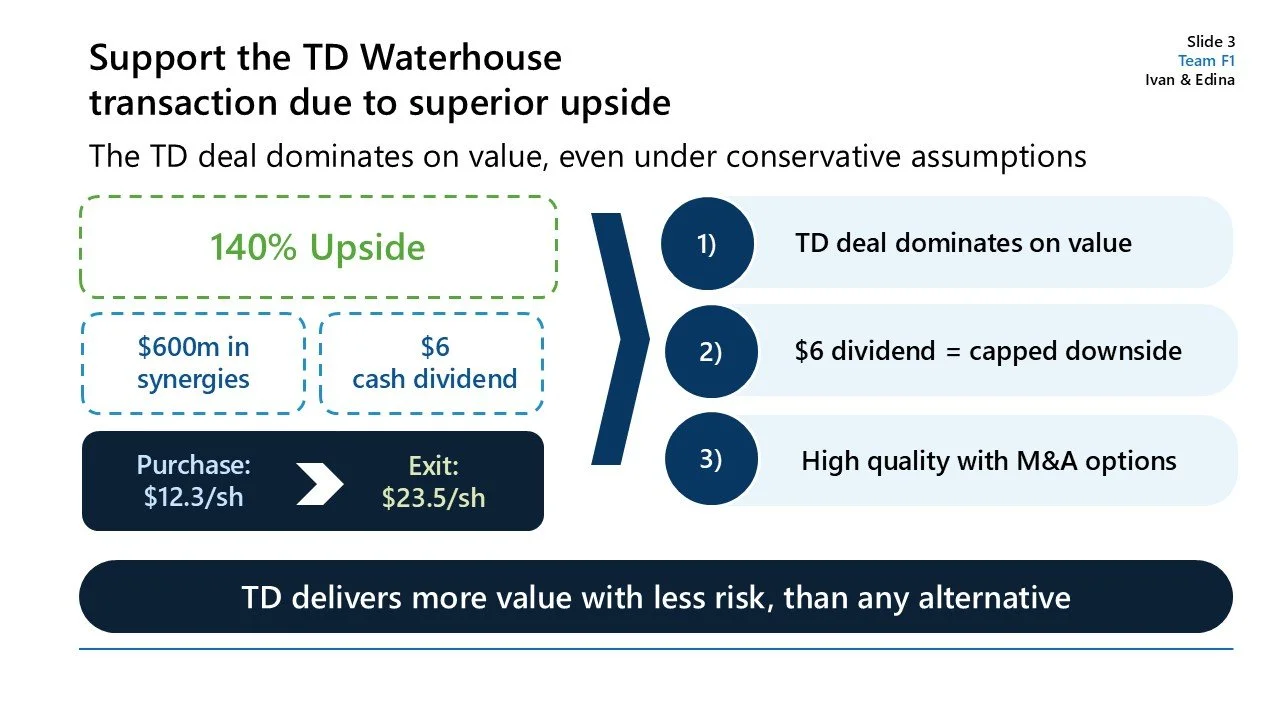

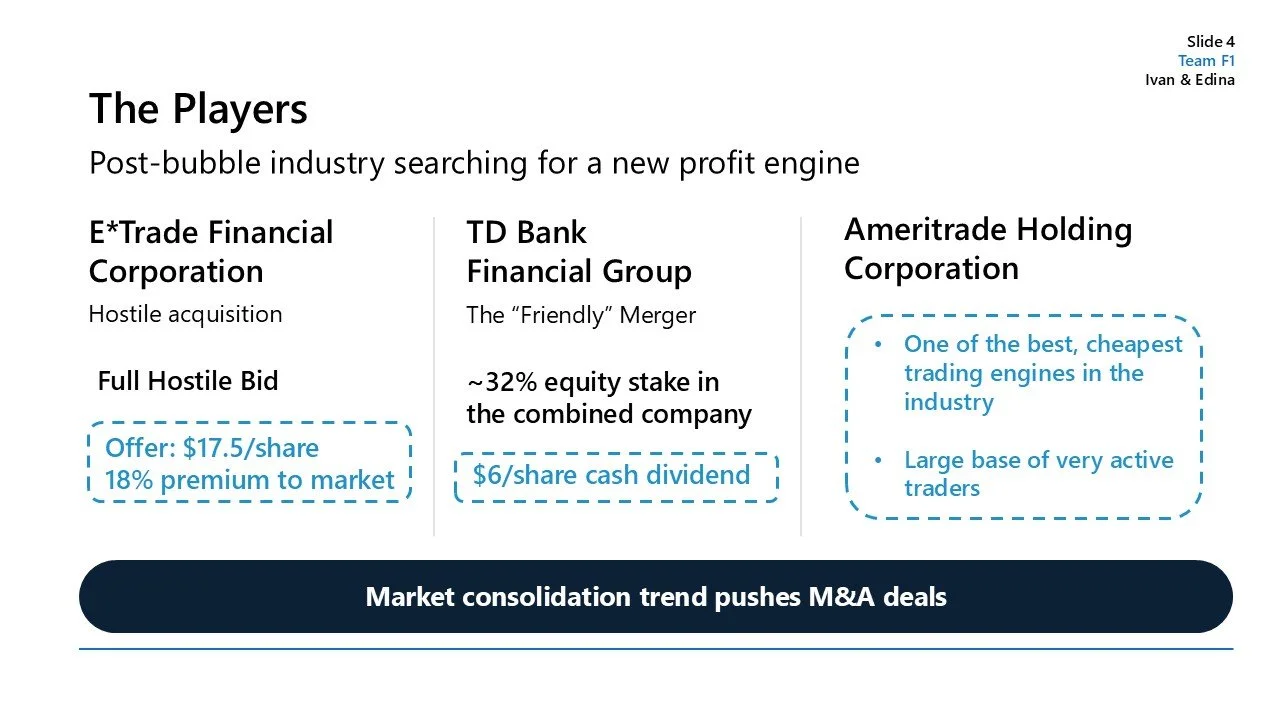

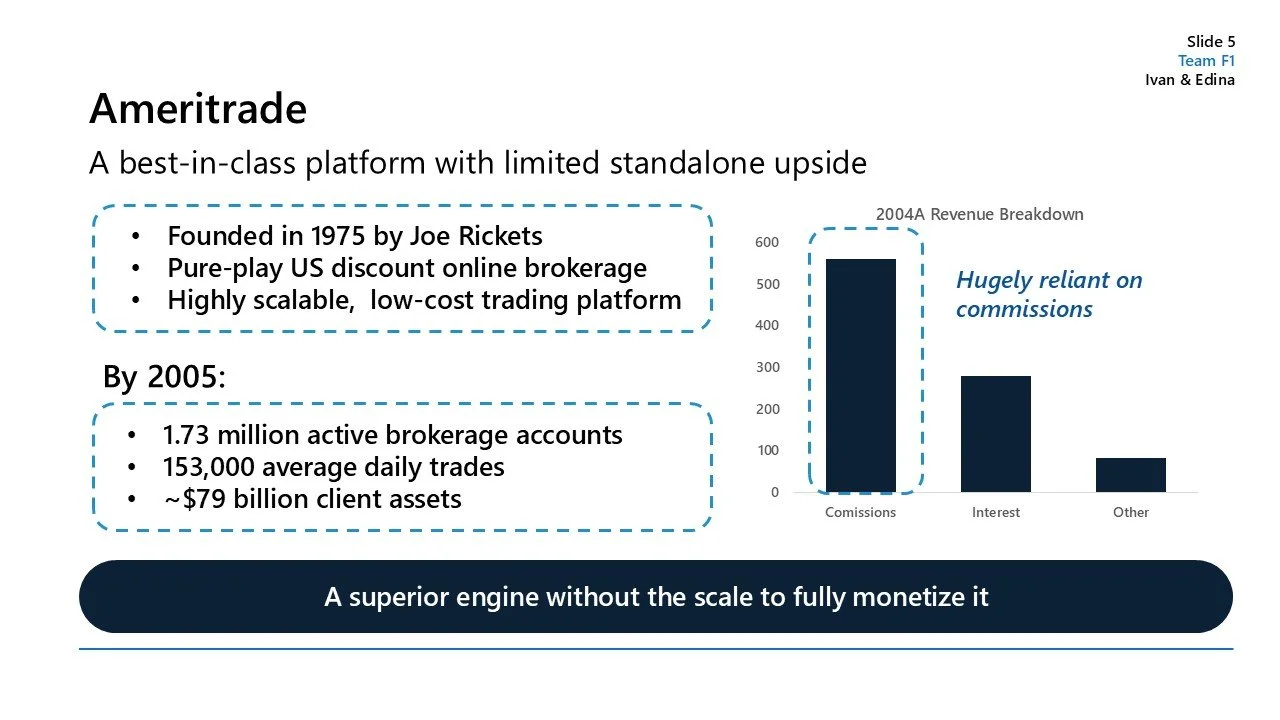

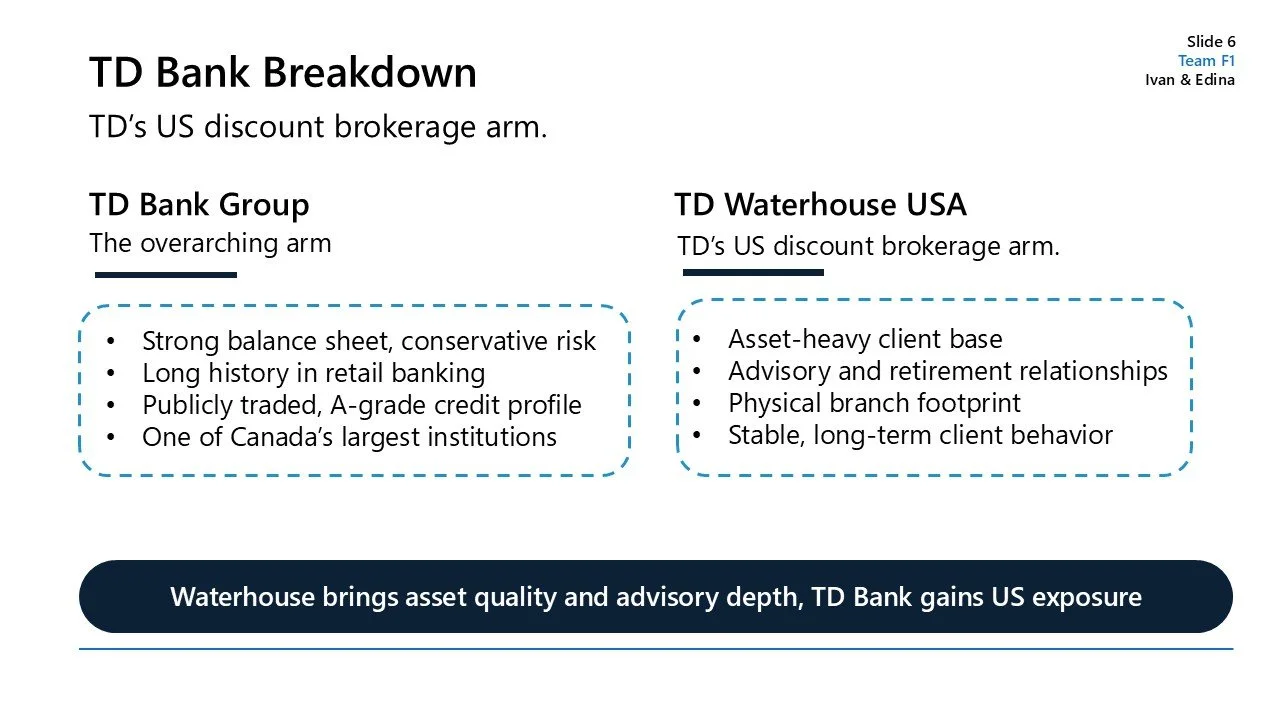

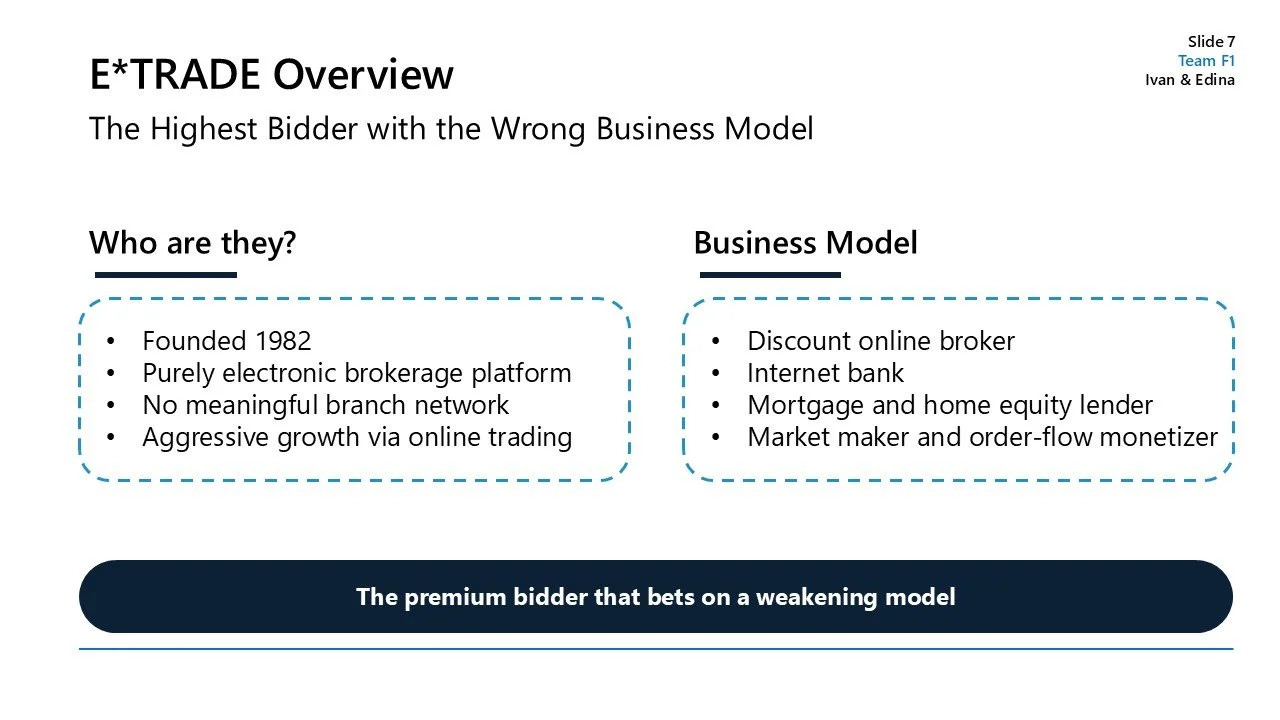

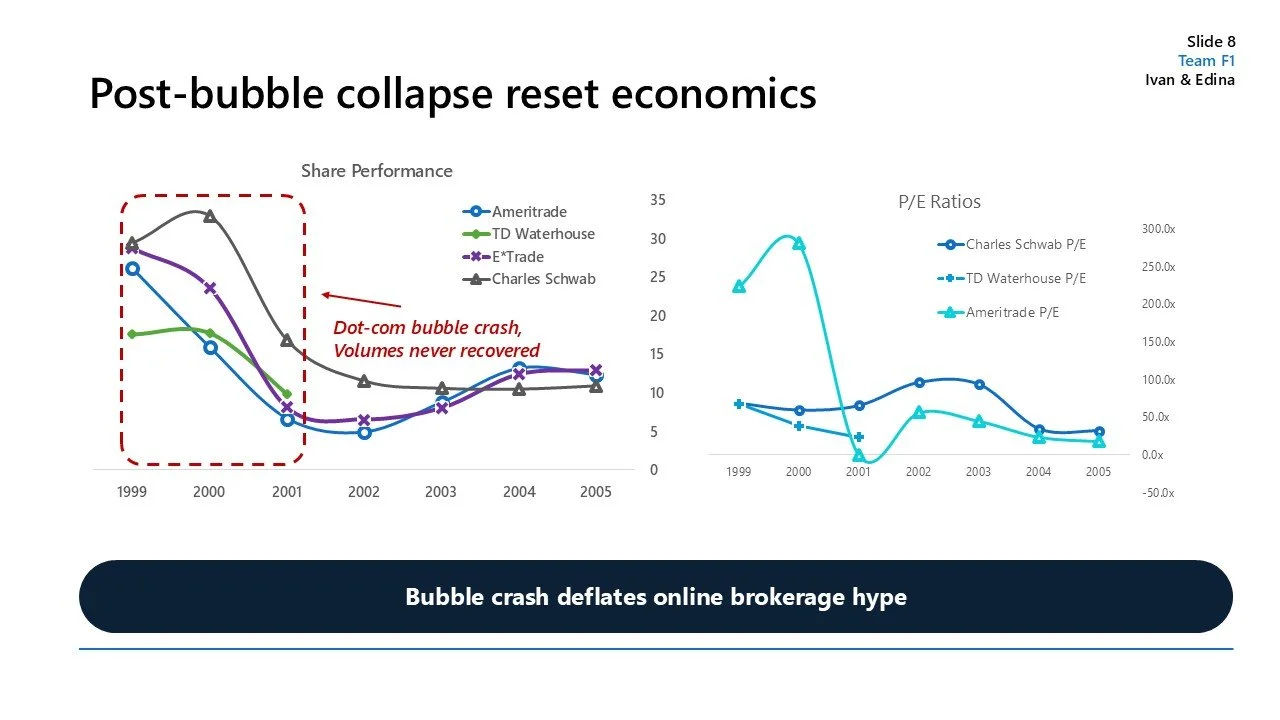

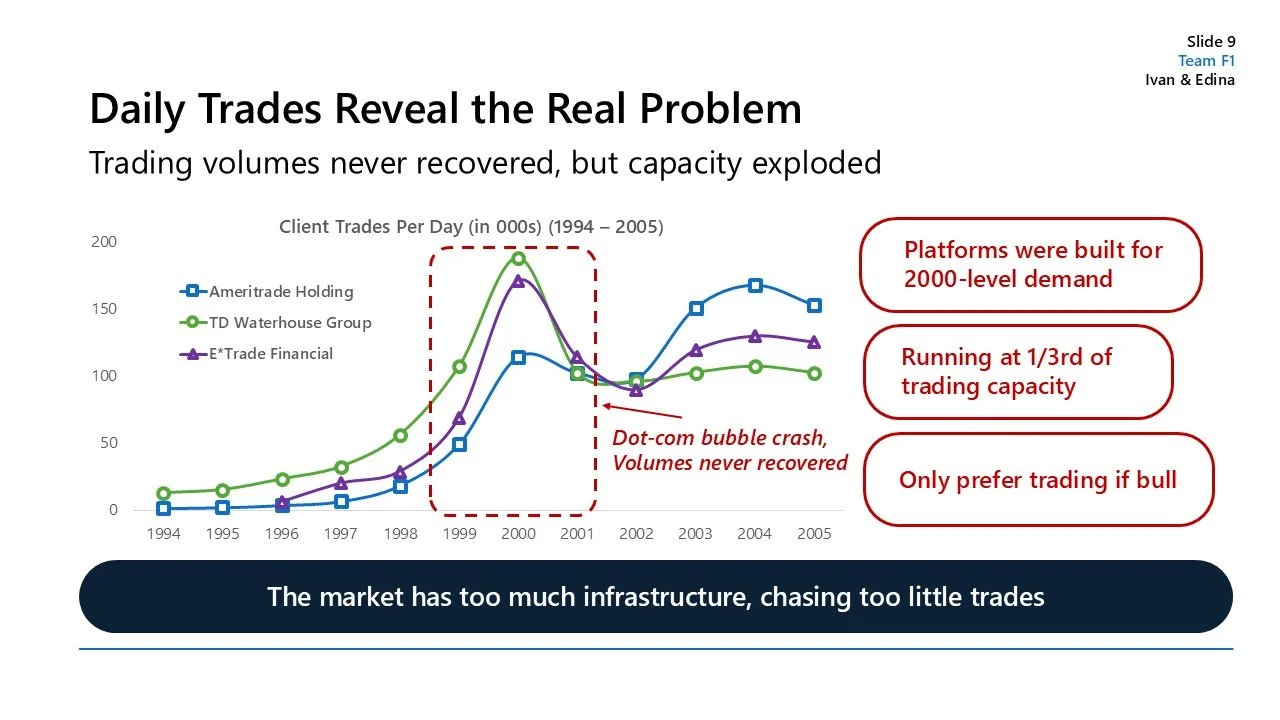

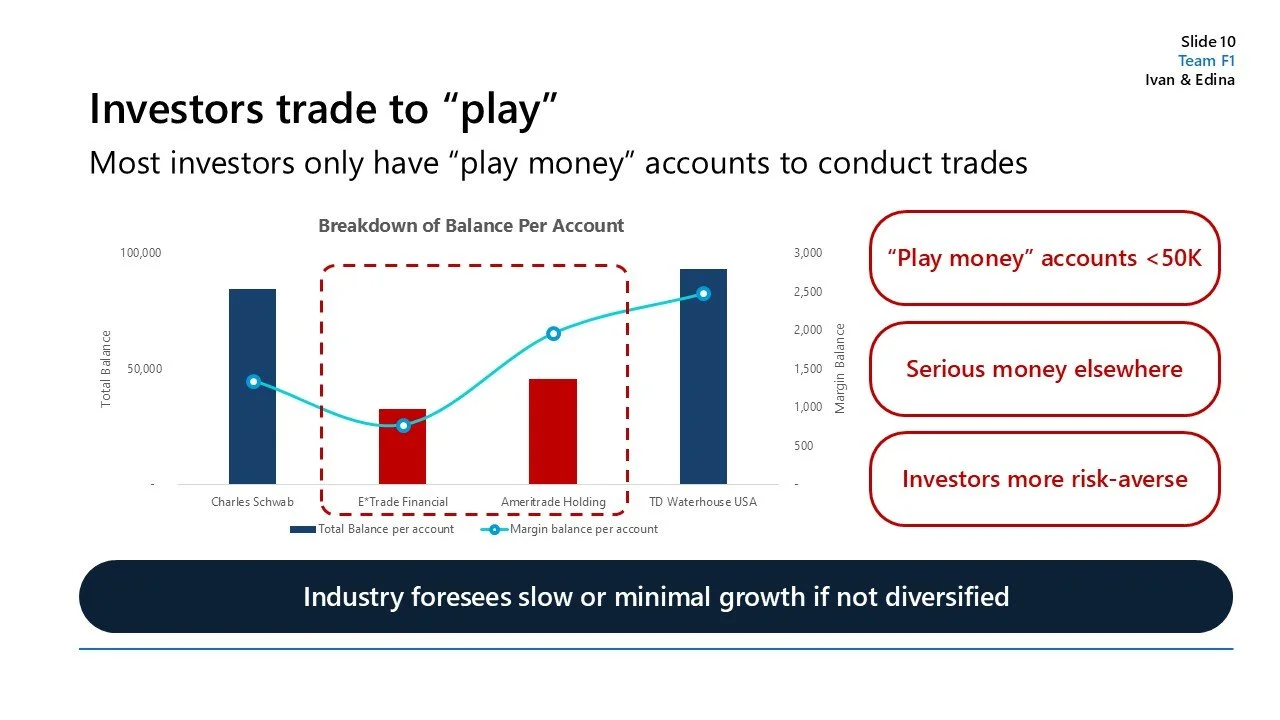

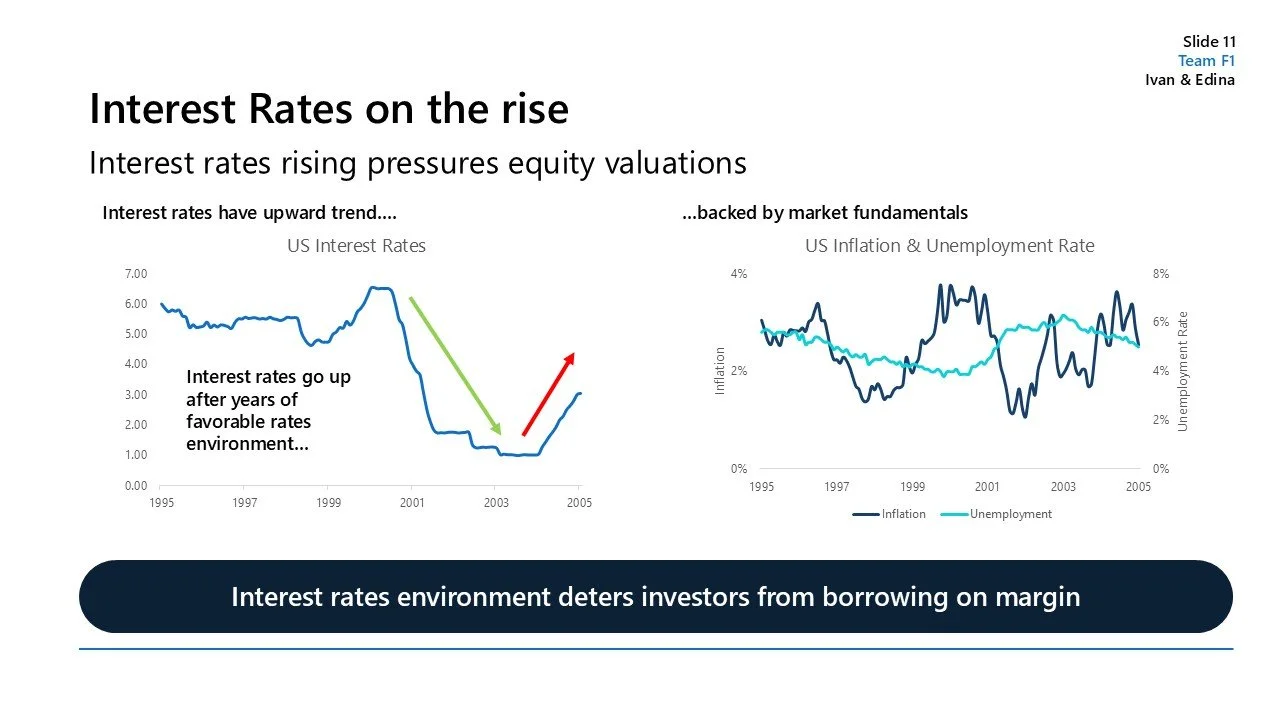

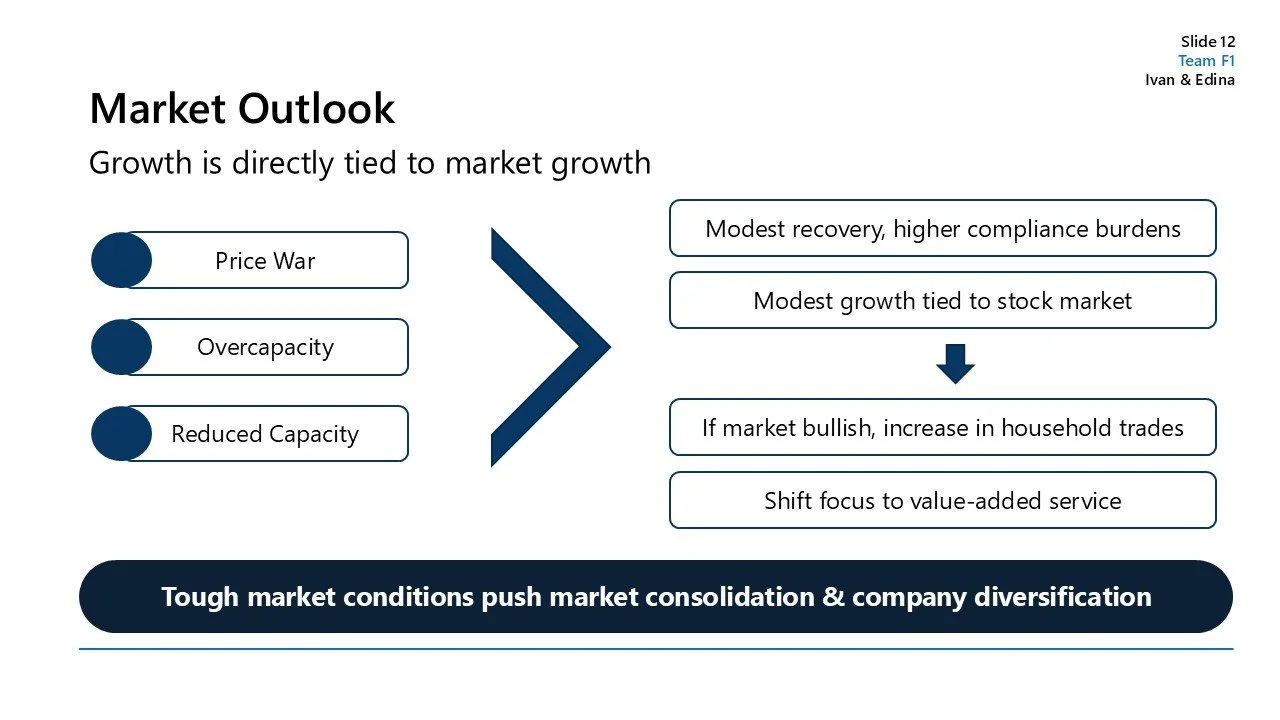

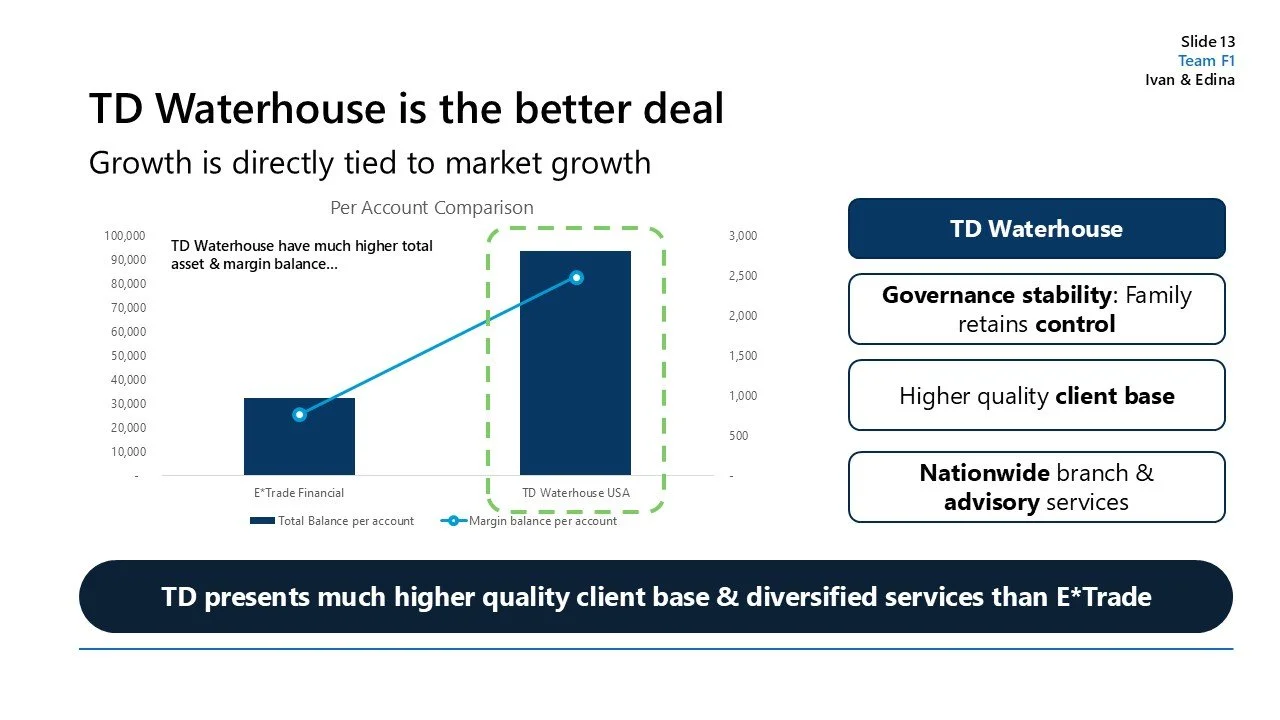

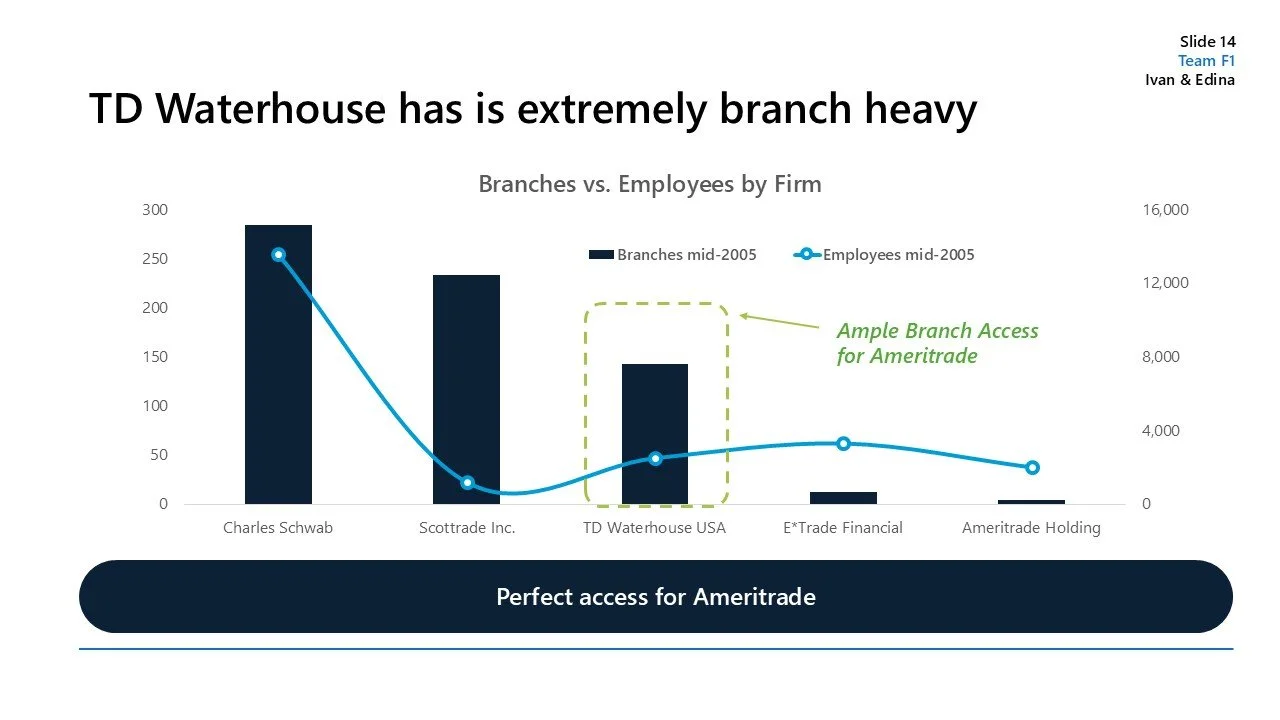

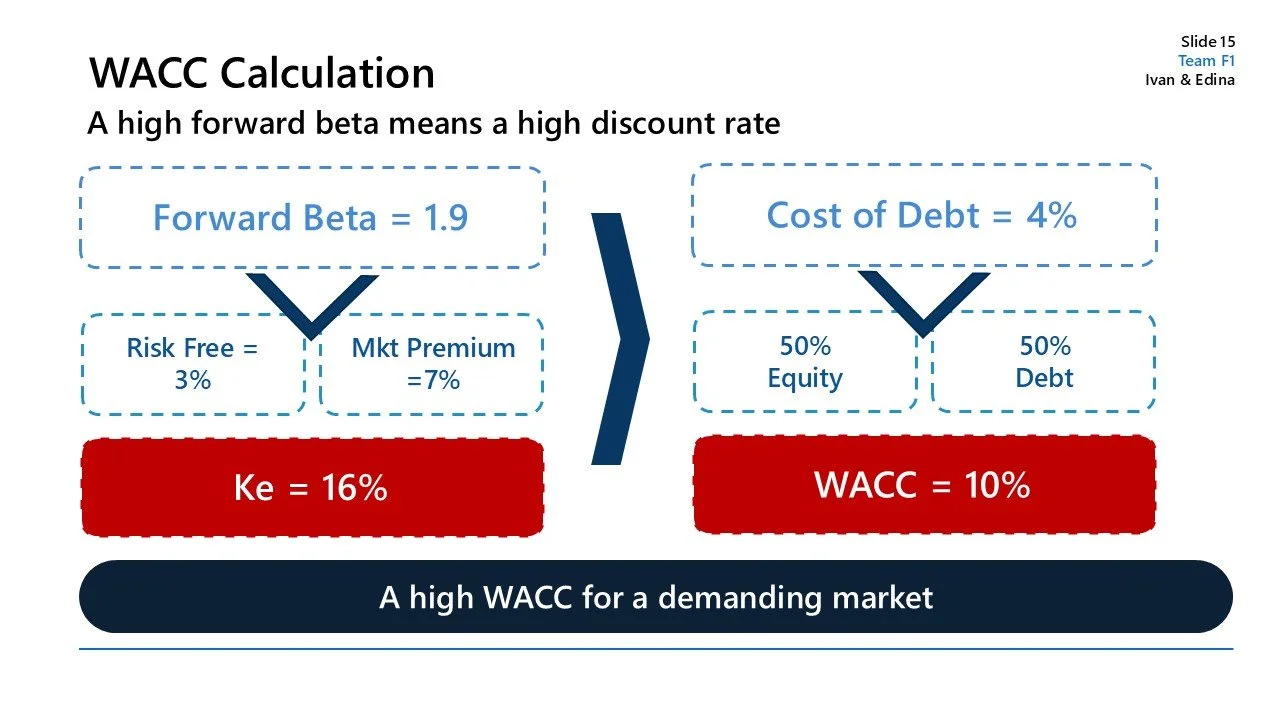

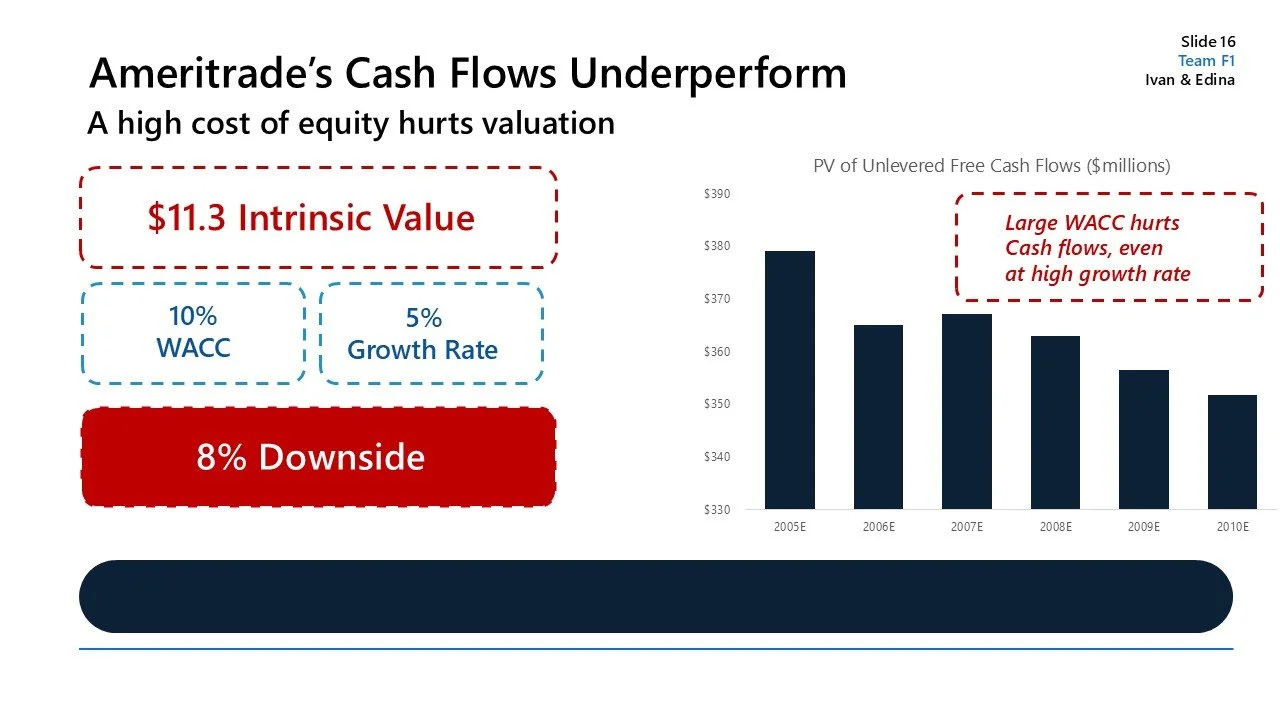

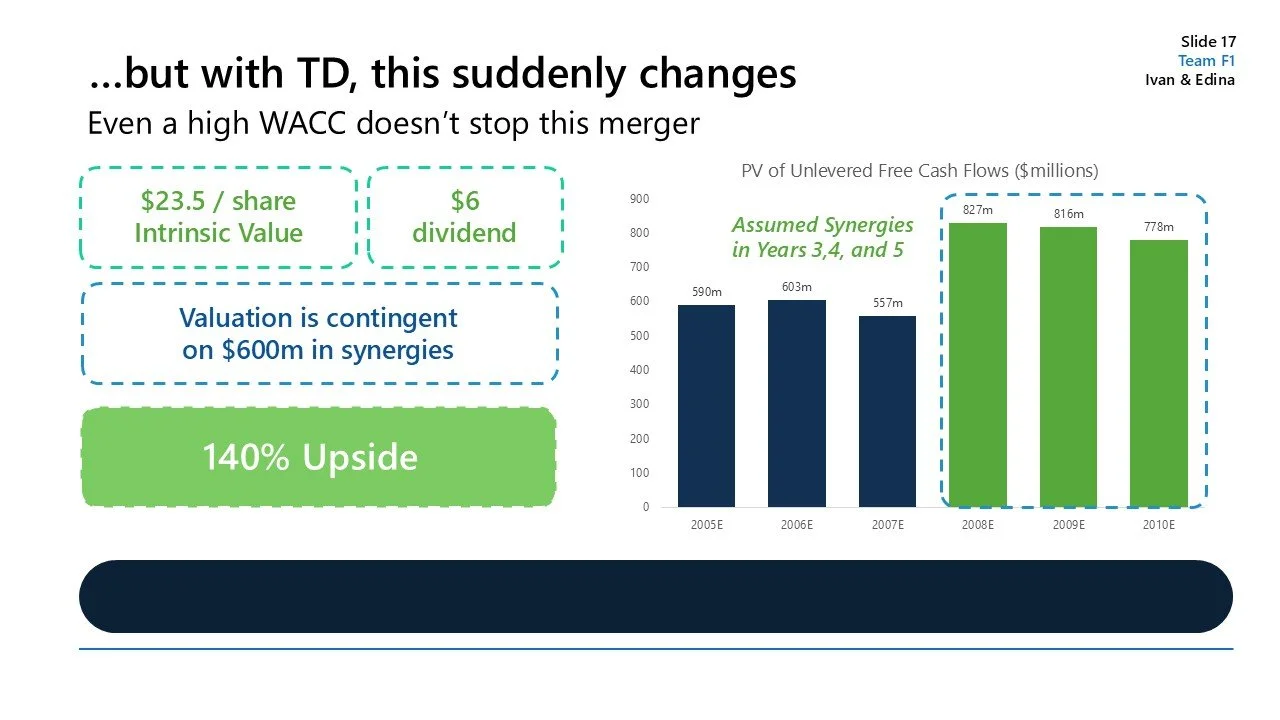

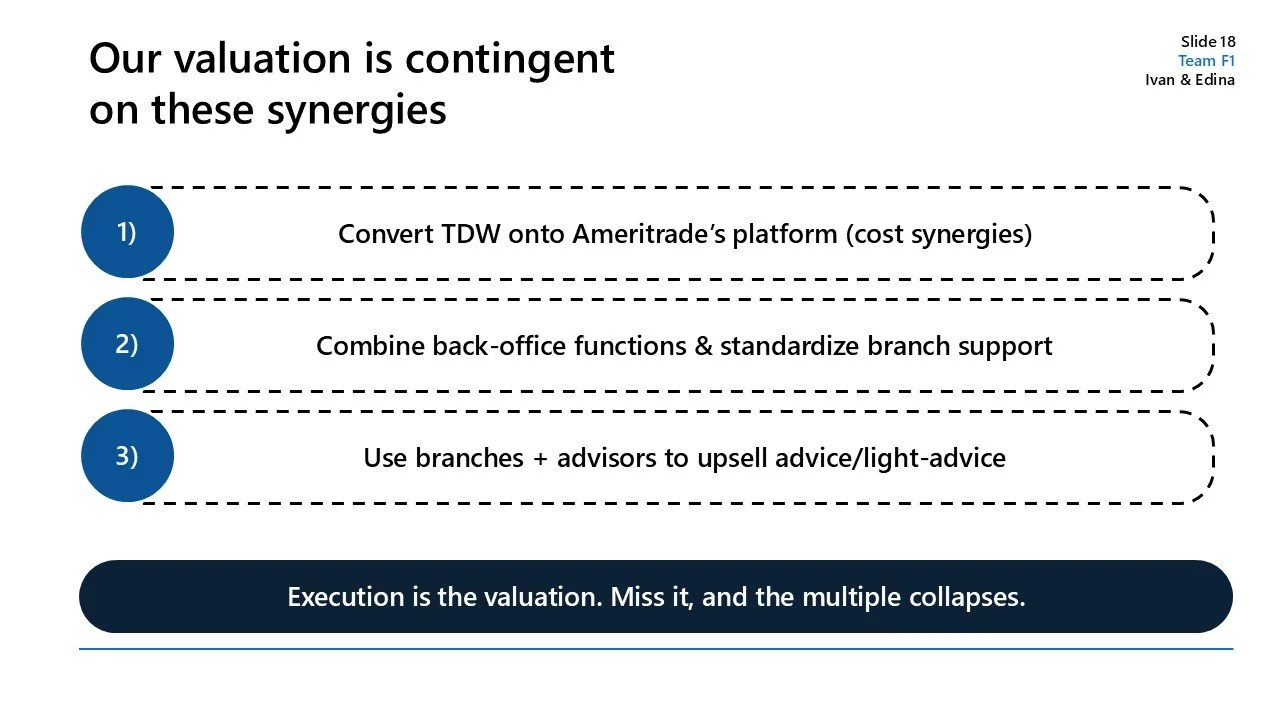

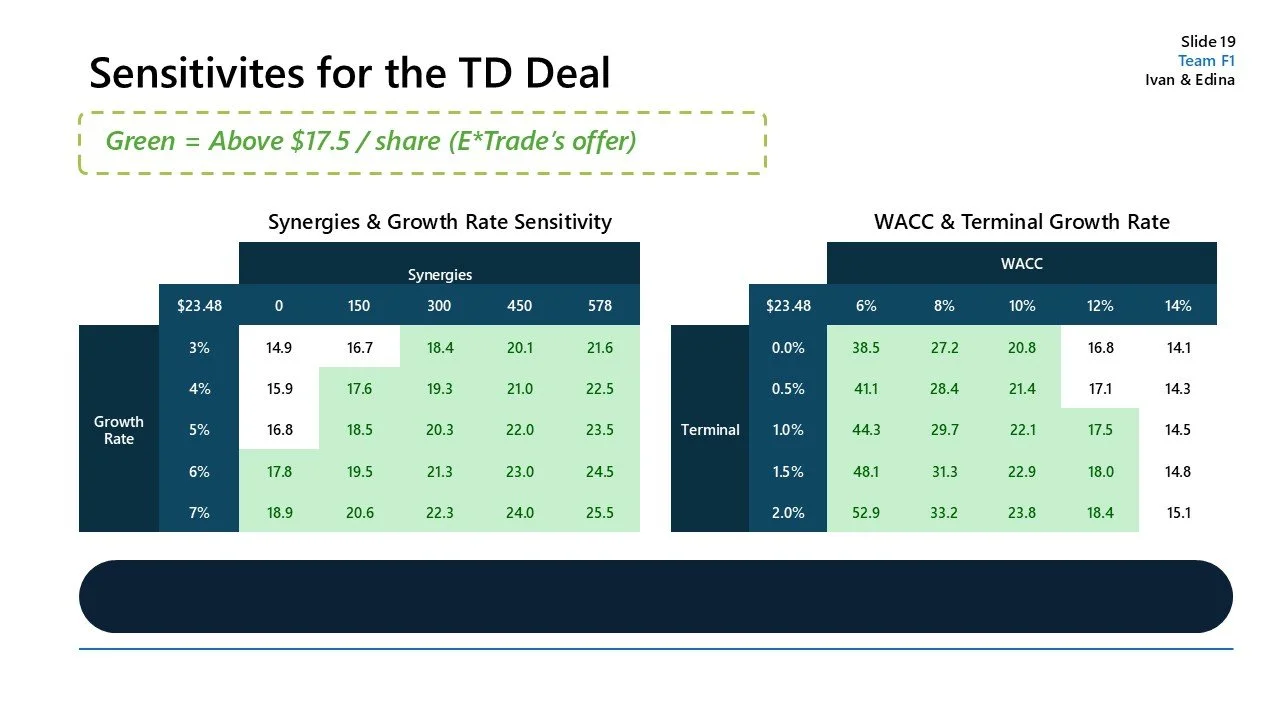

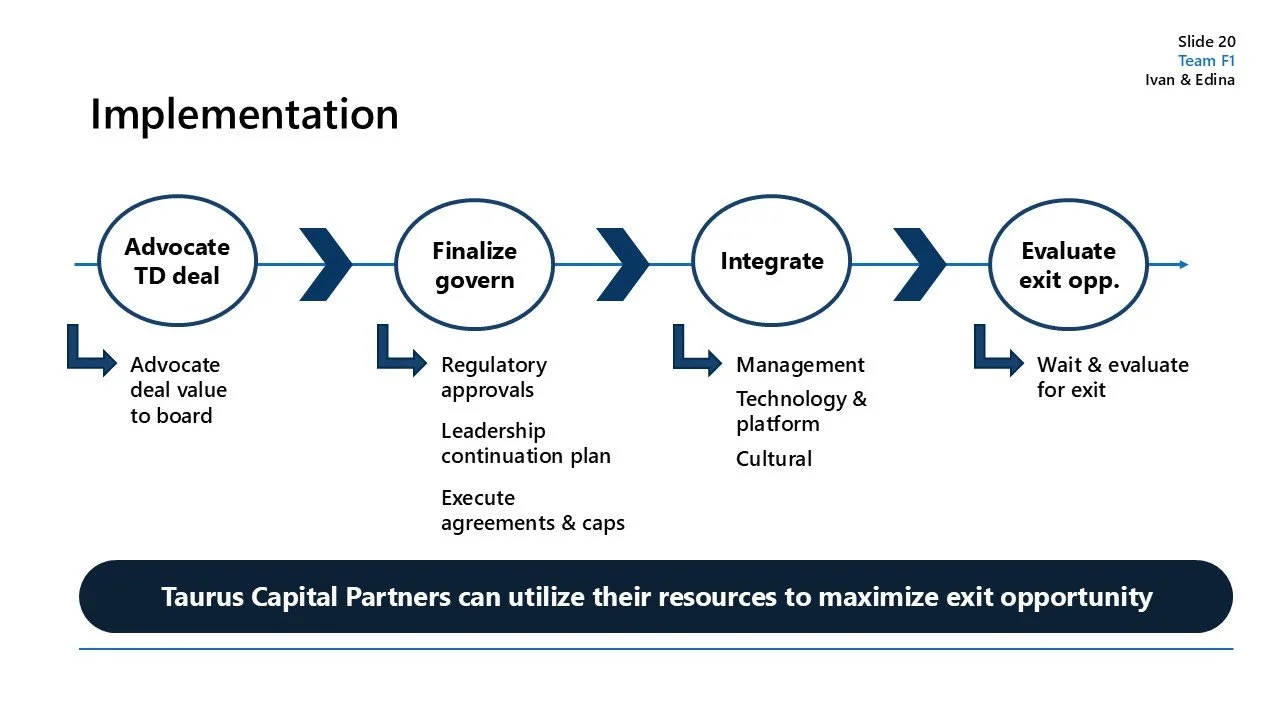

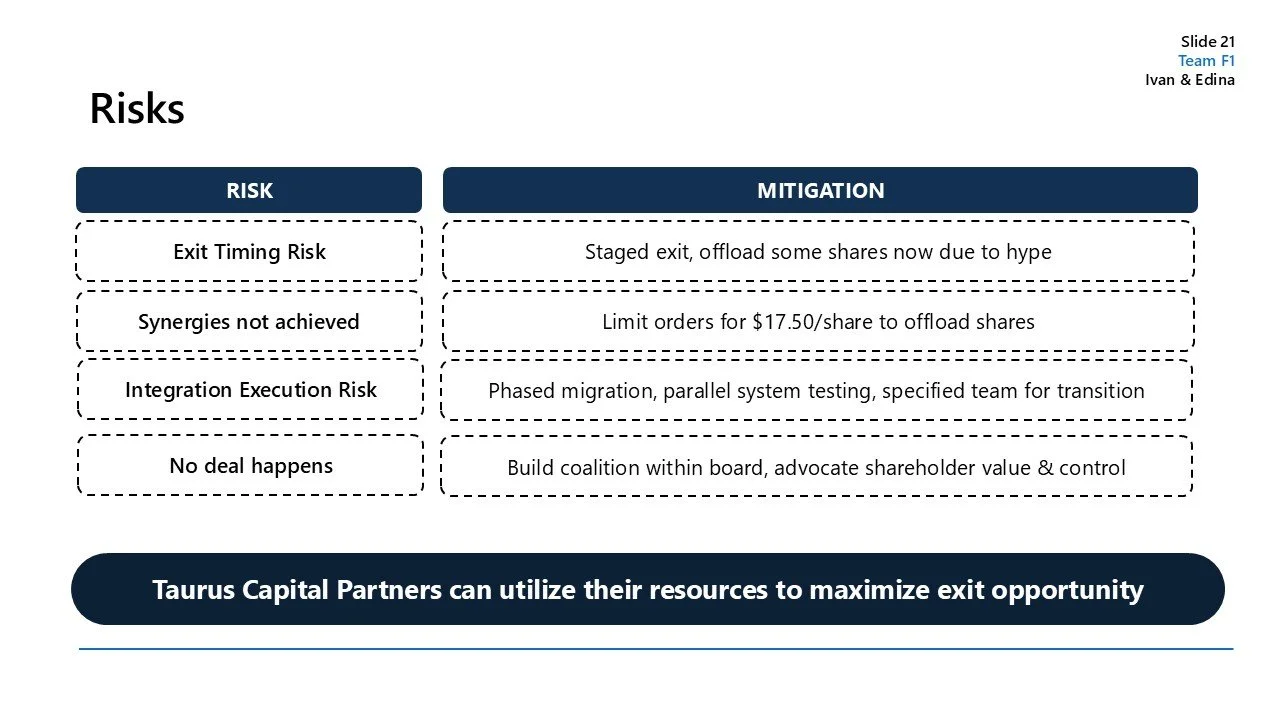

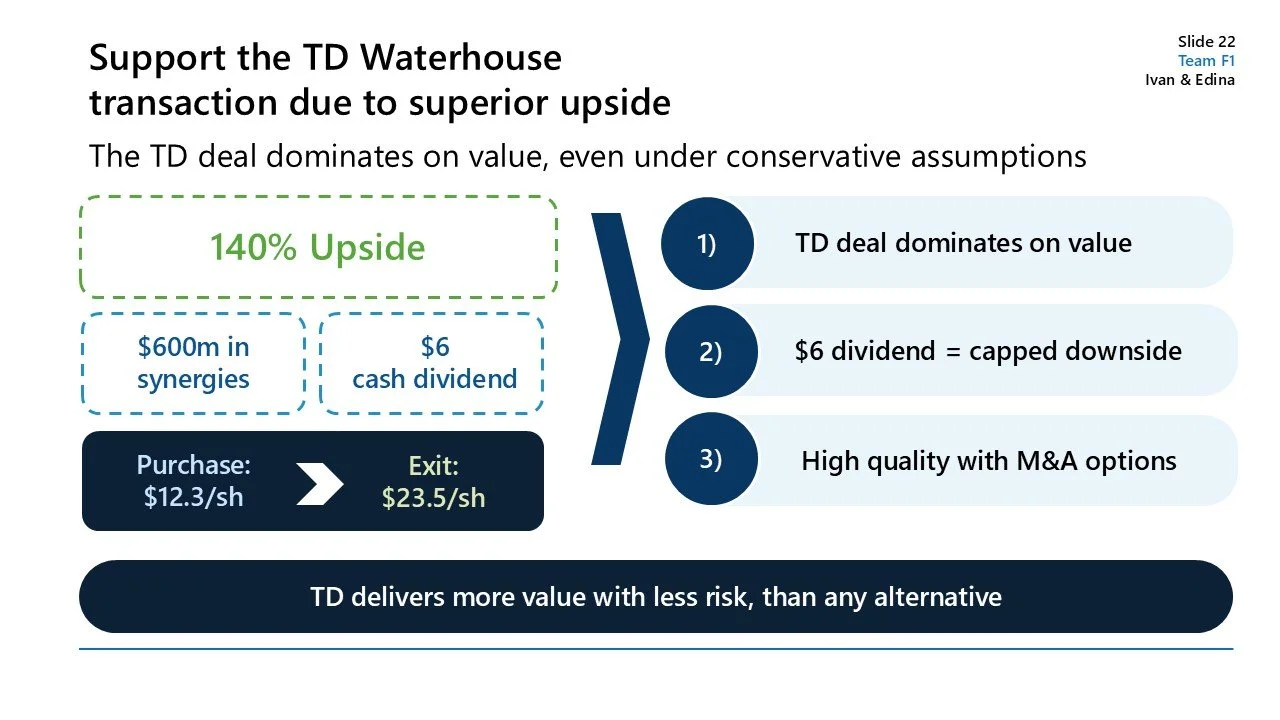

In the aftermath of the dot-com collapse, Ameritrade sat at the center of a consolidating online brokerage industry struggling with excess capacity and collapsing trading volumes. As a major shareholder, Taurus Capital Partners was forced to decide how to position itself amid competing acquisition paths, including TD Bank’s proposed merger with TD Waterhouse and a hostile bid from E*TRADE. The analysis reframed the problem away from corporate strategy and toward investor decision making under limited control. Valuation work focused on downside protection, synergy credibility, and execution risk rather than headline premiums. By stress-testing outcomes across deal and no-deal scenarios, the recommendation favored supporting the TD transaction for its superior risk adjusted value, cash dividend protection, and strategic repositioning away from a pure commission driven model. The case highlighted that in distressed markets, certainty and structure often matter more than nominal upside.