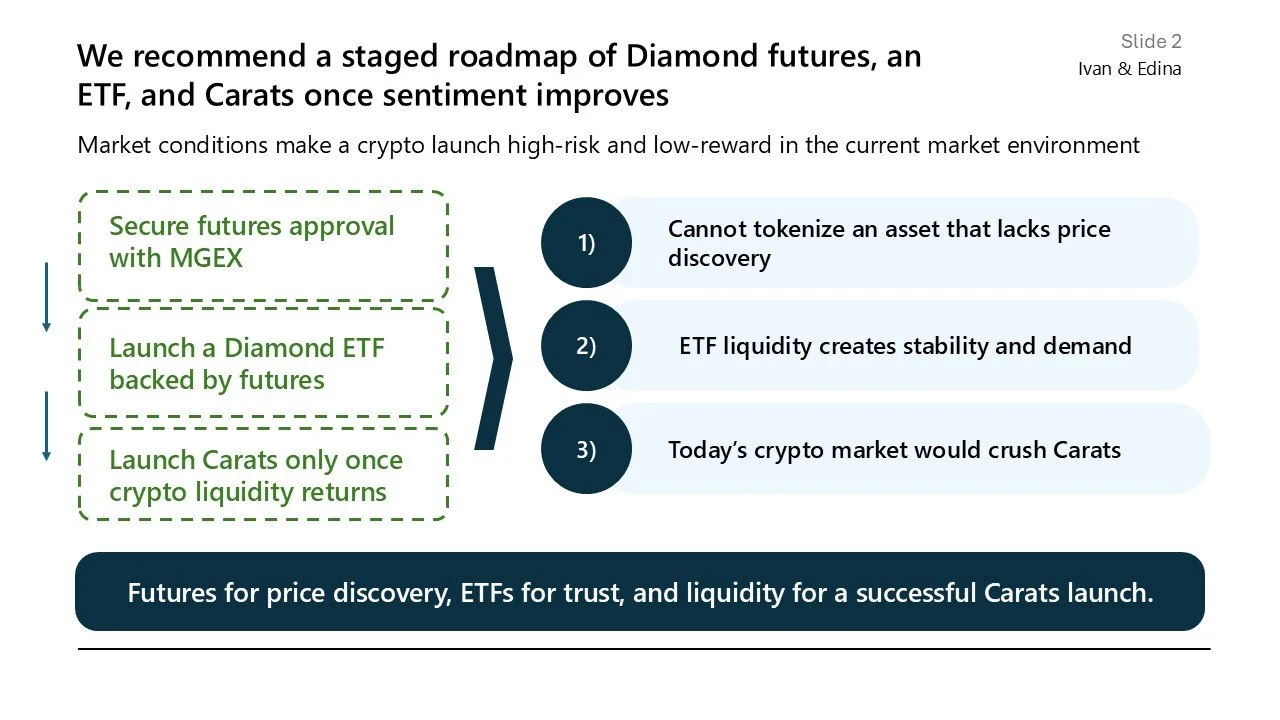

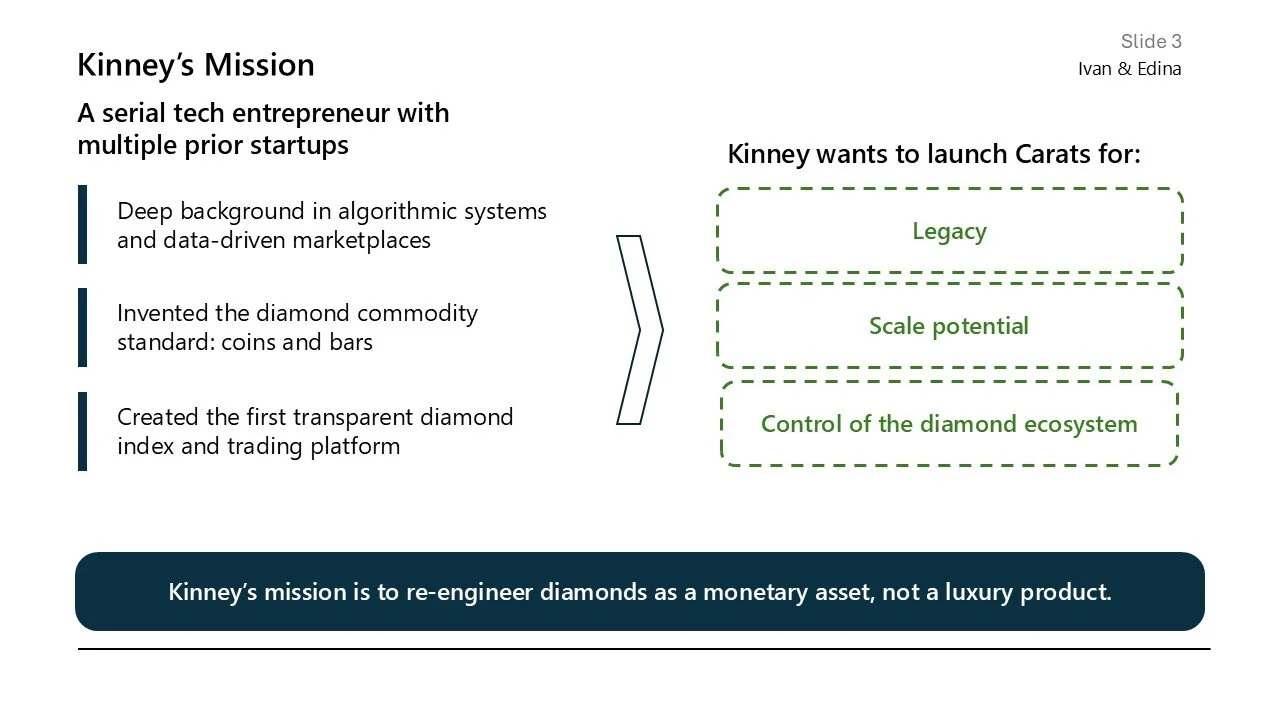

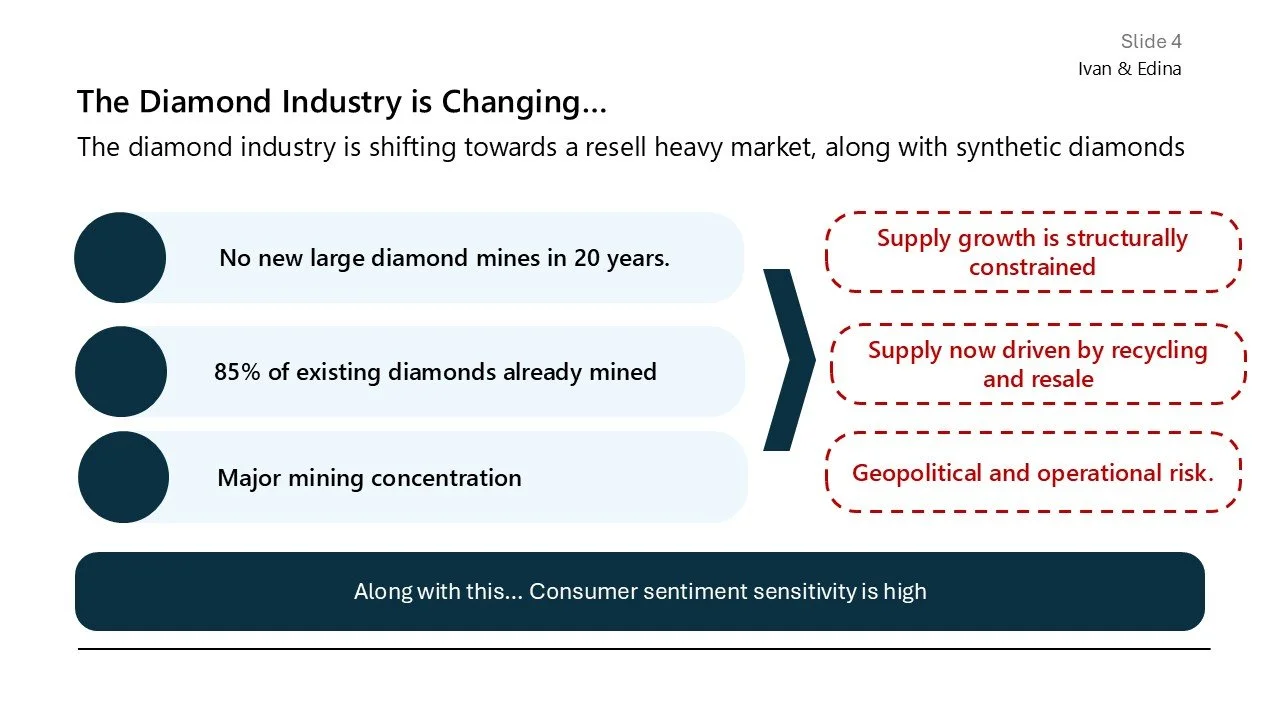

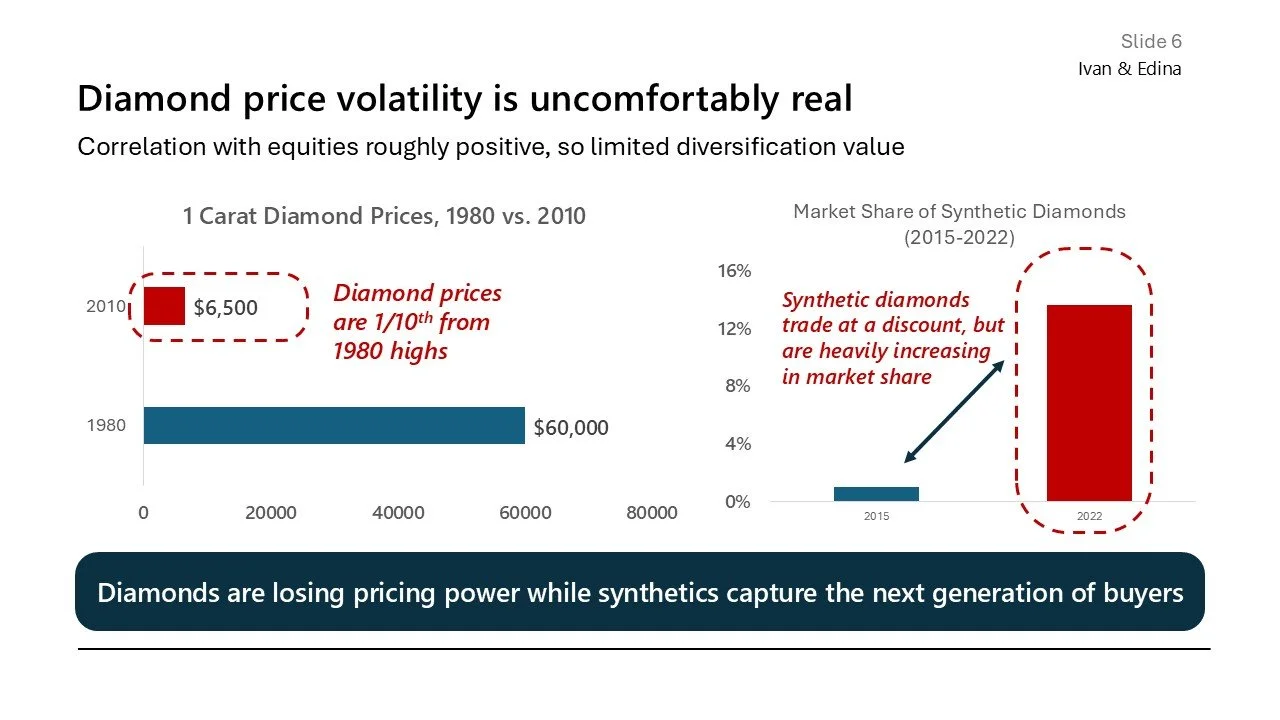

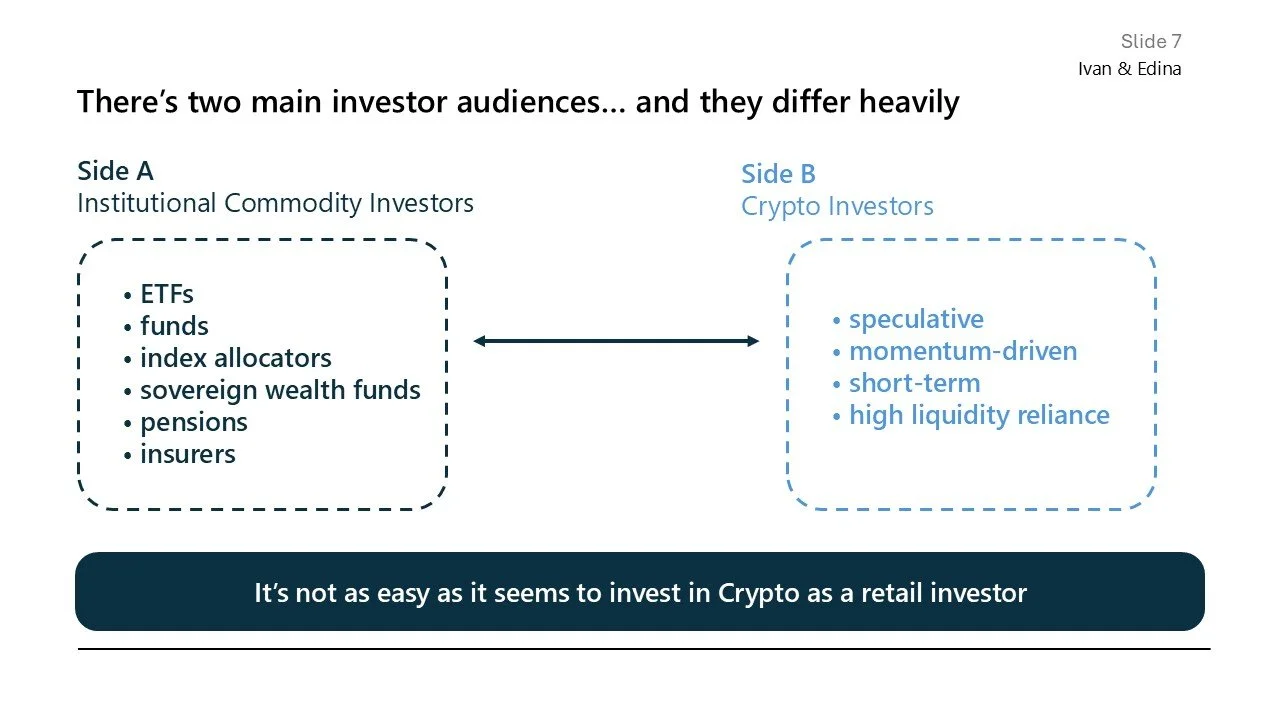

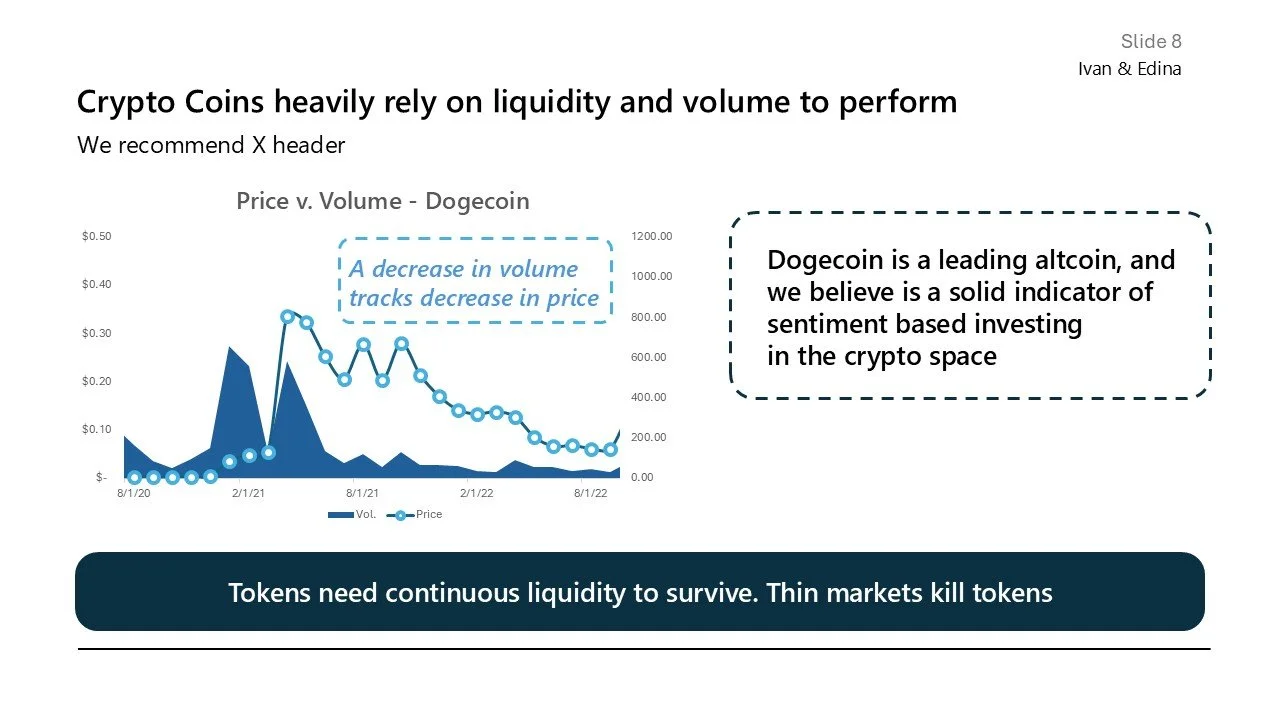

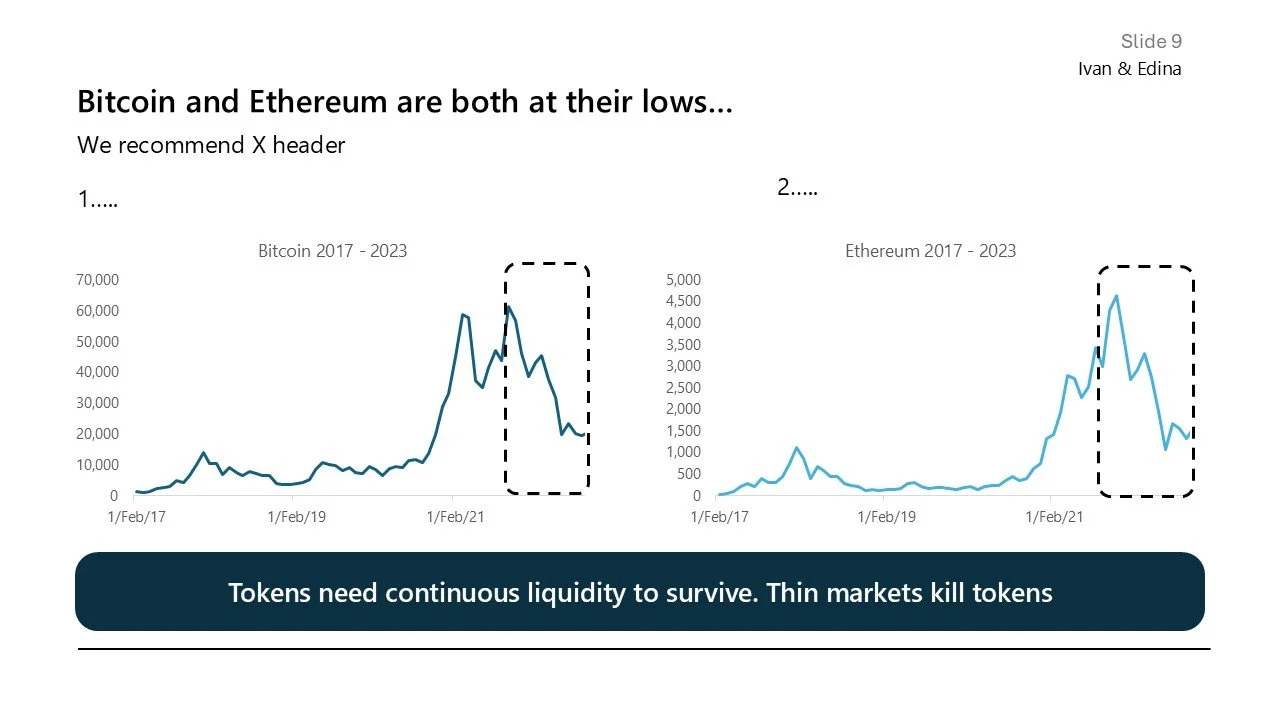

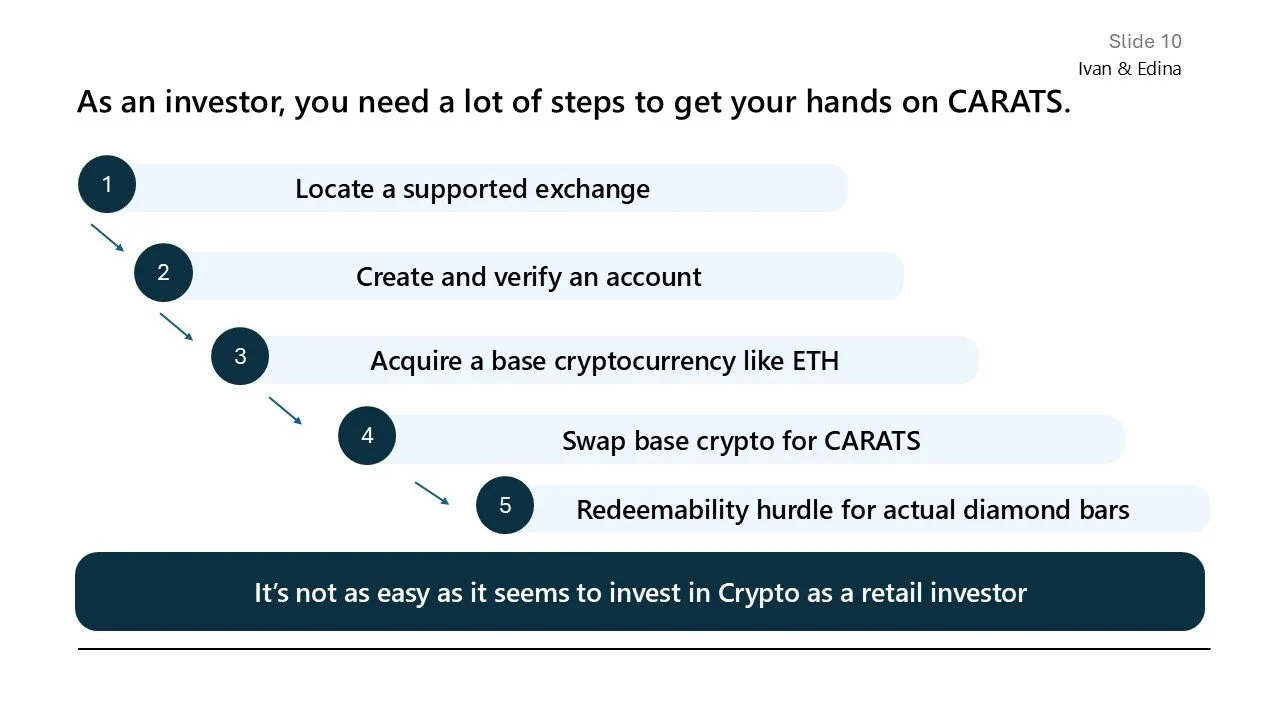

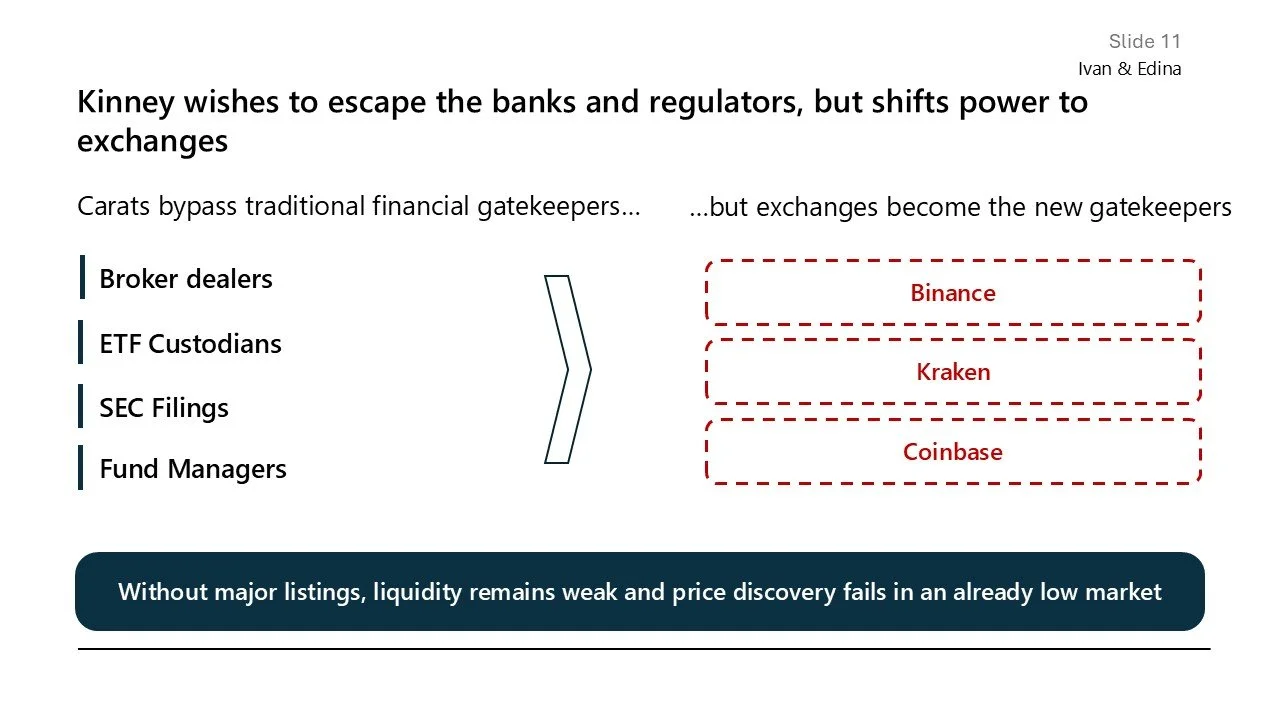

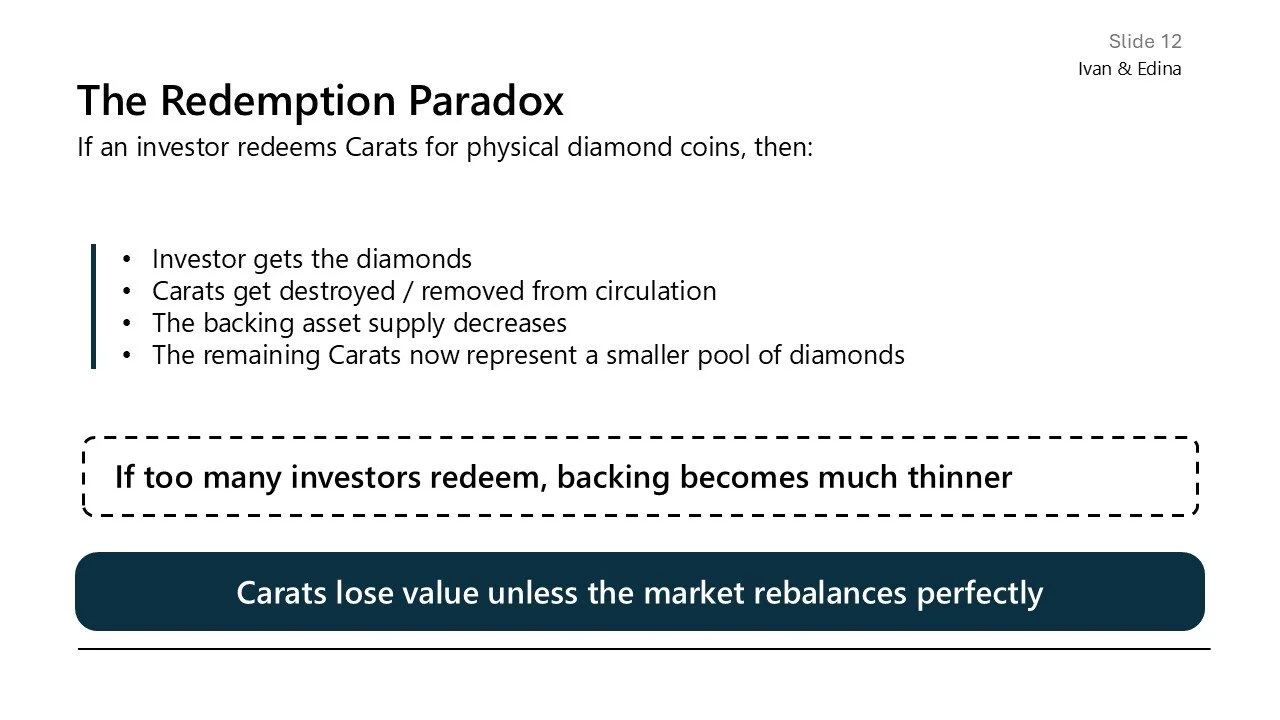

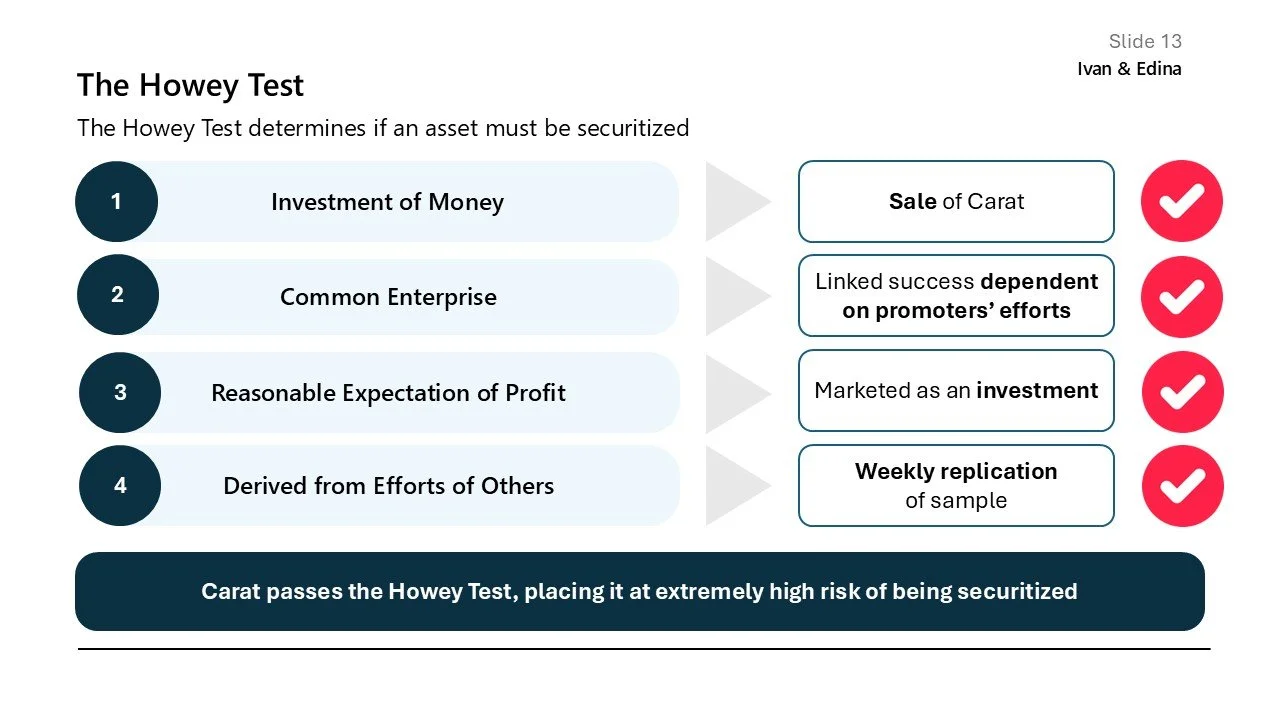

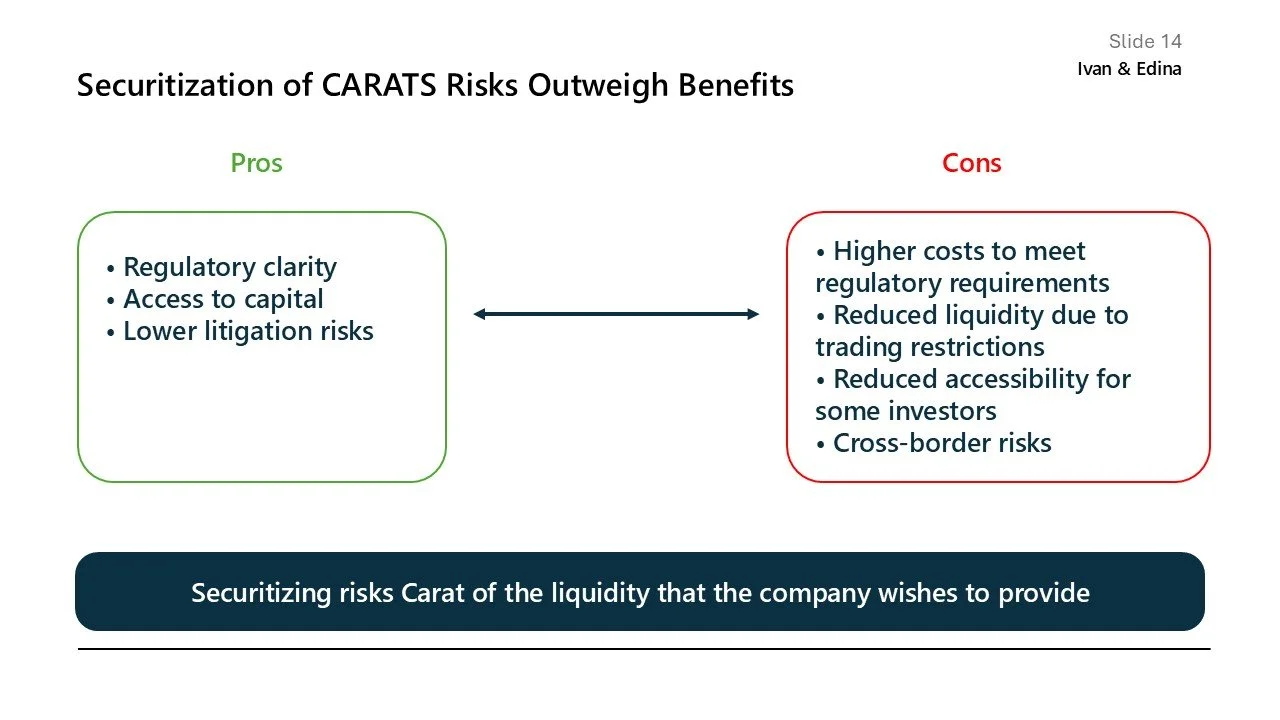

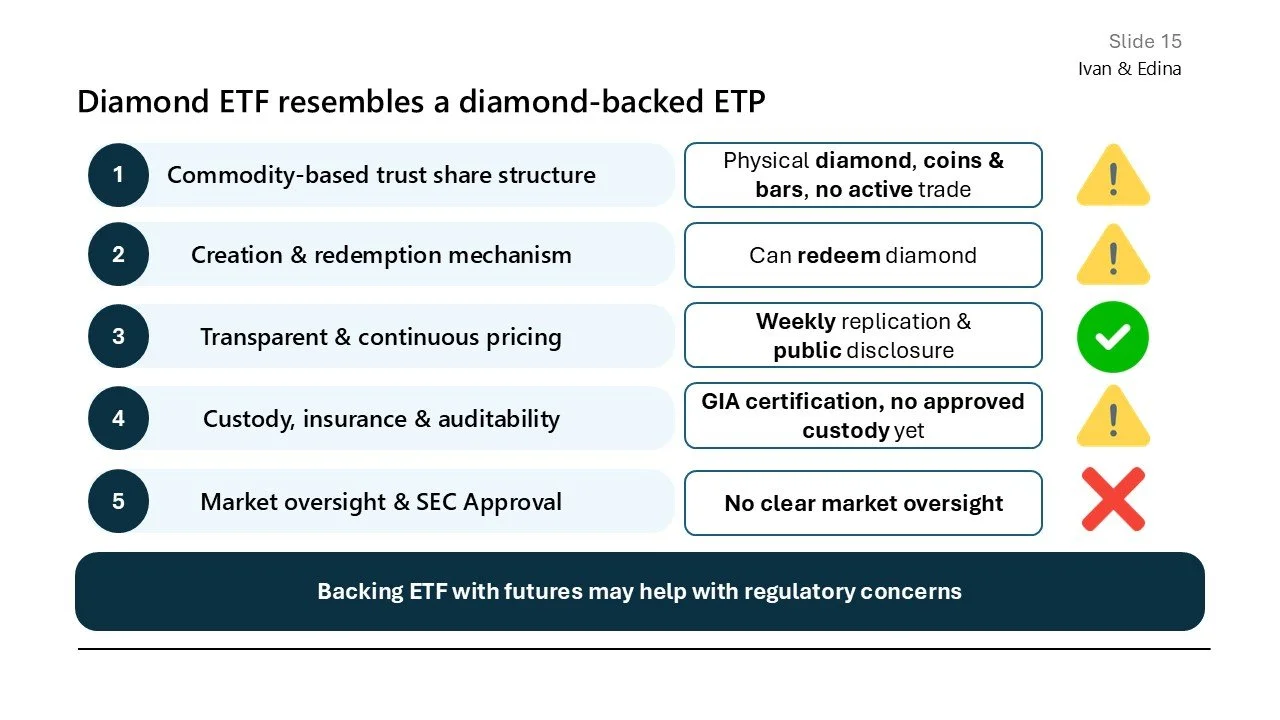

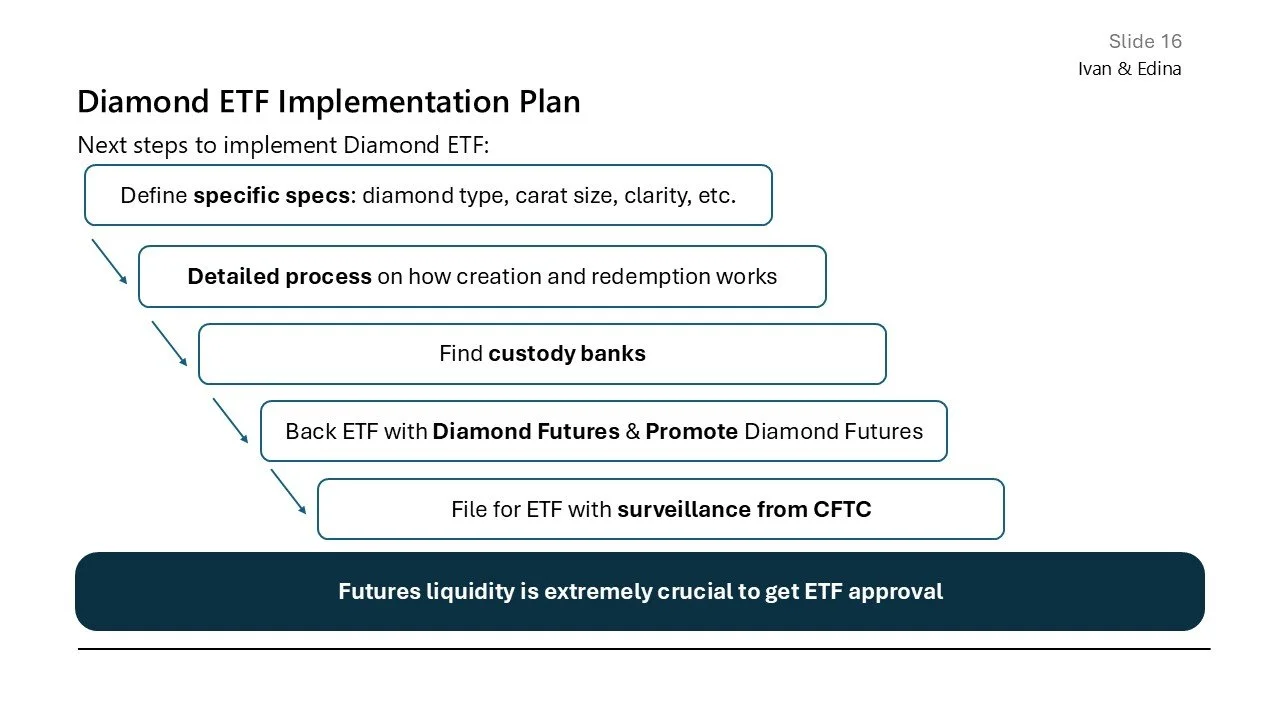

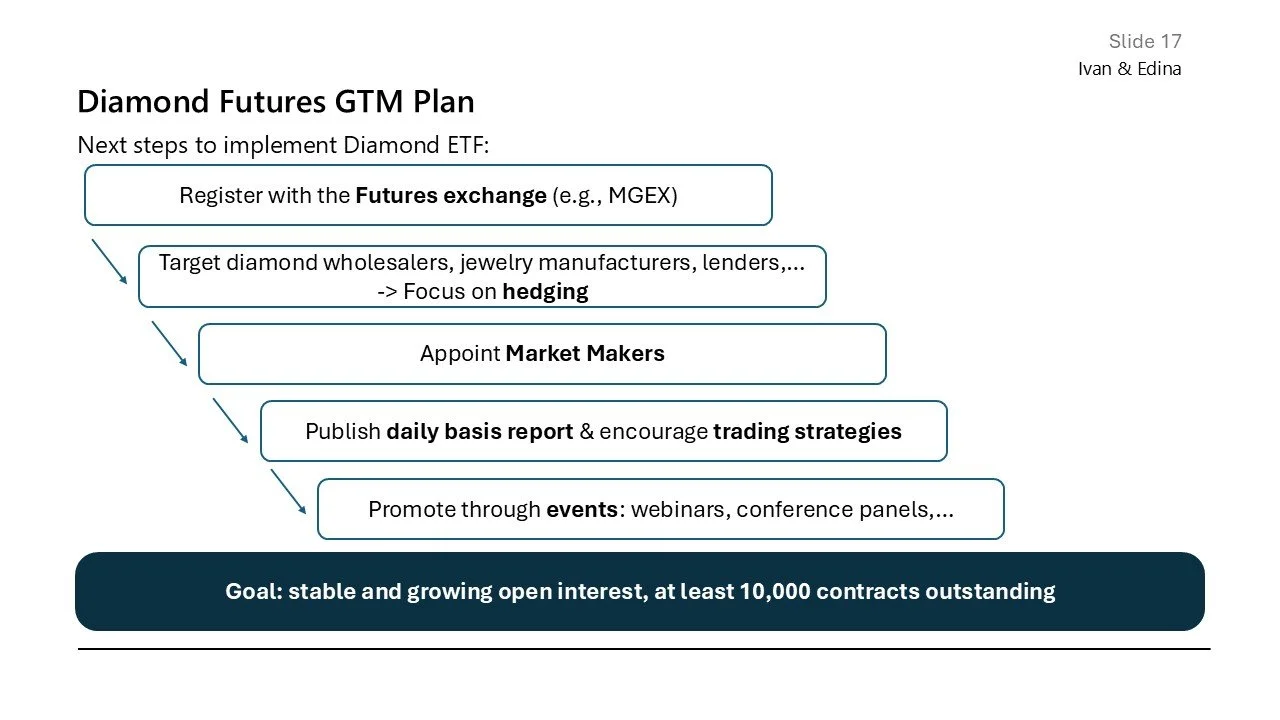

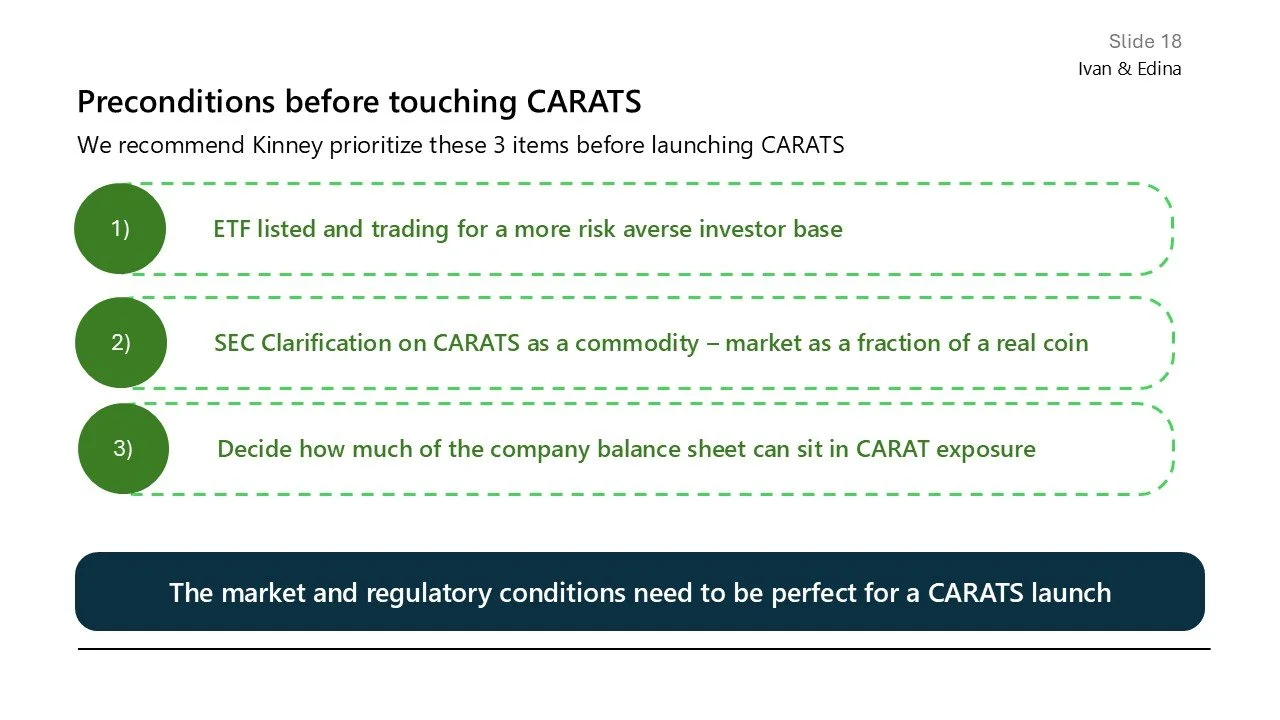

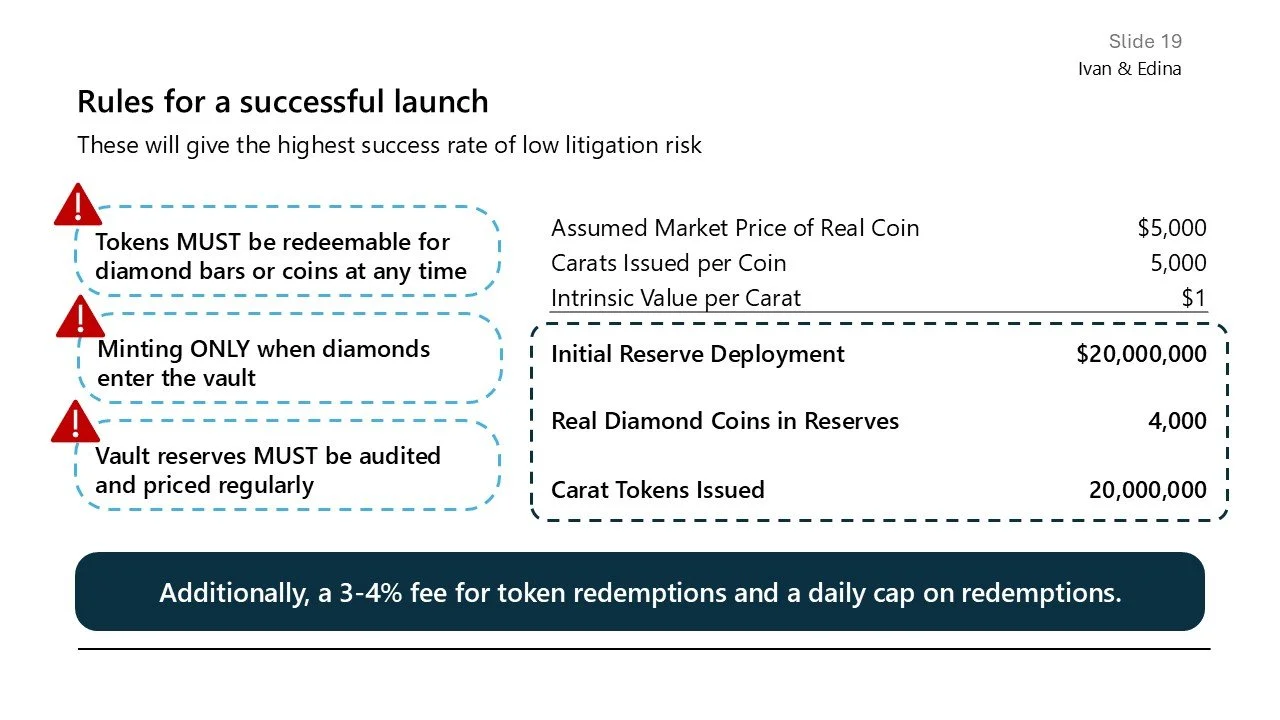

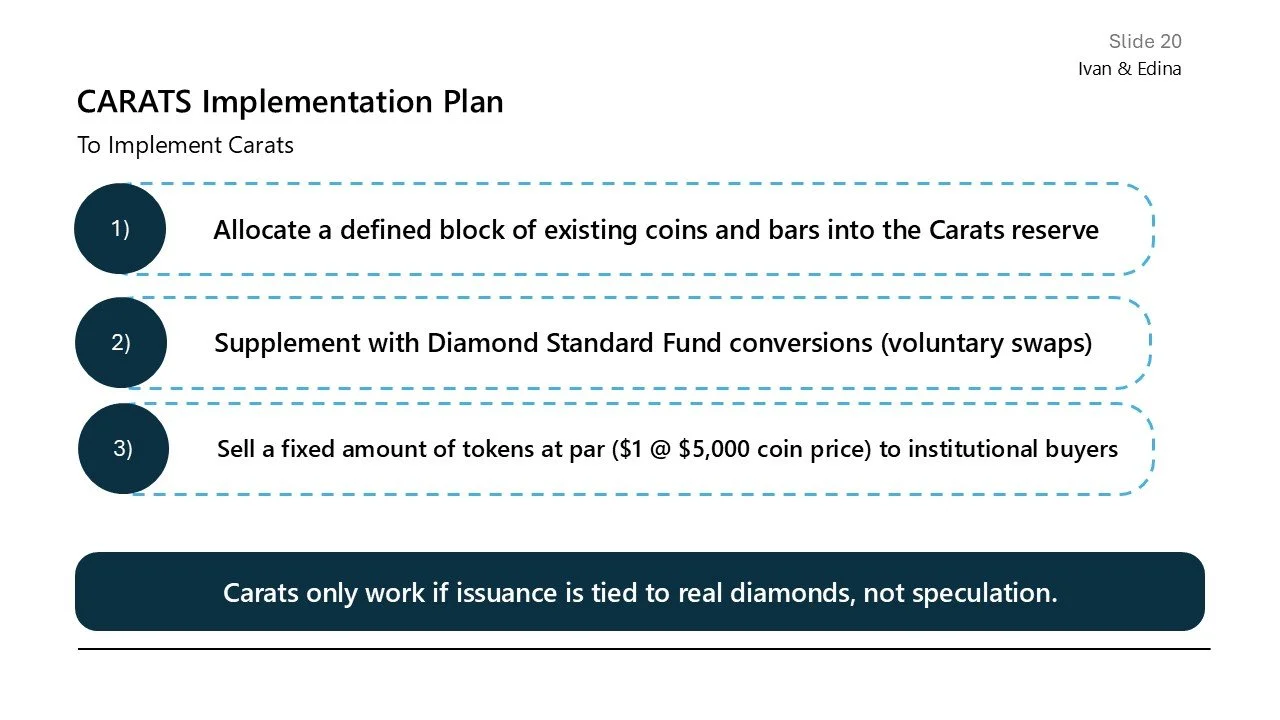

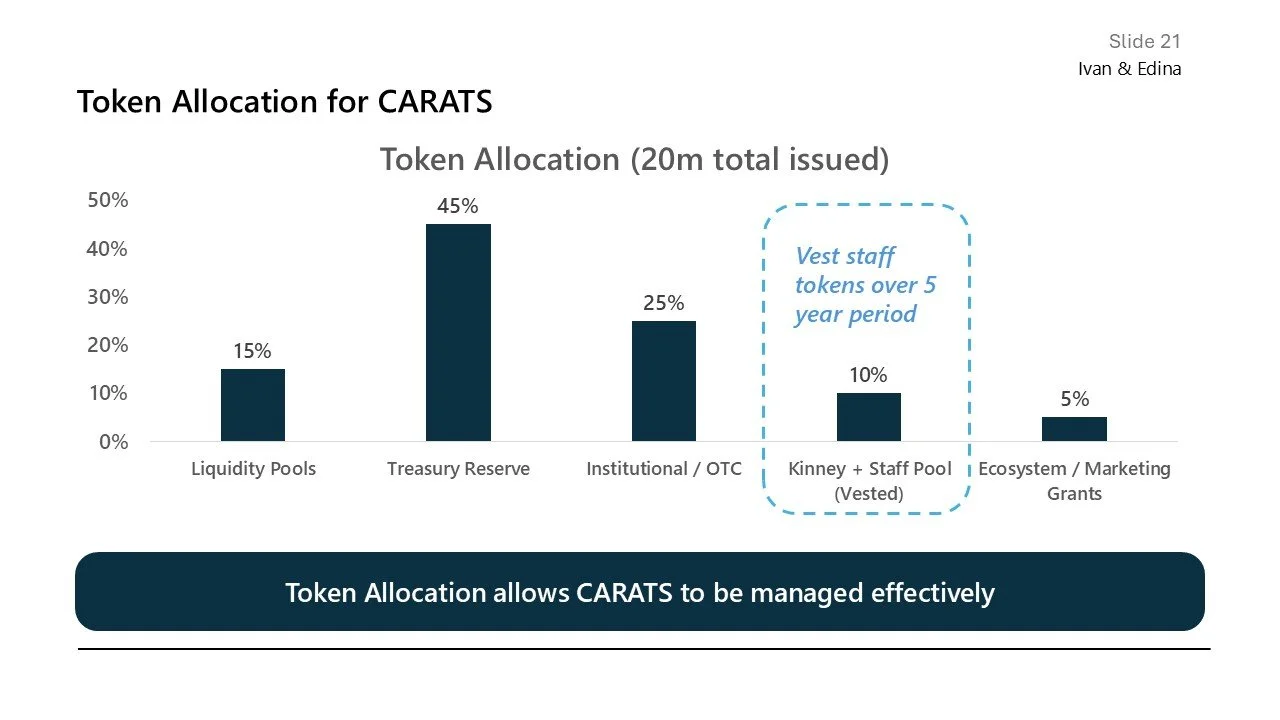

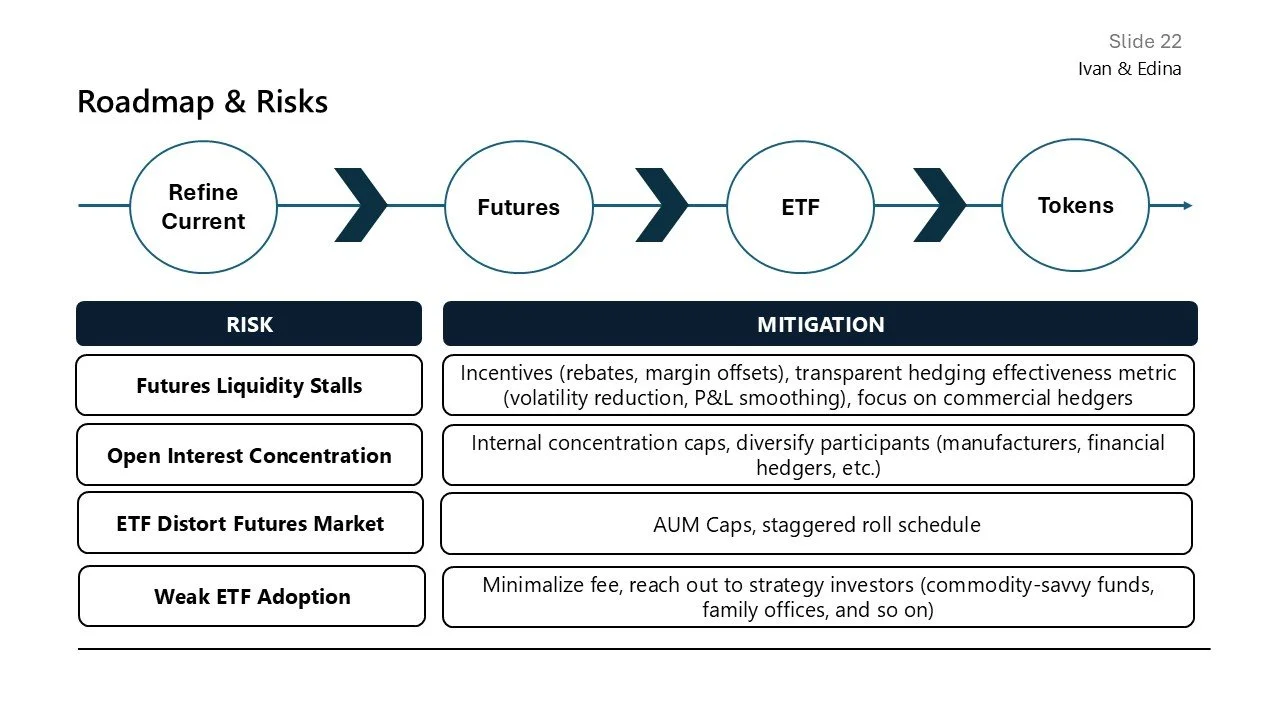

As crypto markets searched for credibility and alternative assets surged in popularity, Diamond Standard faced pressure to move first. The proposal to launch CARATS, a diamond backed crypto token, promised innovation but rested on fragile foundations. With limited price discovery, thin institutional liquidity, and unresolved regulatory classification risk, timing became the central risk. The analysis followed how market structure, redemption design, and sequencing choices could turn a strong concept into a structural failure if launched prematurely. Rather than framing the decision as a binary go or no go, our recommendation pushed for patience. By prioritizing futures based price discovery and an ETF before token issuance, the strategy preserved optionality and positioned Diamond Standard to scale only once the market could support it.