After Russia’s invasion of Ukraine, oil sanctions were designed to crush revenues without collapsing global supply. What followed was more subtle. Russian crude kept flowing, but value began leaking out of the system in places markets do not usually look. This paper followed the path of Russian oil after sanctions took effect and showed that revenue losses did not come from collapsing demand or permanent buyer pressure, but from the growing cost of moving oil across longer, riskier routes.

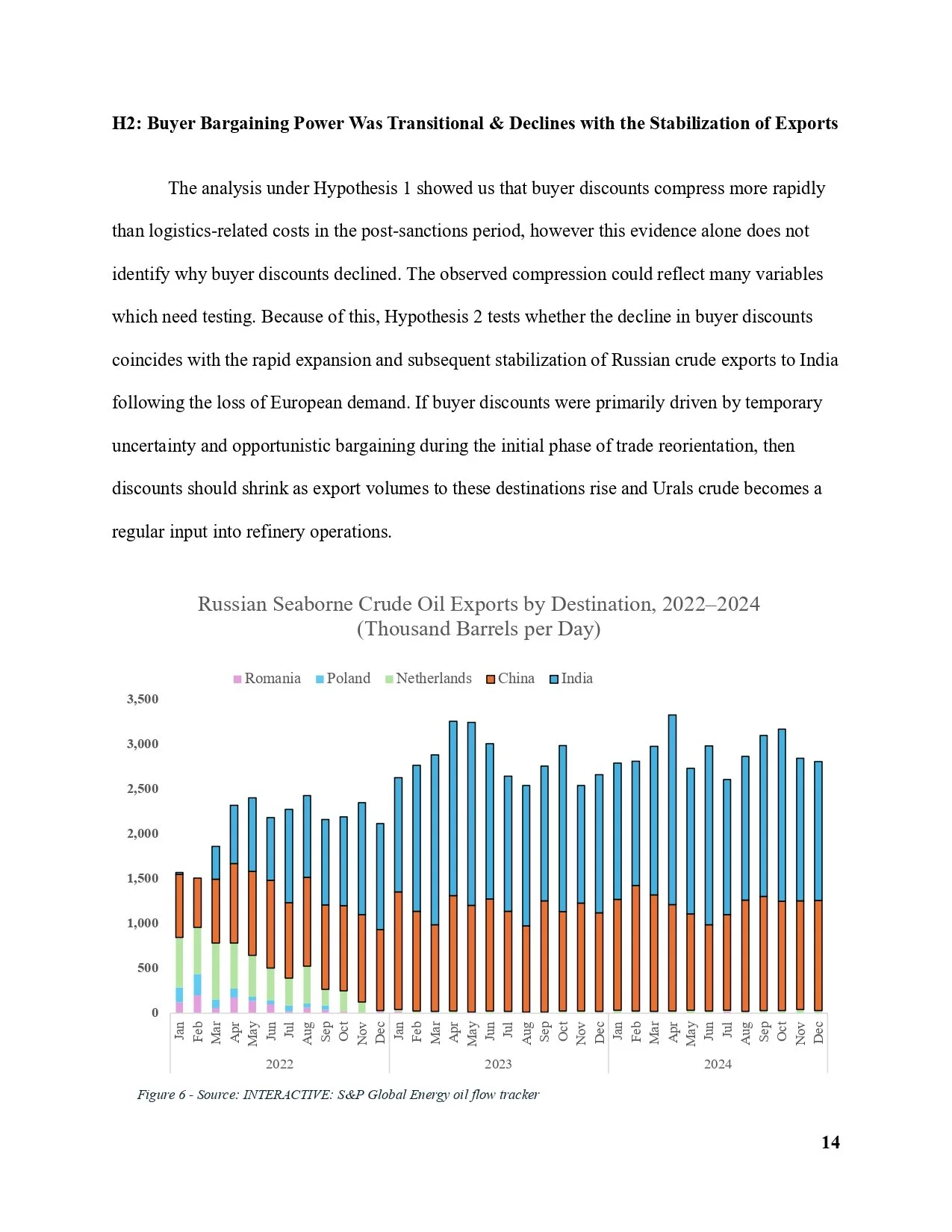

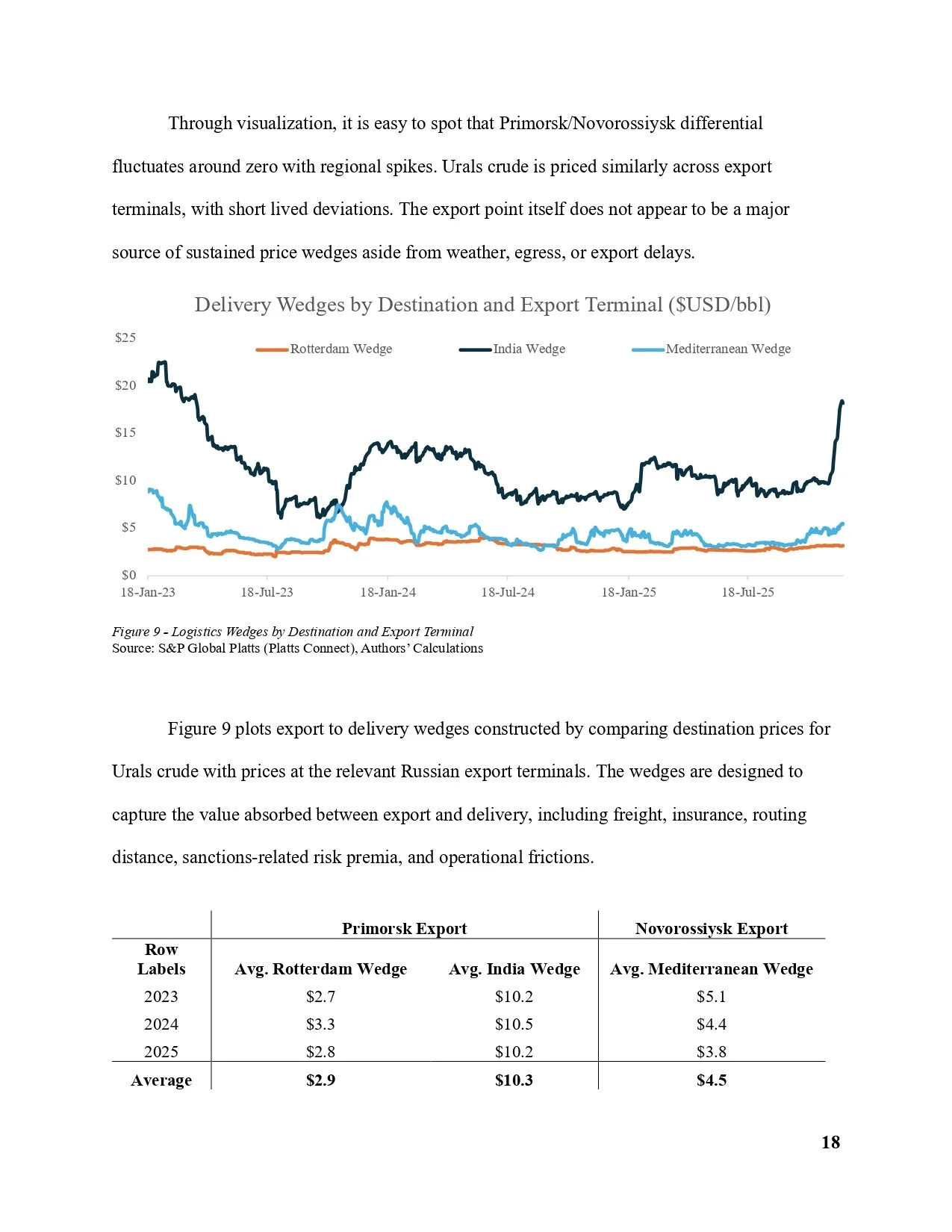

By decomposing the Brent–Urals price differential into buyer discounts and logistics wedges, the analysis demonstrated that bargaining power was temporary while transport frictions became structural. As exports stabilized in India and China, buyer discounts compressed, yet logistics costs persisted and absorbed an increasing share of value. The conclusion reframed sanctions as a tax on logistics rather than a price cap, showing how restrictions can drain revenue without removing barrels from the market.