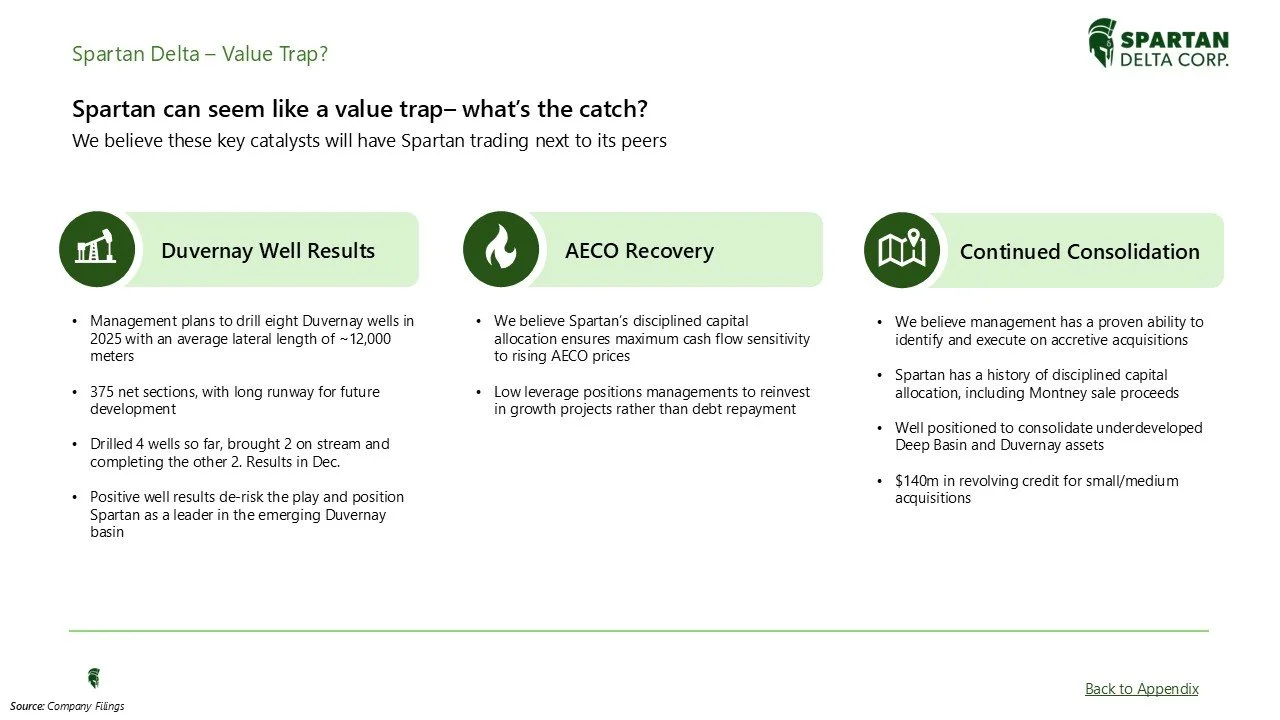

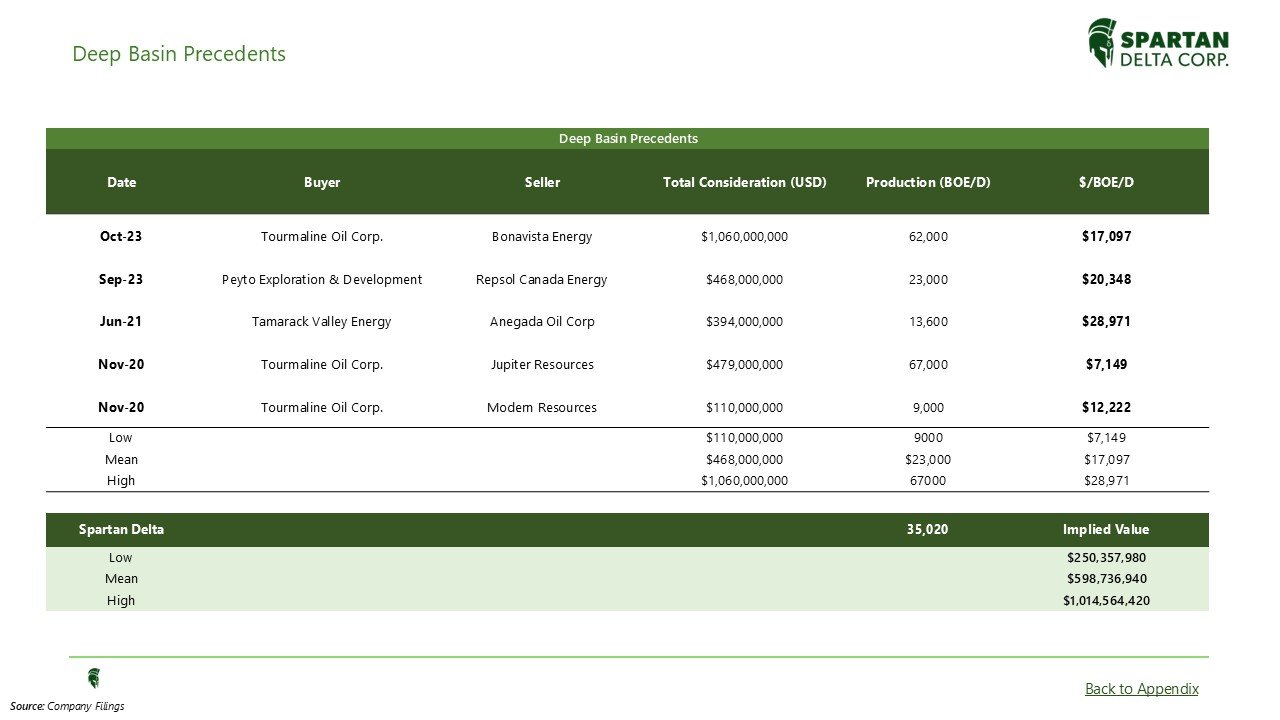

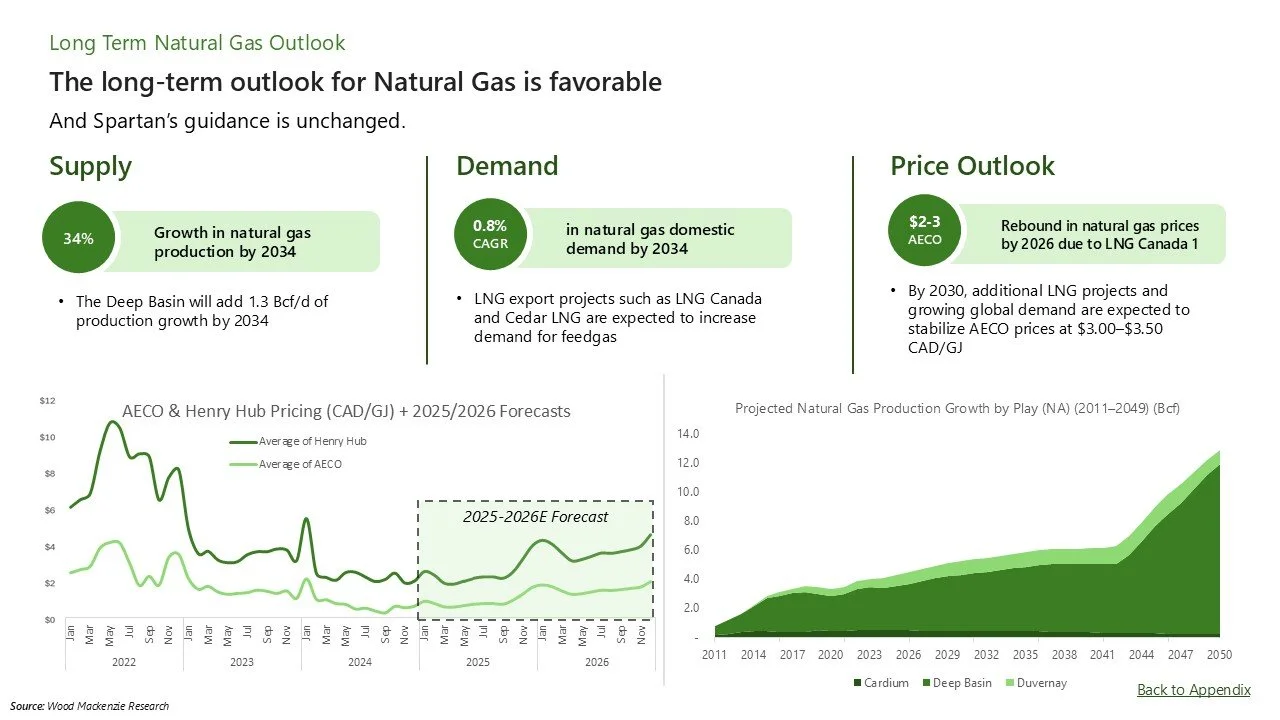

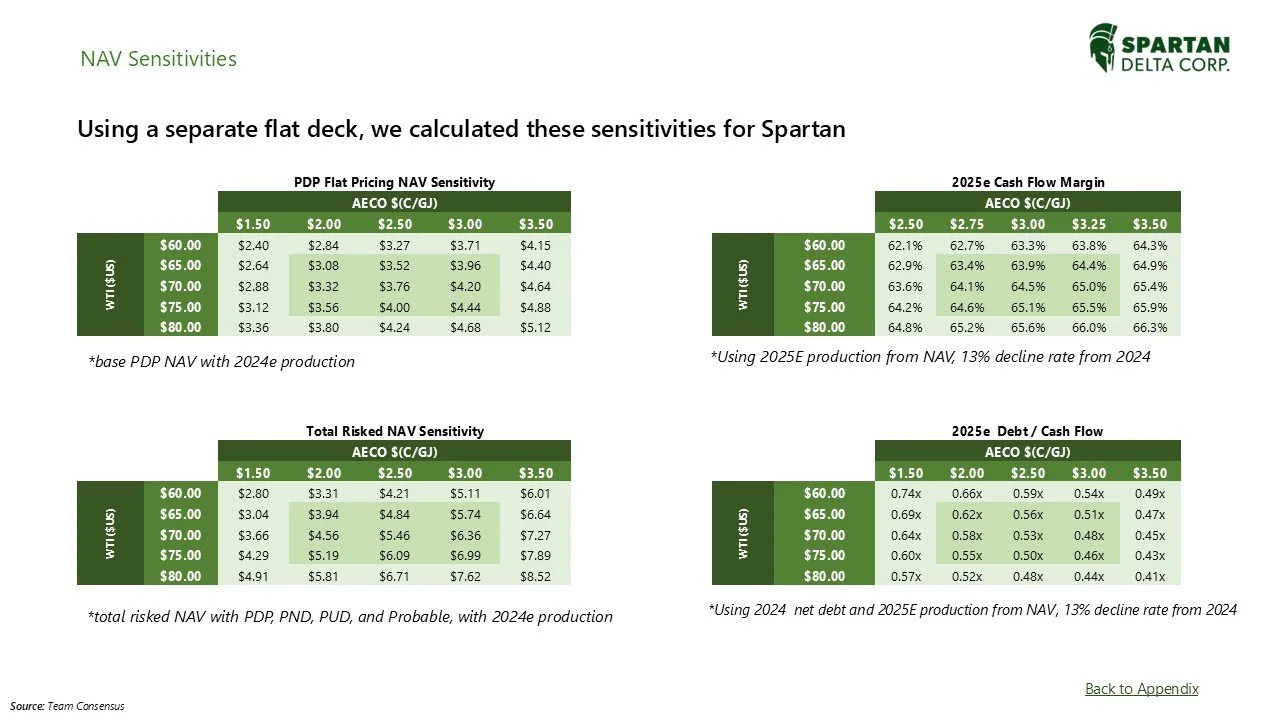

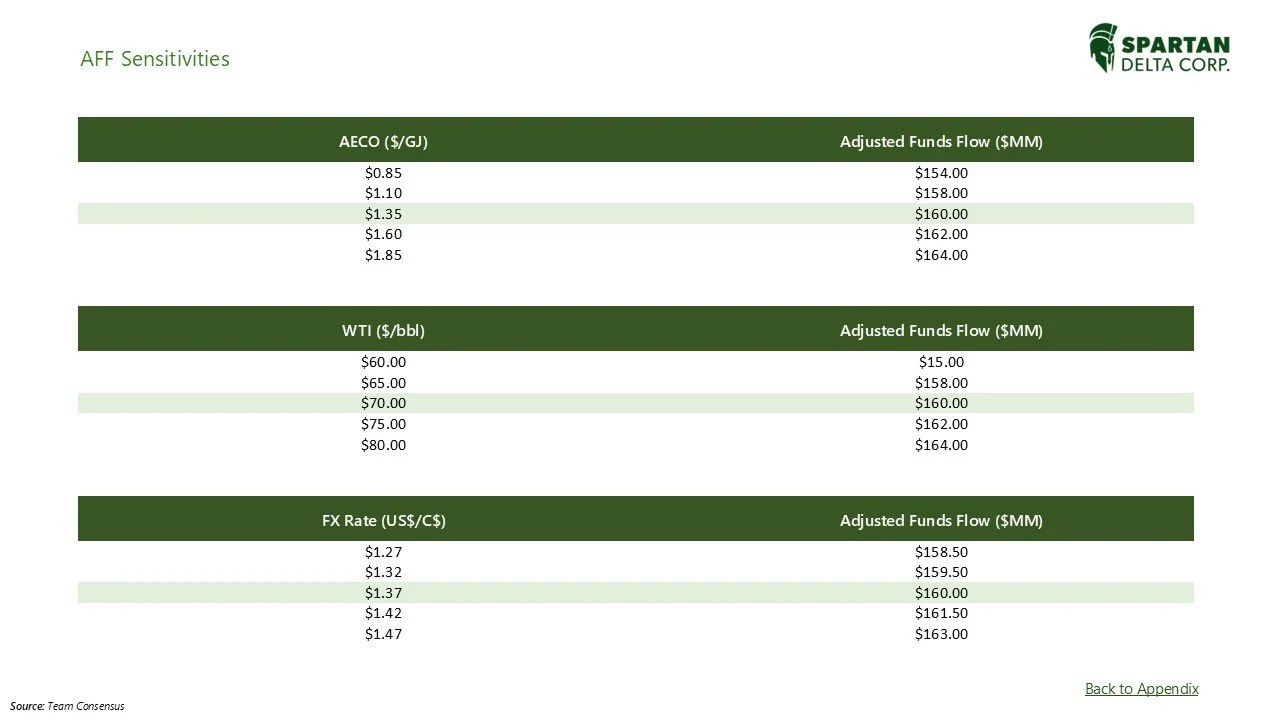

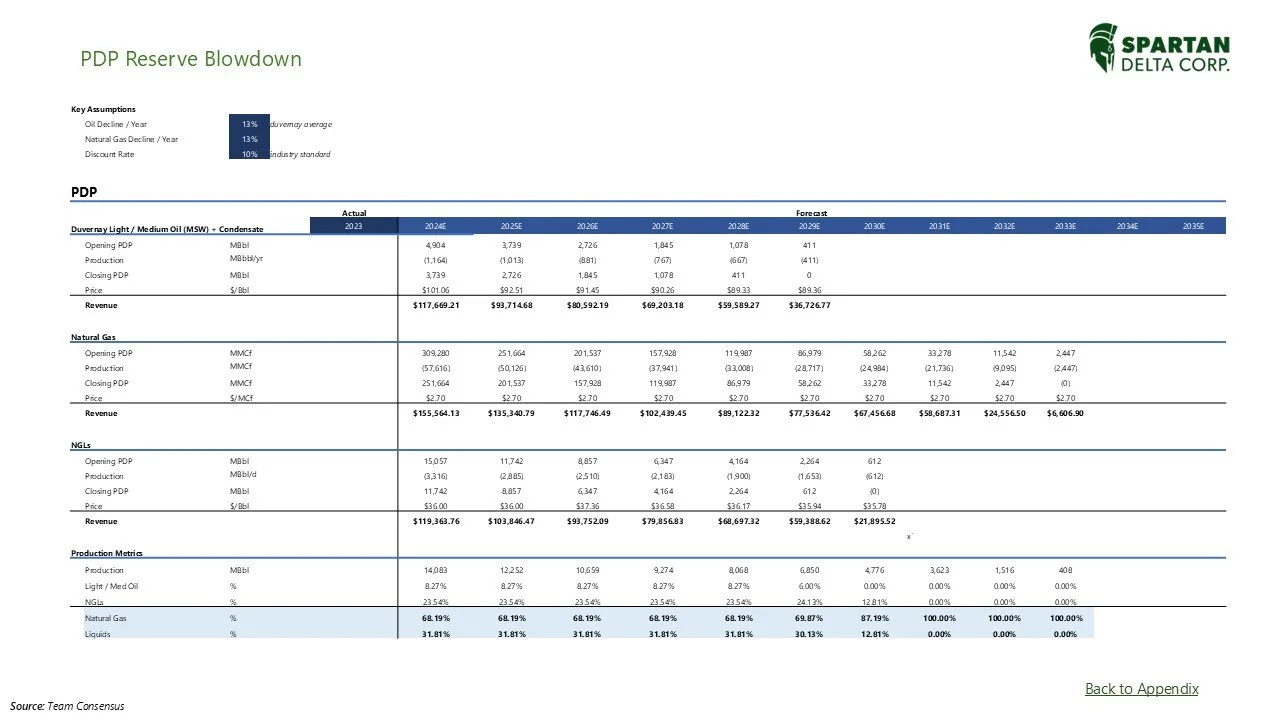

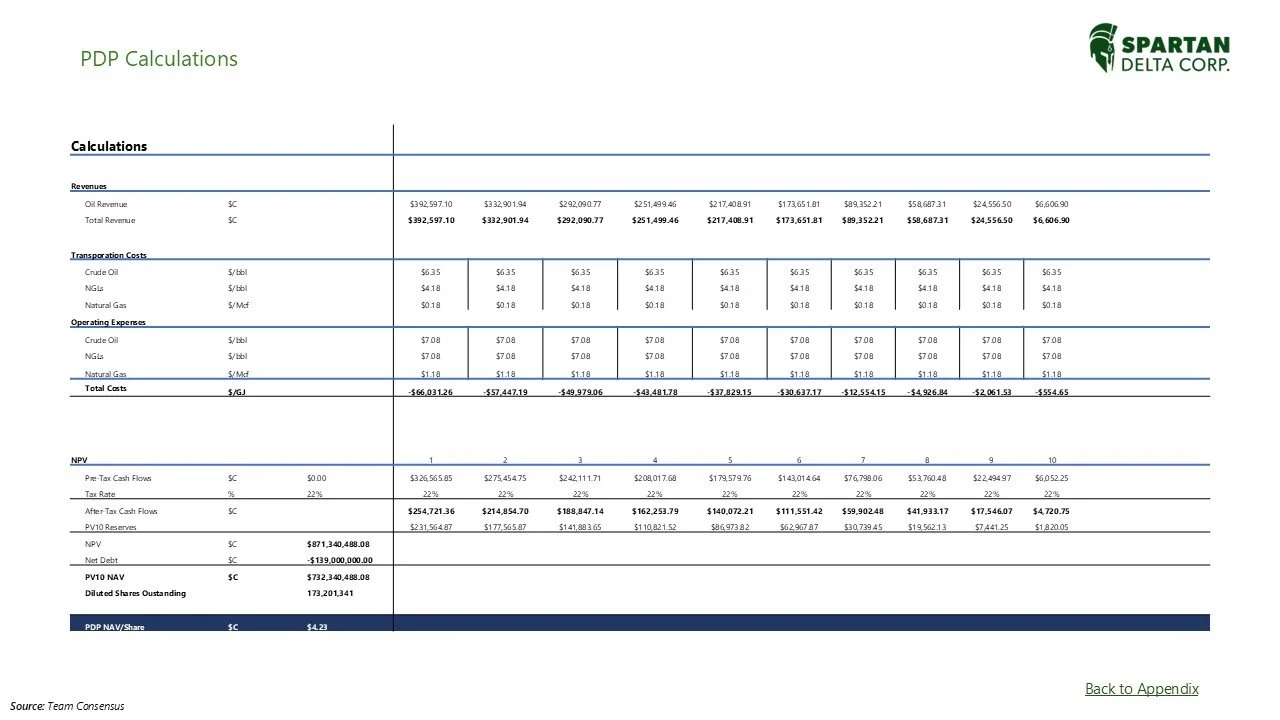

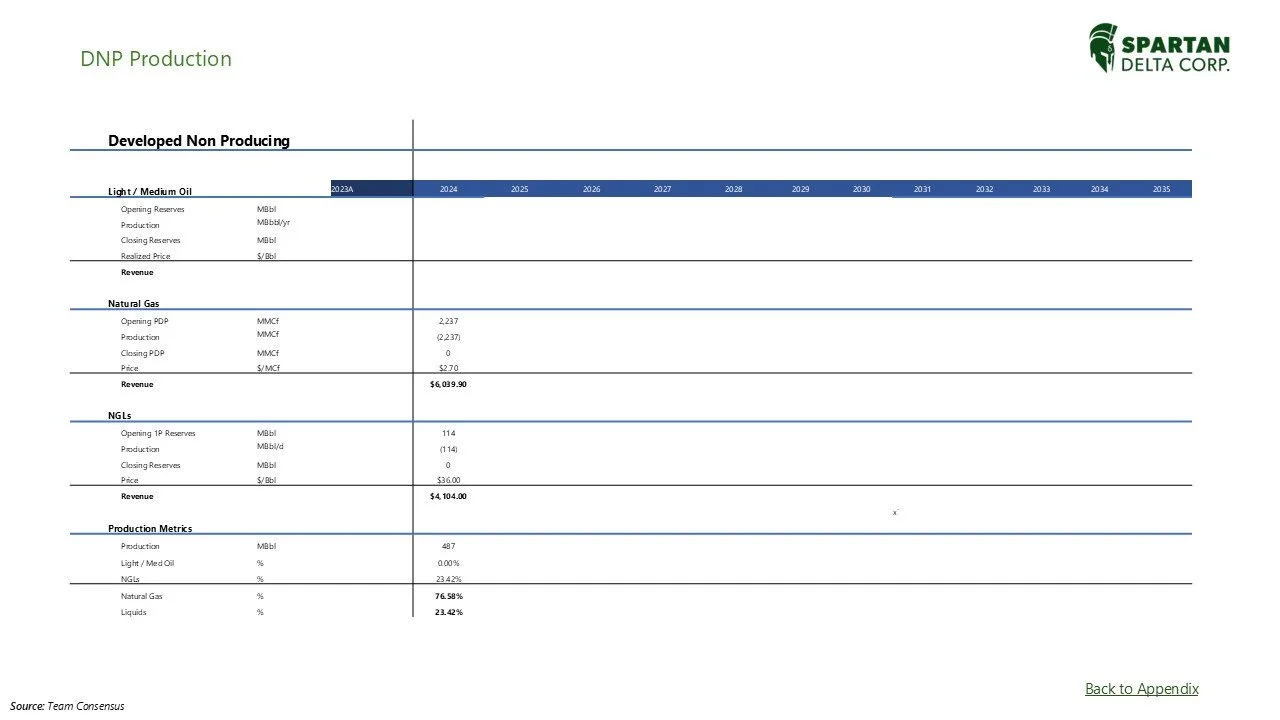

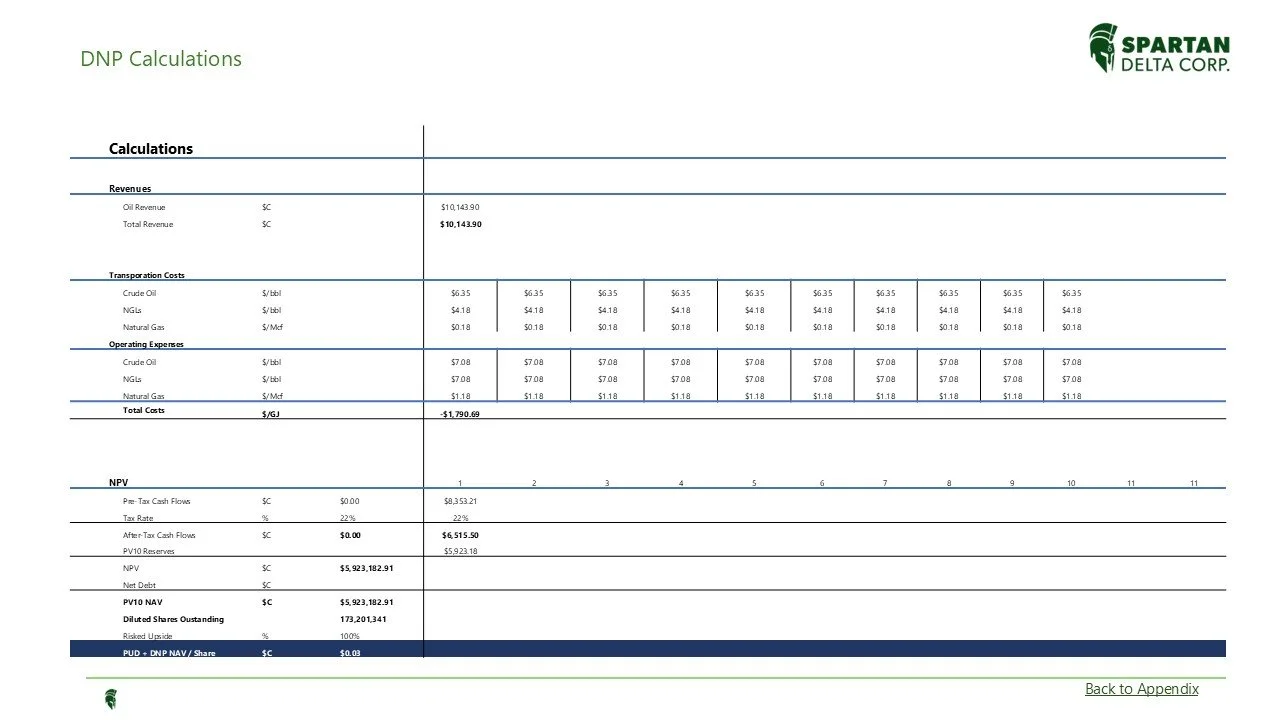

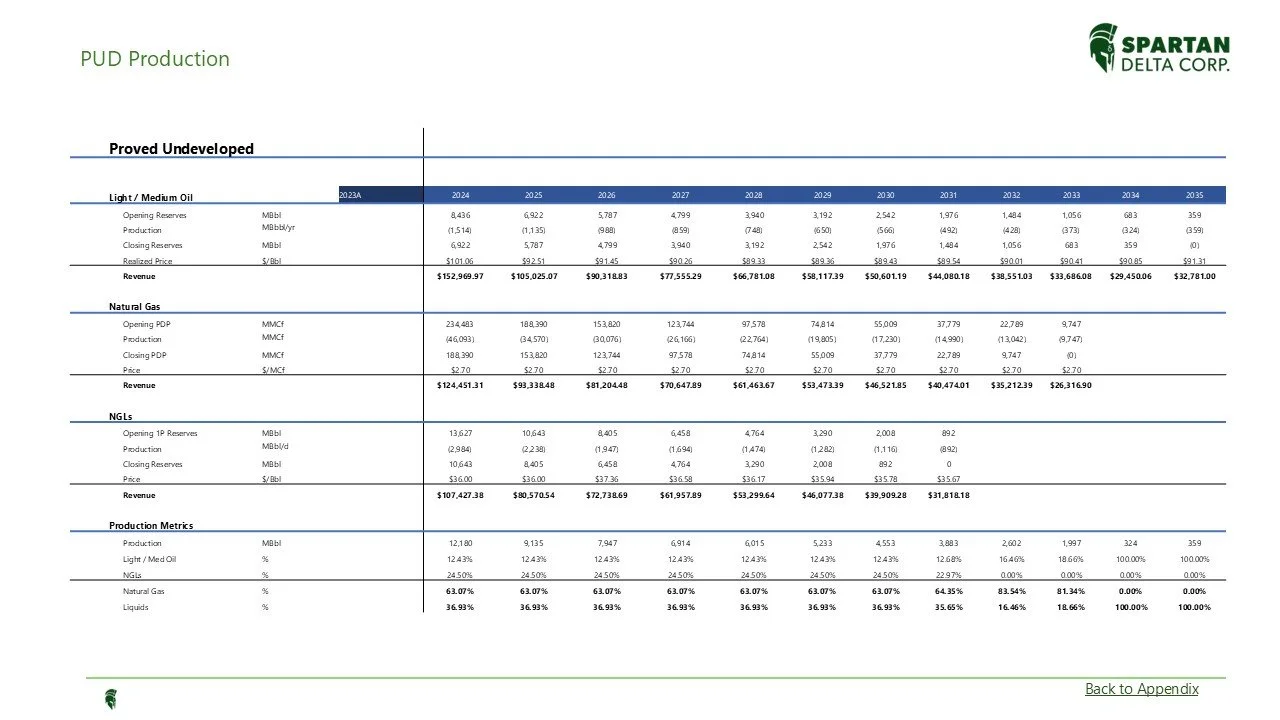

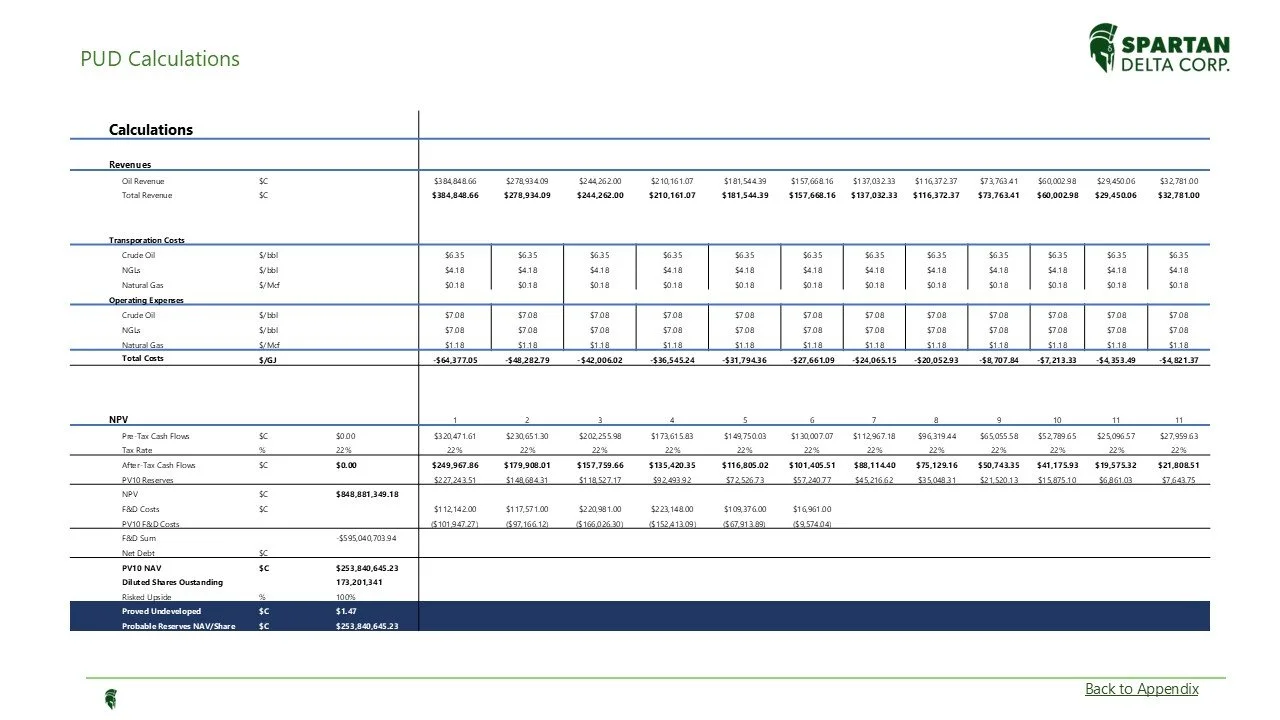

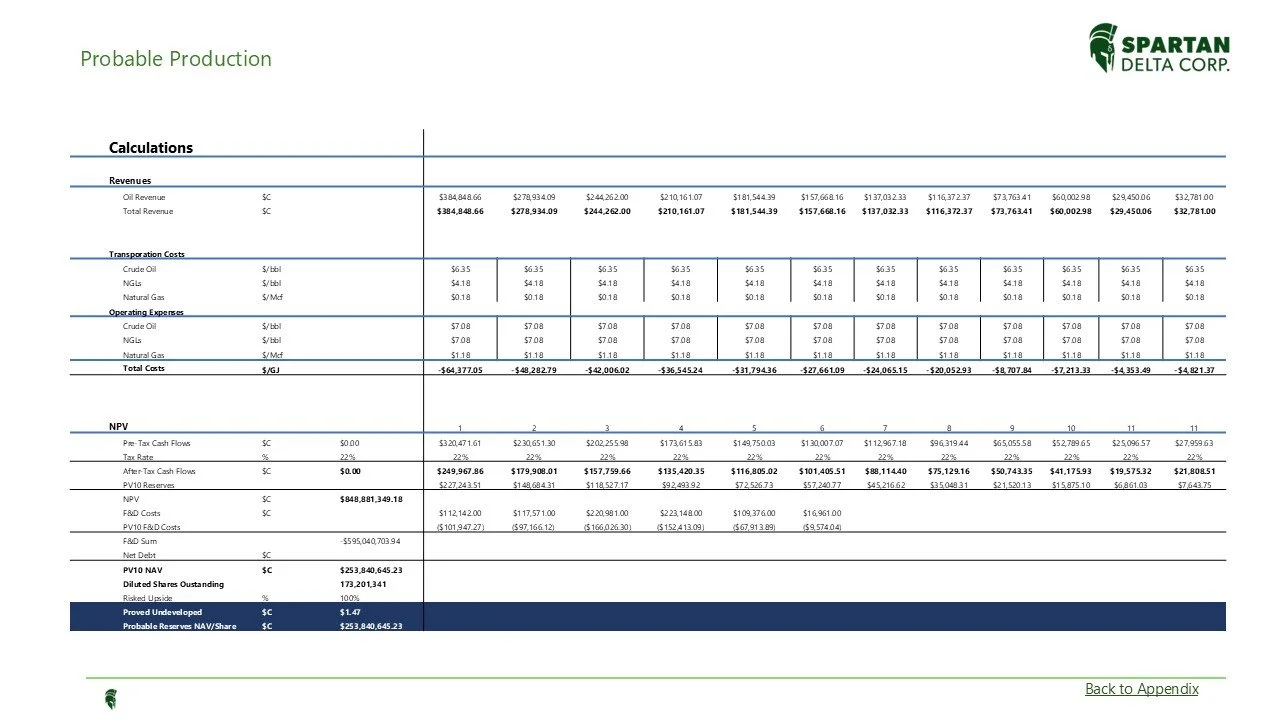

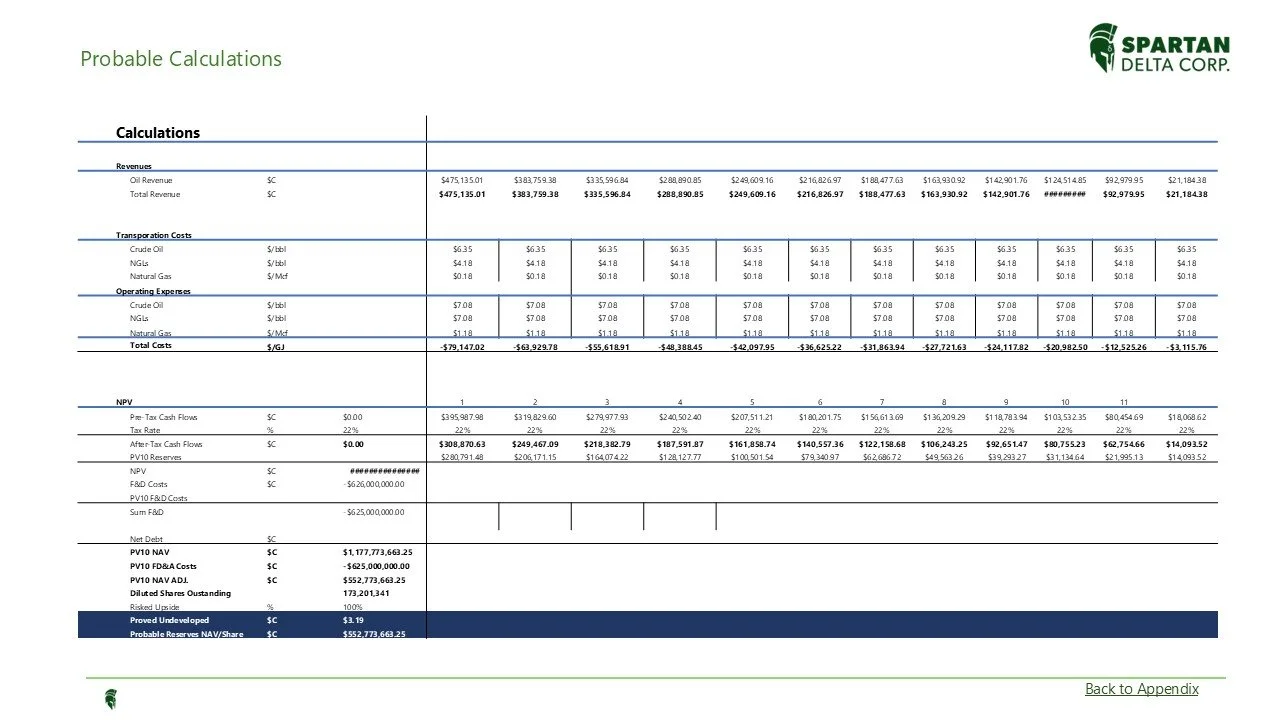

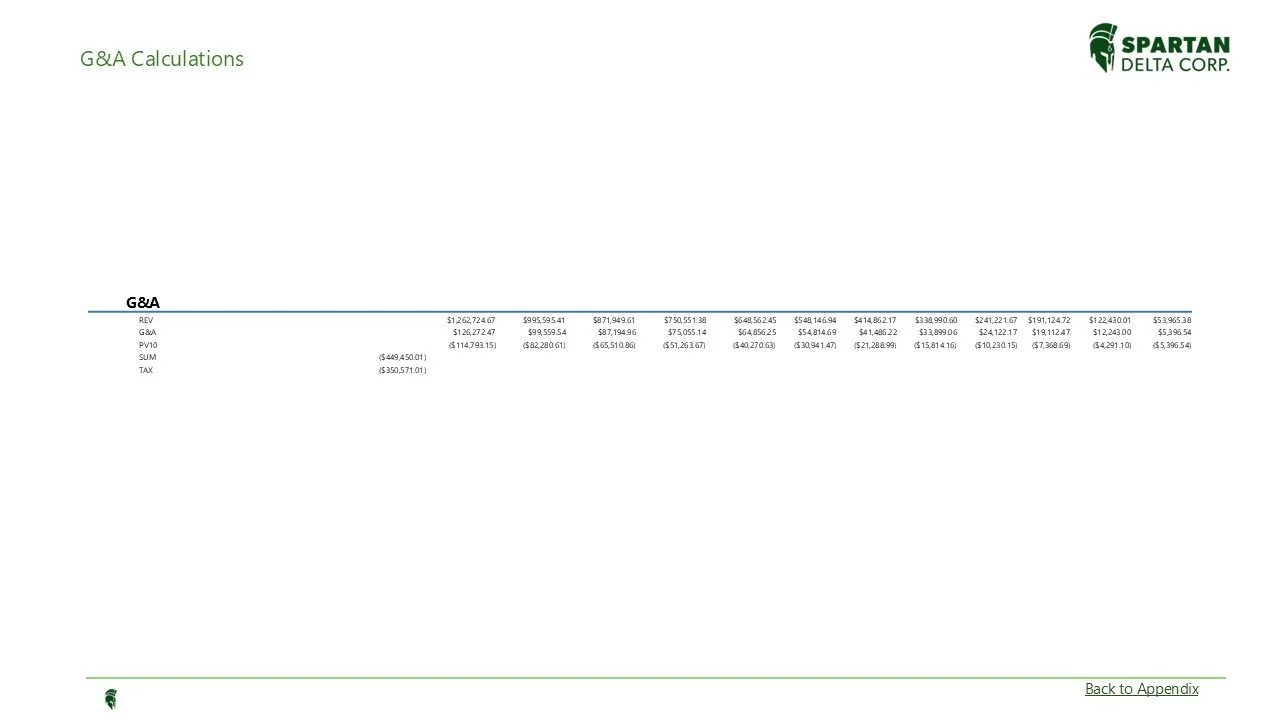

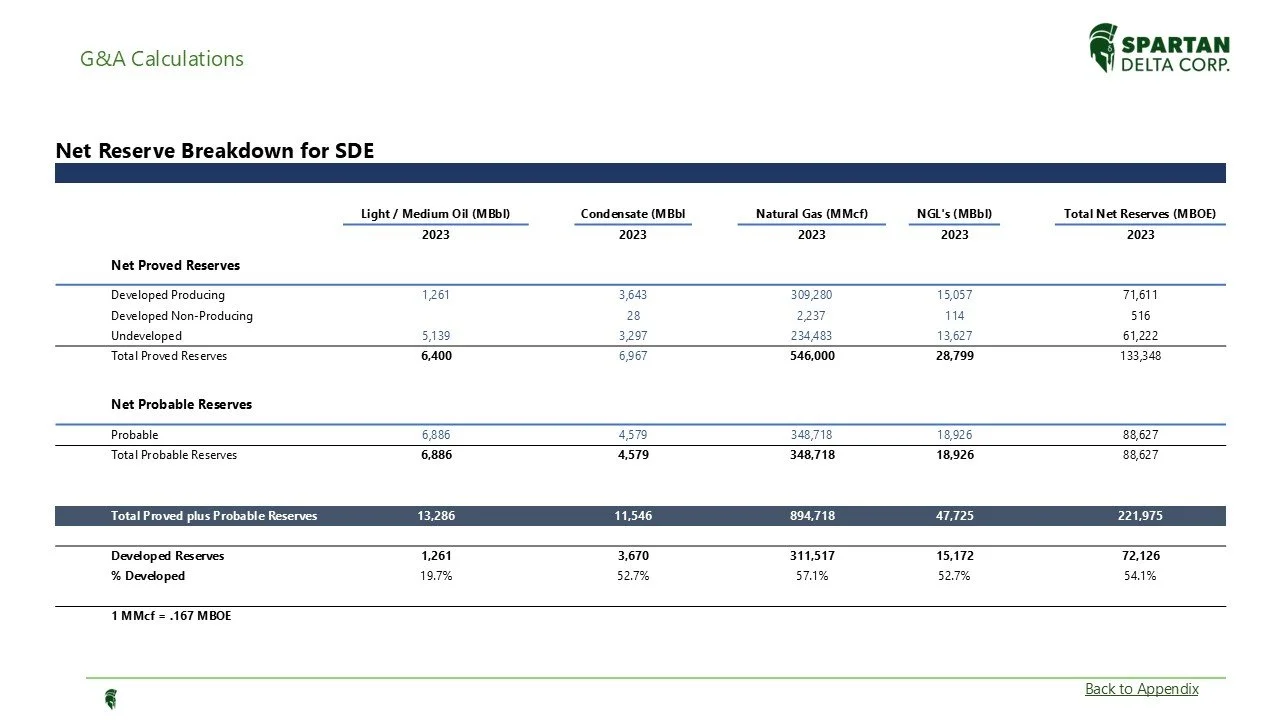

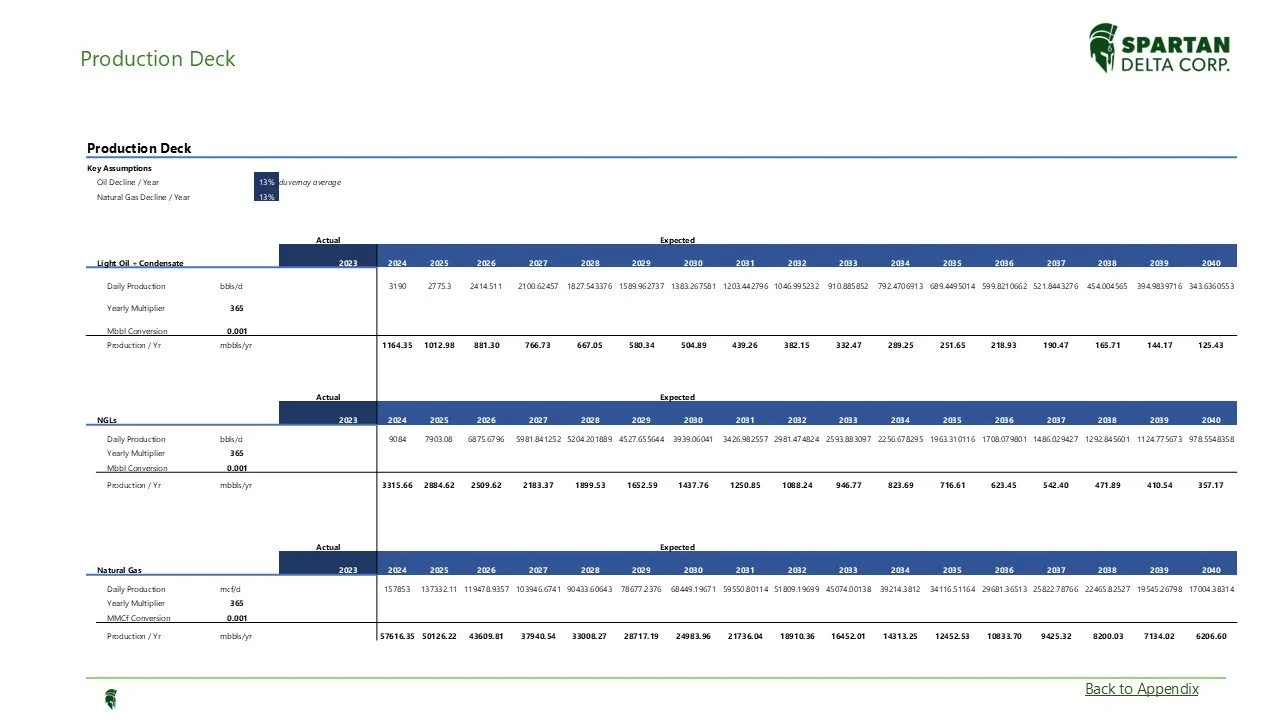

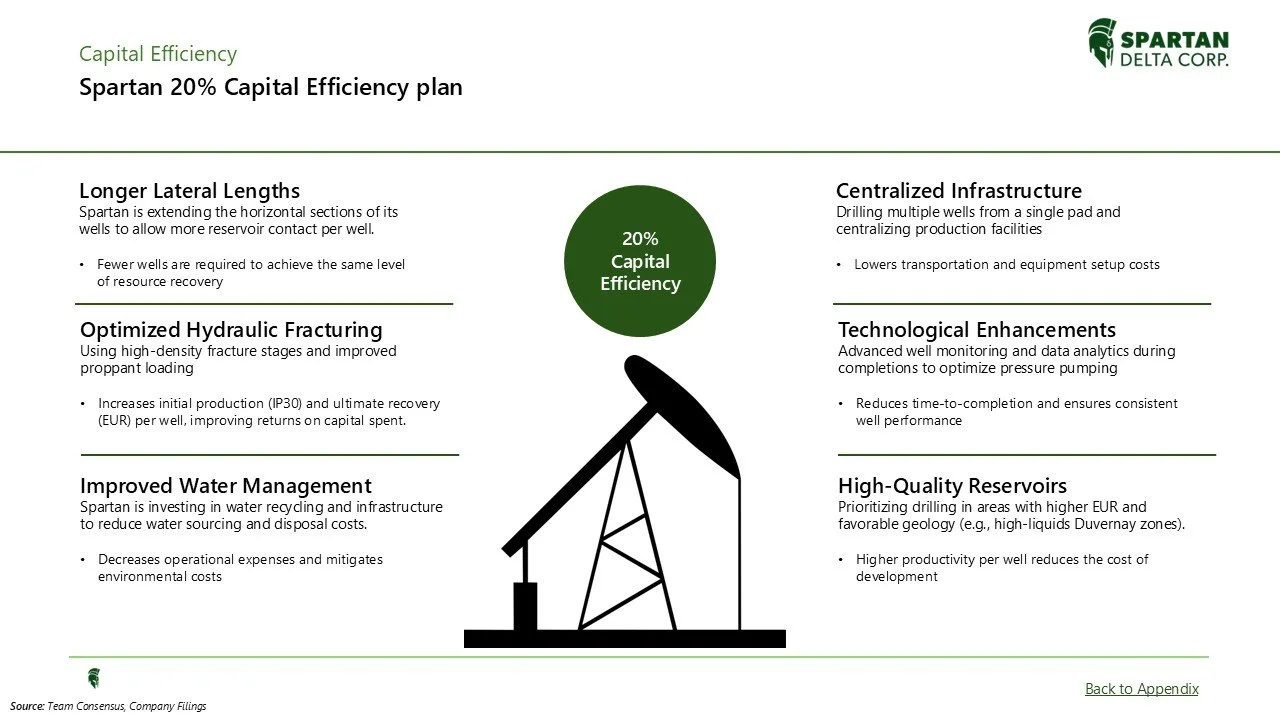

Over two months and more than 200 hours were dedicated to building a full institutional-grade analysis of Spartan Delta at a critical point in its growth trajectory. The valuation was constructed entirely from scratch using a layered net asset value framework, anchoring downside through PDP cash flows before progressively incorporating PUD development and unbooked upside across the Deep Basin and Duvernay. Well-level assumptions, including type curves, spacing, decline rates, capital intensity, and development timing, were independently developed using peer disclosures, basin data, and forward pricing curves.

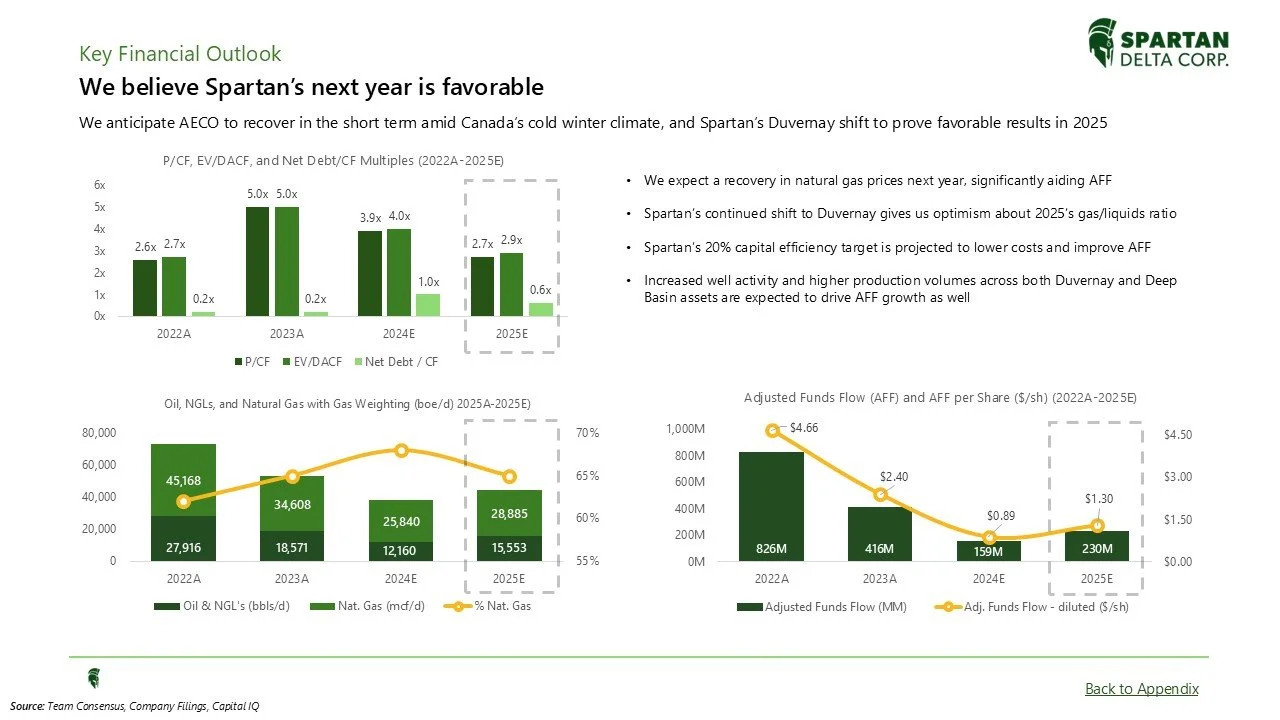

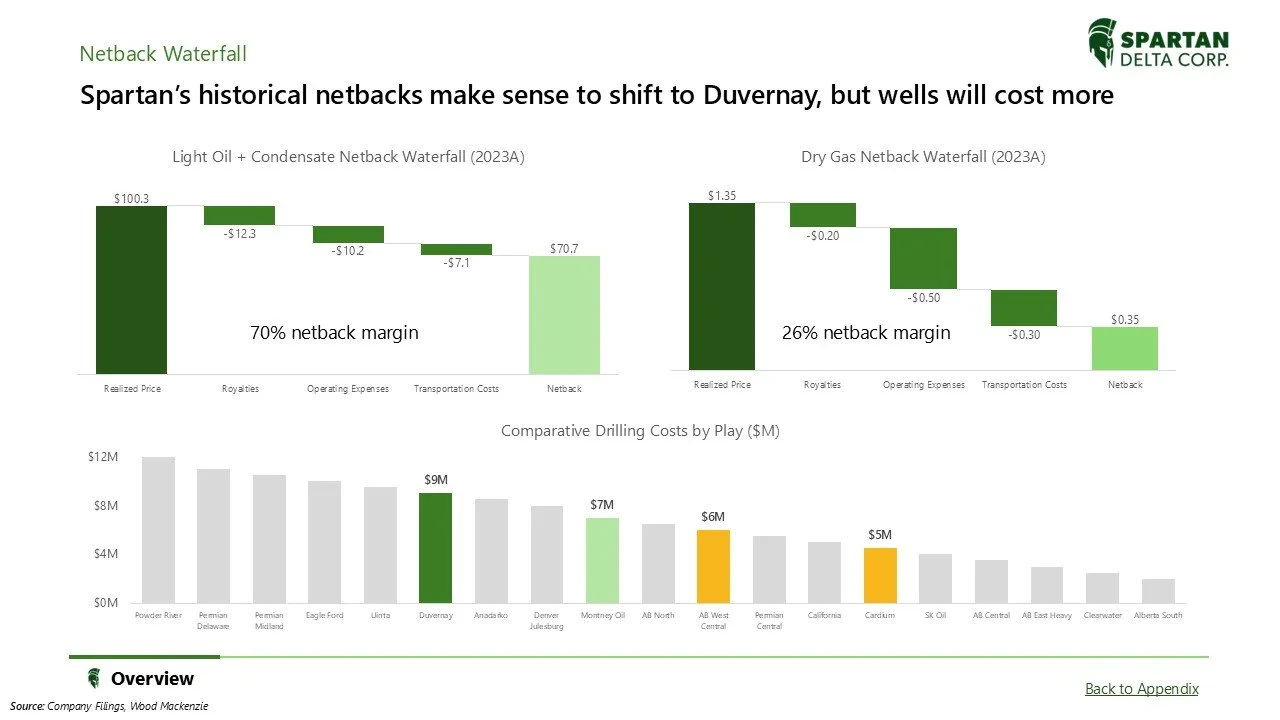

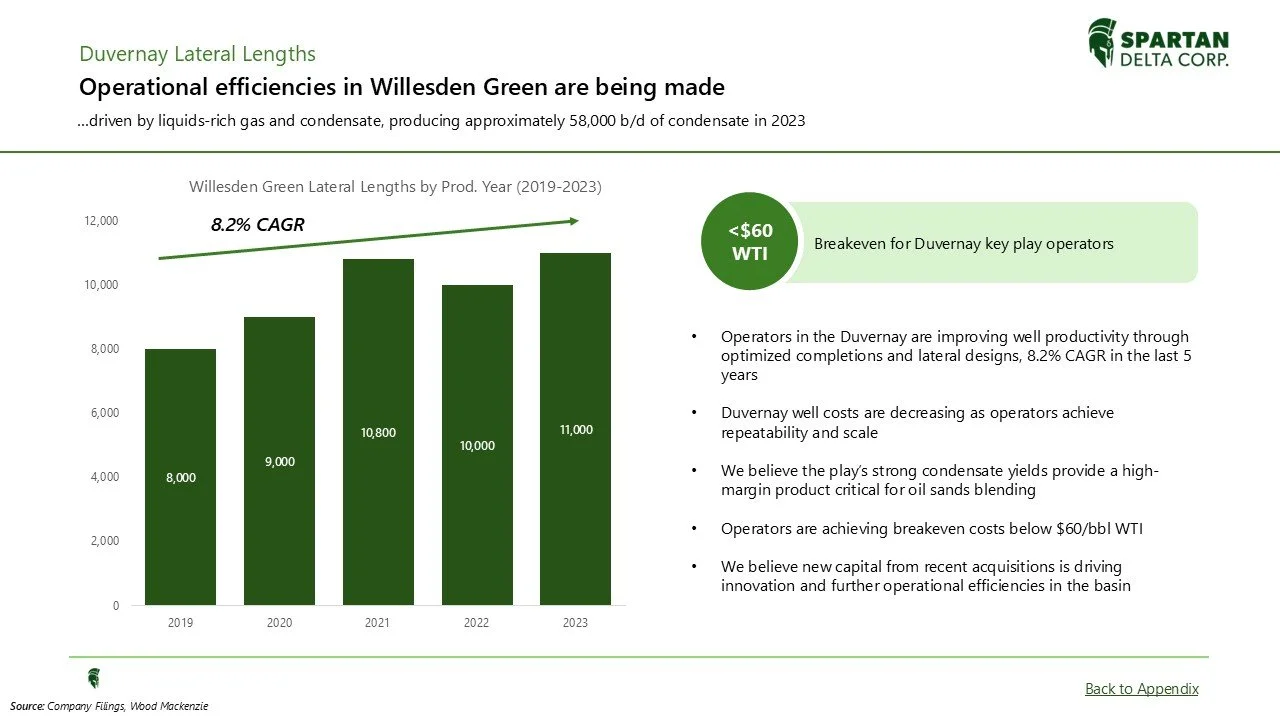

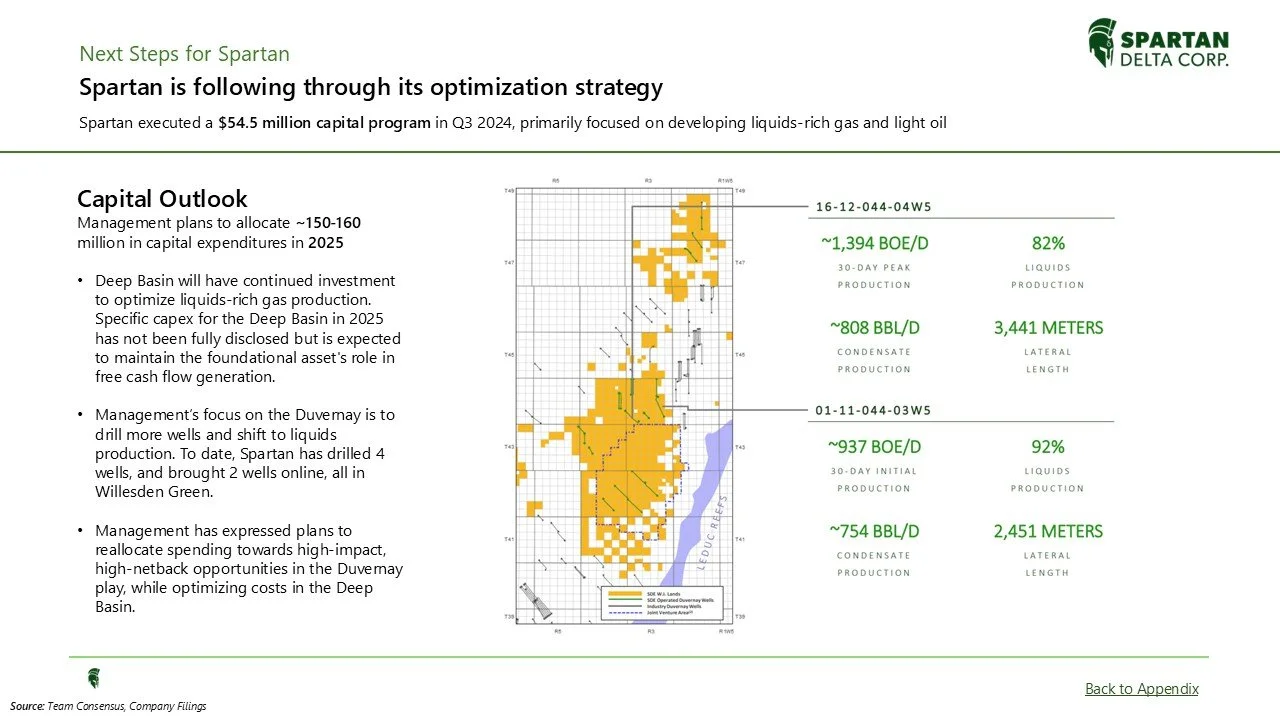

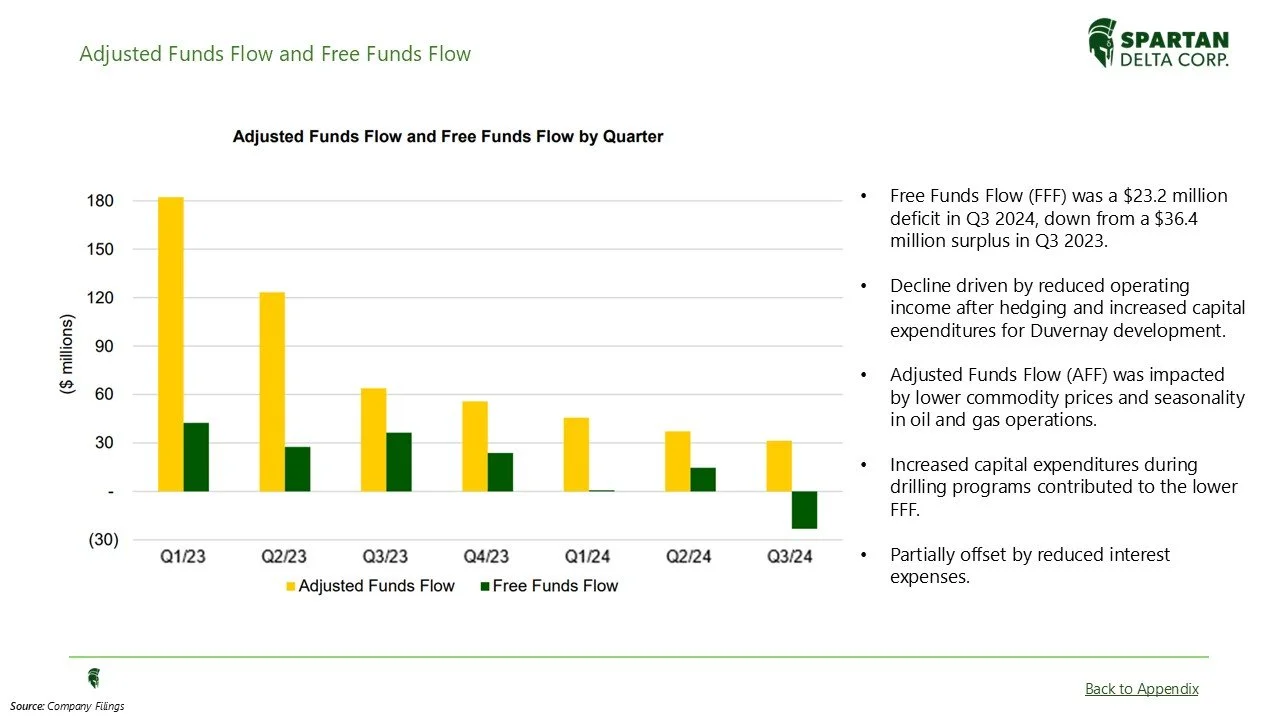

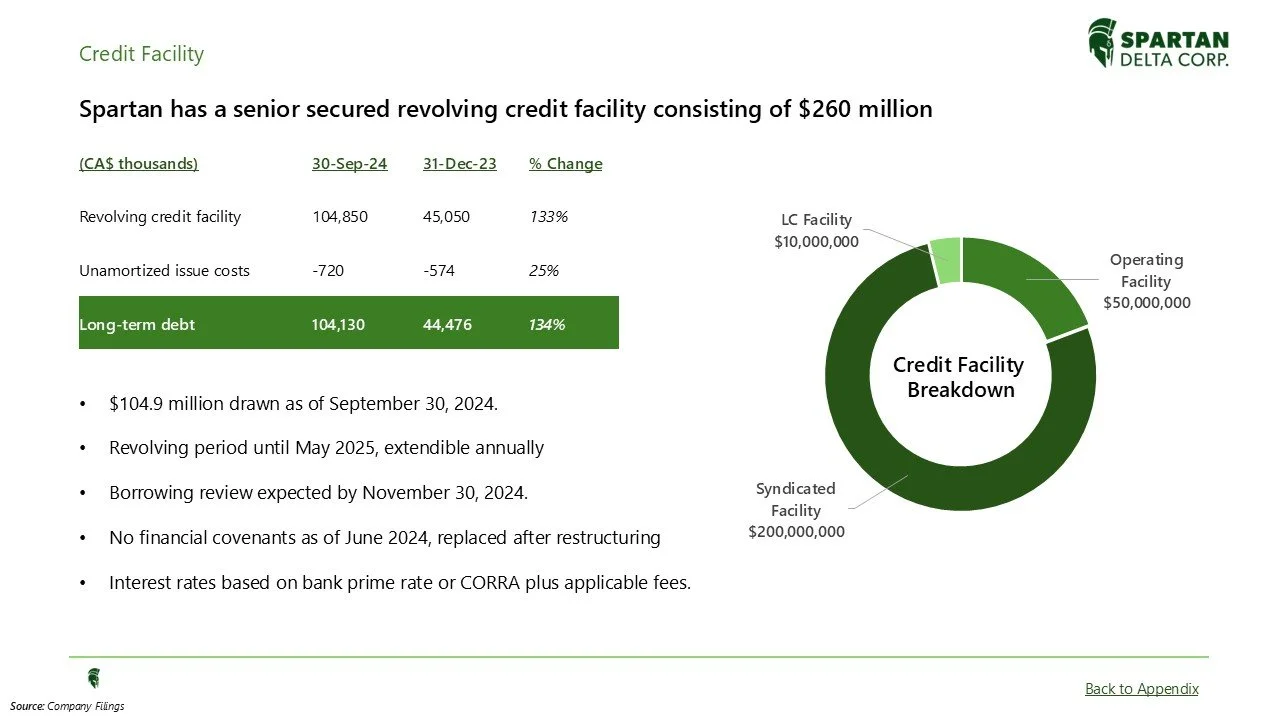

The work focused on how improving Duvernay well results and Deep Basin scale translated into durable free cash flow and a longer inventory runway than the market was pricing in. The investment thesis centered on mispriced cash flow sustainability and underappreciated upside optionality, supported by a balance sheet positioned to fund growth while returning capital. The final output was a 70+ page institutional-quality deck presented to Equity Research Analysts at ATB Capital Markets, designed to withstand real buy-side scrutiny.